This post is about top performer short term bond mutual funds of 2011. The best funds are Virtus Multi-Sector S/T Bd, Thornburg Limited Term Income, Thompson Plumb Bond, etc.

Top Performers

The following short term bond funds are sorted based on its performance up to July 24, 2011. These funds may also best in its class and has performed as top notch funds for the past 3, 5, and 10 years. Details about its performance will be provided on the last table.

|

| Top Short Term Bond Funds 2011 |

Top 10 Short Term Bond Mutual Funds (up to Jul 24th, 2011) are:

- Virtus Multi-Sector S/T Bd A (NARAX)

- Thornburg Limited-Term Income A (THIFX)

- Thompson Plumb Bond (THOPX)

- Metropolitan West Strategic Income I (MWSIX)

- Vanguard Short-Term Corp Bd Idx Instl (VSTBX)

- Columbia Limited Duration Credit A (ALDAX)

- Prudential Short-Term Corporate Bd A (PBSMX)

- Delaware Limited-Term Diversified Inc A (DTRIX)

- DFA Short-Term Extended Quality Instl (DFEQX)

- Maxim Short Duration Bond (MXSDX)

Fund Information

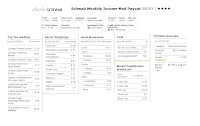

| No | Name | Ticker | M* Rating | Yield | Expense Ratio | Load | Net Assets (mil) | Min to Invest |

|---|

| 1 | Virtus Multi-Sector S/T Bd A | NARAX | 5 | 4.76% | 1.07% | 2.25% | $4,400 | $2,500 |

| 2 | Thornburg Limited-Term Income A THIFX | THIFX | 5 | 3.57% | 0.99% | 1.50% | $1,200 | $5,000 |

| 3 | Thompson Plumb Bond | THOPX | 5 | 3.24% | 0.80% | 0.00% | $583 | $2,500 |

| 4 | Metropolitan West Strategic Income I | MWSIX | 3 | 5.15% | 1.97% | 0.00% | $230 | $ 3 mil |

| 5 | Vanguard Short-Term Corp Bd Idx Instl | VSTBX | N/A | 2.39% | 0.09% | 0.00% | $1,800 | $ 5 mil |

| 6 | Columbia Limited Duration Credit A | ALDAX | 3 | 3.30% | 0.85% | 3.00% | $834 | $2,000 |

| 7 | Prudential Short-Term Corporate Bd A | PBSMX | 4 | 3.98% | 0.77% | 3.25% | $4,600 | $2,500 |

| 8 | Delaware Limited-Term Diversified Inc A | DTRIX | 4 | 2.54% | 0.83% | 2.75% | $2,100 | $1,000 |

| 9 | DFA Short-Term Extended Quality Instl | DFEQX | N/A | 2.55% | 0.22% | 0.00% | $1,200 | $0 |

| 10 | Maxim Short Duration Bond | MXSDX | 5 | 2.89% | 0.60% | 0.00% | $71 | $0 |

| 14 | Lord Abbett Short Duration Income A LALDX | LALDX | 5 | 4.29% | 0.60% | 2.25% | $14,000 | $1,000 |

updated on July 29,2011

1. Virtus Multi-Sector Short Term Bond A (MUTF: NARAX)

As the Top Performer fund, this Virtus Multi-Sector Short Term Bond investment seeks to offer high current income while attempting to limit changes in the fund's net asset value per share caused by interest rate changes. This Virtus fund seeks current income with an emphasis on preserving low volatility and overall short duration by investing primarily in higher quality (i.e. investment grade), more liquid securities across the multiple bond market sectors. It usually invests most of assets (>80%) in bonds, which are fixed income debt obligations of various types of issuers. The fund invests in a diversified portfolio of primarily short-term fixed income securities having an expected dollar-weighted average maturity of < 3 years.

|

| Virtus Multi Sector S/T Bond |

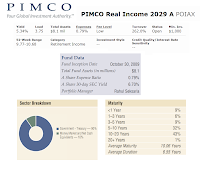

This Virtus fund was introduced to public in October 1997. The lead manager is Kyle A. Jennings. He has managed the fund since June 2011. This fund shares a dividend yield of 4.45% per year. The last dividend distributed in May 2011 was $0.02. This fund has total net assets of $4.19 billion. The fund currently has a net expense ratio of 1.32% per year. It has 0.50% 12b1 fee but has no front-end sales load fee.

This PSTCX fund can be purchased from 44 brokerages, such as JP Morgan, Edward Jones, Schwab, etc. The minimum initial investment for the brokerage account is $2,500 with $100 minimum subsequent investment. The other classes of this fund are Class B (PBARX), Class C (PSTCX), Class I (PIMSX) and Class T (PMSTX).

As the top rated fund, this Virtus fund also has received 5-stars rating from Morningstar. It has performed in 12 positive return years and only 1 year with negative return (occurred in 2008 with -14.28%). It has YTD return of 4.13%. This fund has returned 9.14% over the past one year and 6.60% over the past five years.

As of June 2011, this fund has 856 holdings. The top sector allocations of this fund are Investment Grade Corporate bonds (20.07%), Non-Agency Commercial MBS (18.47%), Asset Backed Securities (13.17%), High Yield Corporate bonds (10.98%), and Bank Loans (10.41%).

2. Thornburg Limited-Term Income A (MUTF: THIFX)

The Thornburg Limited-Term Income fund objective is to achieve high current income consistent with safety of capital. The Thornburg fund invests >65% of net assets in (i) obligations of the U.S. government, and its agencies and instrumentalities, and (ii) debt securities rated in one of the three highest ratings of rating agencies (S&P, Moody’s, advisor opinion). It does not invest in any debt security rated lower than BBB by S&P or Baa by Moody of equivalent quality as determined by Thornburg.

The lead managers of this Thornburg fund are Jason Brady and Lon Erickson. The fund has a sales load of 1.5% and the fund current expense ratio is 0.99%. It also has a yield of 3.57% for the past 12 months.

|

| Thornburg Limited Term Income |

This fund can be purchased from 87 brokerages. Please check with your brokerage for details. The minimum initial investment for the brokerage account is $5,000 with the next minimum subsequent investment of $100. This fund has 0.99% of annual expense ratio. This THIFX fund is available in other class, such as Class C (THICX) and Class I (THIIX). The capital gains of this fund are paid annually while the dividends are paid monthly.

This THIFX fund has 4.10% YTD return. Morningstar also rated this fund with 5 stars rating. The performance of this fund is as below:

- 1-year: 5.23%

- 3-years: 7.44%

- 5-years: 6.31%

- 10-years: 5.12%

As of June 2011, this fund has 369 total bonds. The average maturity is 4.2 years and the effective duration is 3.2 years. The portfolio composition of this fund as of the second quarter is 55.4% in Corporate Bonds, 12.7% in Collateralized Mortgage Obligation, 10.5% in Taxable Municipal Bonds, 4.7% in Asset Backed Securities, 2.7% in Commercial Mortgage Backed Securities, 2.7% in Government Agency, 2.7% in Treasury Securities, 2.4% in Mortgage Pass Through and 6.4% in <1 year and Cash.

3. Thompson Plumb Bond (Ticker: THOPX)

|

| Thompson Plumb Bond Fund details |

The Thompson Plumb Bond fund is seeking a high level of current income while preserving capital. The fund usually invests majority of net assets (>80%) in diversified portfolio of bonds. Although it invests mainly in investment-grade debt securities, it may invest some of net assets (<10%) in bonds rated below investment grade. These below investment grade bonds along with the other bonds in the fund's portfolio comprise at least 80% of the fund's total assets. The fund may invest up to 20% of net assets in other non-debt securities. The dollar-weighted average portfolio maturity of the fund will normally not exceed 10 years.

This Thompson Plumb bond has been managed by John W. Thompson since its inception in February 1992. The fund annual expense ratio is 0.80%. It is a no load fund, meaning it has no management fee or sales load fee. The fund’s yield is 3.24% for the past 12 months. The dividend is distributed on quarterly basis. It has gotten 5-stars rating from Morningstar. The fund has year-to-date return of 3.99%. For the past 1 year, this fund has returned 6.32% and 11.61% for the past three years. You will need a minimum of $2,500 to open a brokerage account in this fund.

This

taxable bond fund has 528 holdings (as of June 2011). The largest bond holdings are Bank of America 3.10%), Morgan Stanley (2.67%), SLM Corp (2.20%), Masco Corp (2.19%), Wynn Las Vegas (2.18%), Con-way (2.18%), Fidelity National Financial (2.17%), Freeport-McMoRan Copper & Gold (2.14%), Zions Bancorporation (2.09%) and Montpelier Re Holdings (2.08%).

4. Metropolitan West Strategic Income I (MUTF: MWSIX)

The Metropolitan West Strategic Income fund seeks to maximize long-term total return without tracking any particular indices or markets. This Metropolitan West fund uses techniques intended to provide absolute (positive) returns in all markets and employs a strategy intended to produce high income while exploiting disparities or inefficiencies in markets. It focuses on inefficiencies between secured or asset-backed debt and unsecured and subordinated debt or equity of companies and issuers. Additionally, the fund focuses on longer-term cyclical anomalies in the fixed income markets. The fund may invest <25% of assets in below investment grade debt securities. It is non-diversified fund.

|

| Metropolitan West Strategic Income |

This short term bond fund has an expense ratio of 1.97% per year. It has a yield of 5.15%. This fund has been managed by Laird M. Landmann since June 2003, but this fund was introduced to public in March 2004. This MWSIX fund is part of no load fund (i.e. there is no sales load). Morningstar has rated this fund with 3-stars rating. Besides the Institutional Class, this fund is also available in Retail Class (MWSTX).

As of March 2011, this

top performer mutual fund has 237 securities. The average duration is 1.9 years and average maturity is 6.2 years. The top sectors of this fund are MBS (45.2%), Corporate (24.4%), ABS (14.8%), UST/AGY (8.1%), Cash and Equivalents (7.2%), and Others (0.3%).

5. Vanguard Short-Term Corporate Bond Index Institutional (VSTBX)

The Vanguard Short-Term Corporate Bond Index Institutional investment seeks to track the Barclays Capital U.S. 1-5 Year Corporate index performance. The index includes U.S. dollar-denominated, investment-grade, fixed-rate, taxable securities issued by corporatse such as industrial, utility, and financial companies. This index fund will have maturities between one and five years.

|

| Vanguard Short Term Corporate Bond Idx |

This Vanguard fund has been managed by Joshua C. Barrickman since its inception in November 2009. Since this fund is new, it hasn’t gotten any rank from Morningstar yet. It has 3.64% YTD return. Currently this fund is positioned on 3rd rank in this top performer category. This fund has the lowest expense ratio of all the funds mentioned here (0.09% annually). This is also a no load fund.

To purchase this fund, please check with your brokerage for details since it is limited. One alternative is to buy the Vanguard Short-Term Corporate Bond ETF which is the ETF class. This fund ticker is VCSH. The VCSH fund only has 0.15% expense ratio.

This Short-Term Corporate Bond is available in Signal Class (VSCSX) and ETF (VCSH). The expense ratio of the VCSH is 0.15%. The benchmark of this fund is Barclays US 1-5 year Corporate Index. As of June 2011, the average duration of this fund is 2.8 years and average maturity 3.0 years with 4.6% average coupon. The bond allocation is 47.0% in industrial, 44.9% in finance, 7.5% in utilities and 0.6% in treasury/ agency.

6. Columbia Limited Duration Credit A (Ticker: ALDAX)

The Columbia Limited Duration Credit fund objective is to provide current income consistent with capital preservation. This Columbia fund invests >80% of net assets in credit-related bonds and debt securities. It mainly invests in debt securities with short- and intermediate-term maturities. The fund invests in corporate bonds and agency, sovereign / government, supranational and local authority bonds. It invests <15% of net assets in securities rated below investment grade (i.e. Junk bonds). It may also invest <25% of net assets may in foreign investments.

|

| Columbia Limited Duration Credit |

This

short term bond fund is managed by Timothy Doubek since April 2009. It gives 3.30% of yield. The last dividend was distributed in June 2011 was 0.02%. ALDAX fund has 0.85% annual expense ratio. It has 12b1 fee of 0.25% and front-end sales load of 3%.

This ALDAX fund has performed in 6 years of positive return and 1 year in negative return. It results in 2.91% of YTD return. This fund has return 4.99% over the past year and 5.16% over the past five years. It has gotten 3-stars Morningstar rating.

The minimum initial investment needed to open a brokerage account is $2,000 and $1,000 for IRA account. The minimum subsequent investment is $100. This Columbia fund can be purchased from 63 brokerages. Investor can choose from any other classes of this fund such as Class B (ALDBX), Class C (RDCLX) and Class Z (CLDZX).

As of June 2011, the assets allocation of this fund is 83.4% in Domestic Bonds, 13.0% in Foreign Bonds and 3.6% in Cash or Cash Equivalent. While the sector allocations are Invest Grade (86.8%), High Yield (9.5%), Cash (3.6%) and US Treasury / Agency/ TIPS (0.1%). This fund has a total of 134 holdings as of June 2011.

7. Prudential Short-Term Corporate Bond A (Ticker: PBSMX)

The Prudential Short-Term Corporate Bond fund seeks income consistent with the preservation of principal. The fund invests majority of the investable assets (>80%) in corporations bonds with varying maturities. It also invests <35% of total assets in dollar-denominated obligations issued in the U.S. by foreign governments and corporations. The fund may also invest <20% of total assets in US Government bonds. It may invest <20% of the investable assets in junk bonds (i.e. below investment-grade fixed income). The effective duration of the fund's portfolio will generally be < 3 years.

|

| Prudential Short Term Corp. Bond |

Steve Kellner has been the lead manager of this Prudential bond fund since August 1999. The fund’s expense ratio is 0.77% per year. It also has 0.30% 12b1 fee and 3.25% front end sales load. This fund shares 3.98% yield. It has paid out the last dividend in June 2011 as much as 0.03%. It has 82.0% annual holdings turnover.

Best Performer Diversified Bond Mutual Funds

Morningstar has rated this fund with 4-stars as this fund has gained 20 years of positive return and only 1 year of down performance (in 2008 with 0.77%). This fund has 2.68% of YTD return and has returned 4.71% over the past ten years.

You can invest in this fund with $2,500 initial balance for regular brokerage account and $1,000 for IRA account. The next minimum subsequent investment is $100. This fund can be purchased from a wide selection of 103 brokerages. Investor can also select other classes of this fund such as Class B (PSMBX), Class C (PIFCX), Class R (JDTRX) or Class Z (PIFZX). The Class R and Z have gotten 5-stars rating from Morningstar.

The top ten holdings out of 698 total holdings are Bank of America (3.4%), Citigroup (3.1%), JP Morgan Chase (3.1%), General Electric (2.6%), Goldman Sachs (2.4%), Morgan Stanley (2.2%), Verizon Communications (2.0%), AT&T (1.9%), Wells Fargo (1.7%) and American Express (1.2%).

8. Delaware Limited-Term Diversified Income A (DTRIX)

The Delaware Limited-Term Diversified Income fund is seeking maximum total return, consistent with reasonable risk. The fund invests <80% of net assets in investment-grade fixed-income securities such U.S. government and U.S. corporation bonds. It may invest <20% of net assets in below investment-grade securities (i.e. junk bonds). The fund may also invest <30% of net assets in foreign securities, including <10% of net assets in emerging markets issuers. It retains an average effective duration from 1 to 3 years.

|

| Delaware Limited Term Diversified Inc |

This Delaware fund was introduced to public in November 25, 1985. And Paul Grillo has been the lead manager since February 1999. Paul Grillo is the CFA Senior Vice President. This fund has 0.83% annual expense ratio. It distributes a yield of 2.54% for the past 12 months. This fund has received 4-stars rating from Morningstar. The fund’s total net asset is $2.11 billion. If you are interested to invest in this fund, please note that there is 0.30% 12b1 fee and 2.75% front-end sales load fee.

The minimum initial investment for brokerage account is $1,000 and $250 for IRA account. This fund can be purchased from 94 brokerages such as JPMorgan, Fidelity, Scottrade, etc.

This DTRIX fund has performed in 24 years with positive return and 1 year in negative return. The best performance was in 2009 with 12.91% and the worst in 1999 with 1.06%. It has 2.66% YTD return. This fund is available in other classes, such as Class C (DTICX), Institutional Class (DTINX) and Class R (DLTRX). The benchmark of this fund is Barclays Capital 1-3 Year Government/ Credit Index.

As of June 2011, this fund has 505 holdings. The portfolio composition is 39.3% in Credits, 25.6% in Mortgage-backed securities, 19.8% in U.S. government securities, 13.5% in Asset-backed securities and 1.8% in Commercial mortgage-backed securities. While the top sectors are Investment grade credits (26.2%), MBS & CMOs (25.6%), Asset-backed Securities (13.5%) and International developed (6.5%).

9. DFA Short-Term Extended Quality Institutional (MUTF: DFEQX)

The DFA Short-Term Extended Quality Institutional fund objective is to maximize total returns from the universe of debt securities. The fund invests in a universe of investment grade U.S. and foreign corporate debt securities. It mainly invests in securities that mature within five years from the date of settlement and maintains an average portfolio maturity and an average portfolio duration of three years or less. The fund normally invests at least 80% of net assets in fixed income securities considered to be investment grade quality.

|

| DFA DFEQX fund characteristics |

David A. Plecha has managed this short term bond fund since its inception in March 2009. This DFEQX is a no load fund. It has no 12b1 fee and no sales load fee. The net expense ratio of this fund is 0.22%. Since this fund is new, there is no Morningstar rating yet. The YTD return was 2.64%. This DFA fund has achieved rank 9th in this top performer category. This fund has 2.58% yield.

The benchmark of this fund is BofA Merrill Lynch US Corporate and Government Index 1-5 Years. As of May 2011, the average maturity of this fund is 2.89 years and duration of 2.70 years. The top 5 holdings as of June 2011 are PNC Capital Markets Repo (2.4%), Cooperatieve Centrale Raiffeisen-Boerenleenbank BA (1.33%), Google Inc (1.2%), Province of Ontario Canada (0.90%) and Toyota Motor Credit Corp (0.88%).

14. Lord Abbett Short Duration Income A (LALDX)

The Lord Abbett Short Duration Income fund is seeking a high level of income consistent with capital preservation. The fund typically invests <65% of net assets in investment grade debt securities of various types. Such securities may include short duration investment grade domestic and foreign corporate debt securities, U.S. Government securities, mortgage-, and other asset-backed securities. The fund may invest < 35% of net assets in lower-rated debt securities, non-U.S. debt securities denominated in foreign currencies and floating or adjustable rate senior loans.

|

| Lord Abbett Short Duration Income |

This top performer short term bond mutual fund was introduced to public in November 1993. Mr. Andreew H. O’Brien has been the fund manager since January 1998. The yield of this fund is 4.25% per year. Its net asset is $13.32 billion. The annual expense ratio of this fund is 0.60%. There is 0.20% 12b1 fee and 2.25% front-end sales load fee. This fund can be purchased from a selection of 100 brokerages with the minimum initial investment of $1,000 for regular brokerage account.

Top World Bond Mutual Funds of 2012

Since its inception, this Lord Abbett fund has performed in 15 years with positive return and 2 years with negative return. The best performance was in 2009 with 16.96%. This Lord Abbett fund has gotten 5-stars rating from Morningstar and it has 2.47% YTD return. This fund is available in many other classes. They are Class C (LDLAX), Class F (LDLFX), Class I (LLDYX), Class R2 (LDLQX) and Class R3 (LDLRX).

The portfolio breakdowns of this fund as of June 2011 are CMBS (30.5%), Investment Grade (30.5%), High Yield Corporate (18.6%), ABS (9.3%), MBS (4.9%), Cash (2.5%), Sovereign (1.7%), Government Related (1.4%) and Other (0.7%).

Disclosure: No Position

Fund Performance - Short, Intermediate, Long Term

updated on July 24,2011

Additional information: