Yield is another important part of investing in this market. During the bear market (i.e. down market), investor can count on the yield to withstand the volatile market. The following top 10 high yielding mutual funds include PIMCO International StocksPLUS TR Strategy A, Forward SMIDPlus Investor, U.S. Global Investors World Precious Minerals, etc. Dividend yield is great for investor who seeks regular income.

This list may include either bond funds (fixed income funds) or stock funds (equity funds). The funds are sorted based on its dividend yield for the past 12 months. These mutual funds may include

international stock fund, REIT stock fund, gold stock fund, equity income funds, and more. Note: The yield or dividend may change anytime, please check the fund’s prospectus for details.

Top 10 High Yield Mutual Funds 2011 are:

- PIMCO International StocksPLUS TR Strategy A (PIPAX)

- PIMCO Fundamental IndexPLUS TR A (PIXAX)

- PIMCO Real Estate Real Return Strategy A (PETAX)

- Forward SMIDPlus Investor (ACSIX)

- PIMCO Small Cap StocksPLUS TR A (PCKAX)

- U.S. Global Investors World Precious Minerals (UNWPX)

- Gabelli Utilities A (GAUAX)

- Russell Commodity Strategies A (RCSAX)

- PIMCO Fundamental Advantage Total Return A (PTFAX)

- PIMCO Commodity Real Return Strategy A (PCRAX)

Updated on 10/1/2011

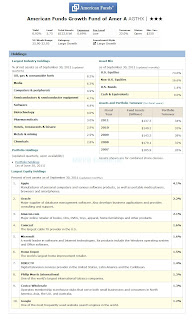

PIMCO International StocksPLUS TR Strategy A (PIPAX)

The PIMCO International StocksPLUS TR Strategy investment fund’s objective is to achieve total return which exceeds that of its benchmark index consistent with prudent investment management. This PIMCO fund usually invests majority of its assets in non-U.S. equity derivatives, backed by a portfolio of Fixed-Income Instruments. It generally limits its foreign currency exposure to 20% of total assets. The fund may invest <10% of total assets in high-yield securities. It may invest in common stocks, options, futures (including options), and swaps. The fund may also invest <10% of total assets in preferred stocks. It is non-diversified.

This fund has been managed by

Chris P. Dialynas since May 2008. This foreign large blend stock fund was introduced on October 2003. As the fund with the highest yield in this list, this PIMCO fund has

43.15% dividend yield that is distributed quarterly. The last dividend distributed in June 2011 is $0.30. This fund has 1.15% annual expense ratio, which is still lower than the average in the Foreign Large Blend category.

To start investing in this fund, either in brokerage or IRA account, you will need $1,000 for the minimum initial investment with $50 minimum subsequent investment. As of September 13, 2011, this

PIPAX fund has recorded 1.051% of annual holdings turnover. This is way higher compared to the average in the category which is 66.67%. This fund charges 0.25% 12b1 fee and 3.75% front-end sales load fee. The total net assets of this fund are $170.28 million. This PIMCO fund is available for purchase from 85 brokerages. The other classes of this fund are Class B (PIPBX), Class C (PIPCX), Class D (PIPDX) and Institutional Class (PISIX). This fund has 1.15 years of average maturity with 1.92 years of average duration.

Morningstar has rated this PIPAX fund with 4-stars rating. Since its inception, it has recorded 6 years of positive return and only 1 year of negative return so far. Based on the load adjusted return, this fund has returned 2.09% over the past three years.

As of June 2011, the top sectors for equity index analysis are Financials (24%), Industrials (13%), Materials (11%), Consumer Discretionary (11%) and Consumer Staples (10%). The top sectors for fixed-income collateral analysis are Money Market and Net Cash Equivalents (59%), Emerging Markets (19%), Non-U.S. Developed (19%) and Investment Grade Credit (6%).

PIMCO Fundamental IndexPLUS TR A (PIXAX)

The PIMCO Fundamental IndexPLUS TR A fund seeks to provide total return which exceeds the performance of

FTSE RAFI 1000 Index. The fund typically invests all of its assets in derivatives based on Enhanced RAFI 1000, an enhanced, performance recalibrated version of the index (“Enhanced RAFI 1000”), backed by a portfolio of short and intermediate maturity fixed-income instruments. It may invest in common stocks, options, futures, options on futures and swaps, including derivatives based on the index.

The CUSIP of this PIXAX fund is 72201F888. Since its inception in June 2005, this PIMCO fund has been managed by William H. Gross.

Bill Gross is the founder and co-CIO of PIMCO in the Newport Beach, CA. He is also a well-known bond guru. This PIMCO fund is in the category of Large Blend fund. The fund has a 1.19% annual expense ratio. It has 24.00% of dividend yield and has just distributed its last dividend in June 2011 ($0.18). The minimum initial investment for brokerage or IRA account is $1,000. There is 0.25% 12b1 fee and 3.75% front-end sales load fee.

The fund has -2.49% YTD return. The yearly performance of this fund since its inception is:

- Year 2010: 30.03%

- Year 2009: 56.50%

- Year 2008: -43.92%

- Year 2007: 7.37%

- Year 2006: 16.70%

This fund has recorded 4 years of positive return with its best 1-year total return in 2009 with 56.50%. Morningstar has granted this PIXAX fund with 4-stars rating. This best rated domestic stock fund is available for purchase from 80 brokerages. Investor can choose from the other classes of this fund such as Class C (PIXCX), Admin Class (PXTAX), Class D (PIXDX), Class P (PIXPX) and Institutional Class (PXTIX). The CUSIP of PIXCX is 72201F870.

As of June 2011, the average maturity of this large blend US stock fund is 1.83 years and the average duration is 1.92 years. The top sectors of this PIMCO fund for equity analysis are Financial (16%), Consumer-Cyclical (13%), Consumer-Non-Cyclical (12%), Energy (12%), Healthcare (11%) and Industrial (11%). The top sectors for fixed-income collateral analysis are Mortgage (26%), Investment Grade Credit (25%), Non-U.S. Developed (19%), Government – Treasury (15%) and Emerging Markets (14%).

PIMCO Real Estate Real Return Strategy A (PETAX)

The PIMCO Real Estate Real Return Strategy A invests mostly in real estate-linked derivative instruments backed by a portfolio of inflation-indexed securities and other bonds. It may invest <30% of total assets in securities denominated in foreign currencies and may invest beyond this limit in U.S. dollar denominated securities of foreign issuers. The fund may also invest <10% of total assets in preferred stocks.

This

PETAX fund is classified as one of the Real Estate fund. The annual expense ratio of the category is 1.45% and the expense ratio of this PIMCO fund is a bit lower (1.19%). The fund was introduced to public in October 2003. The fund’s manager since December 2007 is

Mihir Worah. There is 0.25% 12b1 fee and 5.50% front-end sales load for investing in this fund. This fund has 19.19% dividend yield. The latest dividend was shared in June 2011 ($0.15). It has $1.5 billion total net assets.

This fund has 17.10% YTD return. Since its inception it has recorded 5 years of positive return with the best in year 2009 (53.42%) and 2 years of negative return. Based on the load adjusted return, this fund has returned 24.84% over the past year, 6.08% over the past three years and 3.37% over the past five years. This fund has 4.55% 5-year average return.

To buy this mutual fund, you will need a minimum initial investment of $1,000 for either brokerage or IRA account (tax deferred account). The minimum subsequent investment is $50. It can be purchase from a selection of 80 brokerages. The other classes of this PETAX fund are PETBX (Class B), PETCX (Class C), PETDX (Class D), PRRSX (Institutional Class) and PETPX (Class P).

As of June 2011, the average maturity of this fund is 12.93 years and the average duration is 8.31 years. The top sectors for REIT Index Analysis are Apartments (17%), Regional Malls (16%), Office (14%) and Healthcare (13%). The top sectors for fixed-income collateral analysis are Government Treasury (86%), Non U.S. Developed (8%), High Yield Credit (4%) and Investment Grade Credit (4%).

Forward SMIDPlus Investor (ACSIX)

This Forward SMIDPlus Investor fund invests in synthetics or other instruments that have similar economic characteristics to common stocks of small and medium capitalization issuers, such as those in the Russell 2500 Index (the fund’s Benchmark). Small cap companies are companies with less than $1 billion market cap and mid cap companies are companies with $1 billion - $10 billion market capitalization.

This fund is also known as

Forward Extended Market Plus Fund. It has a dividend yield of 19.35% which is distributed quarterly. The latest dividend was distributed in June 2011 ($0.06). This fund was introduced to public in June 1998 and the current lead manager is Nathan J. Rowader. The annual expense ratio of this fund is 1.65%. This is a bit higher than the average in the Mid-Cap Blend category which is only 1.33%. The fund has total net assets of $129.88 million.

To start investing in this mid cap blend stock fund, investor will need $4,000 to open a brokerage or IRA account (i.e. tax deferred account). Then investor needs to invest a minimum of $100 for the subsequent investment. The 12b1 fee of this fund is 0.25%. There is no front-end sales load fee. The other classes of this fund are Institutional Class (ASMCX) and C Class (ACSMX). The expense ratio of ASMCX is 0.97% and 1.87% for ACSMX. This fund is available for purchase from 49 brokerages.

Morningstar gave this fund 3-star rating. The ratio of positive versus negative return performance since the inception is 7:5. The best 1-year total return was achieved in year 2003 with 43.48% while the worst return was in year 2008 with -40.63%. Based on the load adjusted return, this fund has returned 19.35% over the past year and 5.28% over the past decade. The fund uses Russell 2500 Index as the benchmark.

As of June 2011, the

top 10 holdings of this fund are FNMA, Notes (6.13%), BNP R2500 Bullet Swp (3.90%), JP Morgan Chase & Co (3.67), Chase Issuance Trust, Series 2008-A6 (3.12%), Morgan Stanley, Sr. Unsec. Bonds (3.11%), Discover Card Master Trust, Series 2009-A1 (3.10%), U.S. Treasury Notes (3.07%), Northstar Education Finance Inc, Revenue Bonds (3.03%), General Electric Capital Corp, Sr. Unsec. Bonds (3.01%) and FFCB, Bonds (3.01%). These are the top ten holdings out of 226 total holdings.

PIMCO Small Cap StocksPLUS TR A (MUTF: PCKAX)

The PIMCO Small Cap StocksPLUS TR A fund’s objective is to provide total return which exceeds the Russell 2000 Index performance. This PIMCO fund typically invests majority of its assets in Russell 2000 Index derivatives, backed by a diversified portfolio of Fixed-Income Instruments actively managed by PIMCO. It may invest in common stocks, options, futures, options on futures and swaps. The fund may invest up to 30% of total assets in securities denominated in foreign currencies and may invest beyond this limit in U.S. dollar denominated securities of foreign issuers. It may also invest up to 10% of total assets in preferred stocks.

Bill Gross is the current fund’s manager of this PIMCO fund. This small blend fund was introduced to public on July 31, 2006. This fund has 1.09% expense ratio every year. This fee is a bit lower compared to the average in the Small Blend category (1.38%). This is a 0.25% 12b1 fee and 3.75% front-end sales load for investing in this fund.

Investor will need a minimum initial investment of $1,000 to open a brokerage or IRA account in this best rated small blend fund. For additional minimum subsequent investment, you will need $50 or more. Since its inception, the fund's performance can be seen below:

- Year 2007: 1.17%

- Year 2008: -31.21%

- Year 2009: 44.20%

- Year 2010: 38. 73%

This fund has -15.48% YTD return. Morningstar gave this PCKAX fund 4-stars rating. The CUSIP of this fund is 72201F698. This fund is also available in other classes such as Class C (PCKCX), Class D (PCKDX), Institutional Class (PSCSX) and Class P (PCKPX). The benchmark of this fund is Russell 2000 Index. The average maturity of this PCKAX fund is 2.68 years and the average duration is 2.45 years.

As of June 2011, the

top 5 sectors for equity index analysis of this PIMCO fund are Financials (21%), Information Technology (18%), Industrials (15%), Consumer Discretionary (13%) and Health Care (13%). The top 5 sectors for fixed-income collateral analysis are Investment Grade Credit (38%), Government – Treasury (25%), Emerging Markets (22%), Non-U.S. Developed (20%) and Mortgage (16%).

U.S. Global Investors World Precious Minerals (UNWPX)

This U.S. Global Investors World Precious Minerals seeks long-term growth of capital plus protection against inflation and monetary instability. The fund invests >80% of net assets in companies equity principally engaged in the exploration for, or mining and processing of, precious minerals such as gold, silver, platinum group, palladium and diamonds. It participates in private placements, initial public offerings (IPOs), and long-term equity anticipation securities (LEAPS). The fund normally invests at least 40% of assets in securities of companies that are economically tied to at least three countries other than the U.S.This fund is classified as a non-diversified fund.

This

UNWPX fund has been managed by Frank E. Holmes since June 1999 while the fund was introduced to public on November 29, 1985. The annual expense ratio of this equity precious metals fund is 1.81%. The average annual expense ratio in Equity Precious Metals is 1.40%.

This fund has 0.25% 12b1 fee but there is no sales load. The total net assets of this fund are $604.81 million. This fund is available for purchase from 82 brokerages. The minimum initial investment is $5,000 for brokerage account with $100 minimum subsequent investment. There is no IRA account available. The dividend yield of this fund is 15.84%. The last dividend is distributed in December 2010 ($2.98).

This UNWPX fund has 2-stars rating from Morningstar. The fund has a total of 15 years of positive return during its 25-year tenure in the market. Based on the load adjusted return, this fund has returned 12.71% over the past year and 26.27% over the past ten years. As of August 2011, this fund has a total of 159 holdings. The top 20 holdings represent 52.01% of the total net assets. The top ten equity holdings of this fund are Randgold Resources Ltd (5.03%), Kinross Gold Corp (4.91%), Yamana Gold Inc (4.88%), Agnico-Eagle Mines Ltd (4.39%), Gran Colombia Gold Corp (4.32%), Romarco Minerals Inc (2.98%), Dundee Precious Metals Inc (2.56%), Harmony Gold Mining Co Ltd (2.28%), Silver Standard Resources Inc (2.11%) and First Majestic Silver Corp (1.99%).

Gabelli Utilities A (GAUAX)

The Gabelli Utilities fund invests most of its net assets (>80%) in securities of domestic or foreign companies (i) that are involved to a substantial extent in providing products, services or equipment for the generation or distribution of electricity, gas, and water and the provision of infrastructure operations or telecommunications services, and (ii) that the adviser believes have the potential to achieve either capital appreciation or current income. It may invest <40% of its total assets in foreign companies stocks.

This Gabelli fund currently has expense ratio of 1.43% per year. The average expense ratio in the Utilities category is 1.39%. Mario J. Gabelli has been with this fund since August 1999, though this fund was then introduced to public in December 2002. This GAUAX fund has total net assets of $2.2 billion. It has a distribution rate of 13.64%. The last dividend was paid in August 2011 ($0.07).

The minimum initial investment for brokerage account is $1,000 and $250 for IRA account. There is a 12b1 fee of 0.25% and a front-end sales load fee of 5.75%.

This GAUAX fund has 4-stars rating from Morningstar as it has recorded 7 years of positive return since its inception 8 years ago. Based on the load adjusted return, this fund has returned 9.51% over the past year and 6.19% over the past ten years. This fund uses S&P 500 Utility Index as its benchmark. The other shares classes of this fund are Class AAA (GABUX), Class C (GAUCX) and Class I (GAUIX). The fund can be purchased from 58 brokerages.

As of June 2011, this fund has a total of 240 holdings. The top ten holdings are National Fuel Gas Co. (5.3%), Southern Union Co. (2.2%), Constellation Energy Group Inc. (1.9%), NextEra Energy Inc. (1.9%), Bucyrus International Inc. (1.8%), CONSOL Energy Inc. (1.7%), Lubrizol Corp. (1.7%), Southwest Gas Corp. (1.5%), Edison International (1.5%) and AES Corp. (1.5%).

Russell Commodity Strategies A (RCSAX)

The Russell Commodity Strategies investment fund invests in corporate stocks, U.S. government securities, mortgage-backed securities, asset-backed securities, and municipal debt obligations. The fund also invests <10% of assets in debt securities that are rated below investment grade. It may invest <35% of assets in foreign securities including emerging markets.

This Russell fund will hedge its exposure to foreign currency through the use of currency futures and options on futures, forward currency contracts and currency options. It is non-diversified. James Ind has managed this fund since its inception in July 2010. This fund has total net assets of $1.34 billion.

The dividend yield of this RCSAX fund is 12.72%. The first and latest dividend is distributed in December 2010 ($1.48). The annual expense ratio of this fund is 1.41% while the average expense ratio in Commodities Broad Basket is 1.32%. The 12b1 fee of this fund is 0.25% and 5.75% front-end sales load fee.

Since this fund is new, there is no rank from Morningstar yet. The fund has returned 16.68% over the past year. The YTD return of this fund is -3.11%. This fund is currently available at a shortlist of 11 brokerages only. The other classes of this fund are Class C (RCSCX), Class E (RCSEX), Class S (RCCSX) and Class Y (RCSYX).

PIMCO Fundamental Advantage Total Return A (PTFAX)

The PIMCO Fundamental Advantage Total Return fund objective is to provide maximum total return, consistent with prudent investment management. This PIMCO fund generally invests in derivatives providing long exposure to Enhanced RAFI 1000 and short exposure to the S&P 500 index, backed by a diversified portfolio of short and intermediate maturity Fixed-Income Instruments. It may invest in common stocks, options, futures, options on futures and swaps to gain long exposure to Enhanced RAFI 1000 and short exposure to the S&P 500. The fund may invest in exchange traded funds. It may also invest <10% of total assets in preferred stocks.

This PIMCO fund is one of the highest yielding funds in the Intermediate-Term Bond category. This is another Bill Gross managed PIMCO fund. Bill has managed this fund since February 2008 yet this fund was introduced to public in July 2008. This fund has a dividend yield of 12.62% which is distributed quarterly. The last dividend distributed for second quarter of 2011 is $0.05. The annual expense ratio of this fund is 1.29%.

To start investing in the brokerage or IRA account of this PFTAX fund, investor will need $1,000. There is 0.25% 12b1 fee and 3.75% front-end sales load. The total net assets of this fund are $3.61 billion. The yearly performance of this fund since its inception is:

- Year 2009: 15.78%

- Year 2010: 10.24%

Based on the load adjusted return, this

bond fund has returned -4.22% over the past year and 7.31% over the past three years. Even though this fund is still new, but it has 3-stars return rating from Morningstar already. This fund is available in other classes like Class C (PTRCX), Class D (PFSDX), Class Institutional (PFATX) and Class P (PFAPX). The average maturity of this PIMCO fund is 1.28 years with 2.64 years of average duration. As of June 2011, the

top 5 sectors of this fund are Money Market and Net Cash Equivalents (49%), Non-U.S. Developed (17%), Emerging Markets (14%), Invest. Grade Credit (11%), Mortgage (9%), Government - Treasury (8%) and High Yield Credit (4%).

PIMCO Commodity Real Return Strategy A (PCRAX)

The PIMCO Commodity Real Return Strategy fund typically invests in commodity-linked derivative instruments backed by a portfolio of inflation-indexed securities and other fixed-income instruments. It seeks to gain exposure to the commodity markets primarily through investments in leveraged or unleveraged commodity index-linked notes. It also can invest in preferred stocks.

Mihir Worah has managed this PIMCO fund since December 2007. The PCRAX fund has been in the market since November 2002. This fund has a dividend yield of 12.34%. The last dividend was distributed in June 2011 ($0.46). This fund has 1.24% annual expense ratio which is a bit lower compared to the average in the Commodities Broad Basket category (1.32%).

To buy this commodity mutual fund in the brokerage account, you will need a minimum of $1,000 for the initial investment. Same amount applies for IRA account. This fund has total net assets of $27.61 billion. There is 0.25% 12b1 fee and 5.50% front-end sales load fee. Morningstar gave this fund a 3-stars rating.

Based on load adjusted return, this fund has returned 26.80% over the past year and 2.91% over the past five years. Since its inception, the fund has recorded 6 years of positive return and 2 years of negative return. This fund can be purchased from 101 brokerages. The complete shares or classes of this PIMCO Commodity Real Return Strategy Fund are:

- Class A: PCRAX

- Class Admin: PCRRX

- Class B: PCRBX

- Class C: PCRCX

- Class D: PCRDX

- Class I: PCRIX

- Class P: PCRPX and

- Class R: PCSRX

As of June 2011, the top 5 sectors of this fund based of DJ-UBS Commodity TR Index Analysis are Energy (34%), Grains (18%), Industrial Metals (17%), Precious Metals (15%), Softs (7%), Livestock (6%) and Vegetable Oil (3%).

Note: Another alternative to invest in this PIMCO Commodity Real Return Strategy A fund is to invest in

Harbor Commodity Real Return Strategy (Ticker:

HACMX).

Why invest in High Yield Funds? Reasons to invest in highest yielding mutual funds:

- Some researchers have shown that dividends provide the majority of stock market returns over the long haul.

- The current tax system favors high dividend stock or high dividend stock funds

- High income from dividend can be used to reinvest for higher performance

- High dividend yield may be used as regular income for retiree and high net worth individuals

How can you buy these mutual funds? Several options of best brokerage to choose from:

- Fidelity – Fidelity is my first choice for investing in mutual funds. Fidelity offers variety of NTF mutual funds. It also offers 30 ishares ETFs for free trade. It also offers cash management banking such as rewards credit card, checking, ATM card, etc

- Scottrade – Scottrade offers variety of mutual funds. There are 3,000 No load & No Transaction Fees (NTF) fund for free. You can also trade 15,000 mutual funds for $7.00 per trade.

- Merrill Edge – This new Merrill Edge product is offered by Bank of America (BofA). It also offers about 3000+ mutual funds. If you meet the requirement, you can also get 30 free trades for trading stocks or ETFs (Exchange Traded Funds).

- Firstrade – Firstrade offers 11,000 mutual funds to invest. You can use the mutual funds screener to select your fund. It is free to invest in No Transaction Fee mutual funds and load funds, but it charges $9.99 for no loads funds.

Please check my

Best Online Brokerages 2012 page for additional online mutual fund brokers or stock brokerages.

Disclosure: No Position

Other Mutual Funds articles:

Fund Information

| No | Name | Ticker | Rating | Yield | Expense Ratio | Load | Net Assets (mil) | Min to Invest |

|---|

| 1 | PIMCO International StocksPLUS TR Str A | PIPAX | 4 | 43.15% | 1.15% | 3.75% | $170 | $1,000 |

| 2 | PIMCO Fundamental IndexPLUS TR A | PIXAX | 4 | 24.00% | 1.19% | 3.75% | $958 | $1,000 |

| 3 | PIMCO Real Estate Real Return Strategy A | PETAX | 1 | 18.26% | 1.19% | 5.50% | $1,600 | $1,000 |

| 4 | Forward SMIDPlus Investor | ACSIX | 3 | 19.35% | 1.65% | 0.00% | $130 | $4,000 |

| 5 | PIMCO Small Cap StocksPLUS TR A | PCKAX | 4 | 18.98% | 1.09% | 3.75% | $425 | $1,000 |

| 6 | U.S. Global Investors Wld Prec Minerals | UNWPX | 2 | 15.84% | 1.81% | 0.00% | $605 | $5,000 |

| 7 | Gabelli Utilities A | GAUAX | 4 | 13.64% | 1.43% | 5.75% | $2,300 | $1,000 |

| 8 | Russell Commodity Strategies A | RCSAX | N/A | 12.72% | 1.41% | 5.75% | $1,300 | $0 |

| 9 | PIMCO Fundamental Advantage Total Ret A | PTFAX | 3 | 12.62% | 1.29% | 3.75% | $3,600 | $1,000 |

| 10 | PIMCO Commodity Real Ret Strat A | PCRAX | 3 | 12.34% | 1.24% | 5.50% | $28 | $1,000 |

Note: