As part of stock mutual fund, investing in domestic stock funds are essential for assets allocation. These domestic stock mutual funds are also known as U.S. stock mutual funds. These best rated domestic stock mutual funds include American Funds Growth Fund of America fund, Vanguard 500 Index Fund, Vanguard Total Stock Market fund, etc.

Intro

As we know, there are three types of mutual funds. They are stock mutual fund, bond mutual fund, and balanced fund. Stock mutual funds can be classified into 2 main classes such as domestic stock funds or US stock funds, and international stock funds (including emerging markets). The domestic stock funds invest mainly in US companies.

There are 9 categories of domestic stock mutual funds. The categories are: large growth, large blend, large value, mid-cap growth, mid-cap blend, mid-cap value, small growth, small blend, and small value. These domestic stock funds may specialize in a particular sector of the market such as technology, financials, health care, utilities, communications, natural resources, real estate, and miscellaneous.

October 28, 2010

October 27, 2010

Position update - MCK, FLIR, URS & SRS

My position is still healthy and is gaining momentum especially MCK (Mckesson) and FLIR (FLIR System). MCK reaffirmed the earning and announced new shares buyback. FLIR has posting good earning last week. I continue to like the chart and look to be slightly breakout today after 2-3 days flagging.

URS also reverse course and closed out only slightly negative for the day.

My SRS hedge also turned positive. I'll keep holding this hedge just in case the market turn violently.

I'm also eyeing some bond CEFs and solid stocks. I'll see how these CEFs will react to downside after more down day. Usually, it will create an arbitrage opportunity for short term trade. Some solid stock also turn negative such as Pepsi (PEP), FirstEnergy (FE), TEVA and SWN . I'll look into these stocks if the market turn negative.

Overall, it was a good day for MEPB Financial.

Note: Please trade responsibly.

URS also reverse course and closed out only slightly negative for the day.

My SRS hedge also turned positive. I'll keep holding this hedge just in case the market turn violently.

I'm also eyeing some bond CEFs and solid stocks. I'll see how these CEFs will react to downside after more down day. Usually, it will create an arbitrage opportunity for short term trade. Some solid stock also turn negative such as Pepsi (PEP), FirstEnergy (FE), TEVA and SWN . I'll look into these stocks if the market turn negative.

Overall, it was a good day for MEPB Financial.

Note: Please trade responsibly.

October 25, 2010

Top 10 Cheapest Online Discount Brokerage Account and More

With the current stock market, finding a good & cheap online discount brokerage is important. Fees can cut into the trading profit. The following top 10 cheapest discount brokerages are: Lightspeed Trading, Interactive Brokers, Just2trade, OptionsHouse, eOption, SogoTrade, Zecco, TradeKing, MB Trading, and Lowtrades.

I will provide a summary of various online stock brokerages with their commissions and fees. I have been using multiple trading platforms such as Fidelity, Zecco, Vanguard, Lightspeed, and Just2trade. For me, the brokerage needs to satisfy the following requirement:

I will provide a summary of various online stock brokerages with their commissions and fees. I have been using multiple trading platforms such as Fidelity, Zecco, Vanguard, Lightspeed, and Just2trade. For me, the brokerage needs to satisfy the following requirement:

- Low commission fees or cheap fees to trade or buy stocks, etfs, and mutual funds

- Reliable, can be access freely, stable trading platform

- Offer ACH electronic transfer

- Responsive and contactable customer service

To get the low commission fee, usually an investor or trader will need to sacrifice some investment tool such as good charting, tax tool, financial services, transfer capability etc. So don't be surprised about the barebone platform for this discount brokerage. You can essentially supplement the lack of features by open another account with full service brokerage such as Fidelity, Schwab, etc or you can just use internet service such as stockcharts & finviz for charting and filter.

|

| Brokerages Logo |

Top 10 cheapest online discount stock brokers to trade stock or ETF are:

1. Lightspeed Trading

Lightspeed offers stock, etf, option, forex and future for trading. The cost to buy stock online is the cheapest discount brokerage as far as I know. To trade stock, you only pay for $0.00395 per shares with $0.40 per 100 shares. The minimum is $0.40 per trade. There is no ticket fee to buy option; it only cost $0.50 per option contract. The minimum balance to open is only $1,000 for cash account and $2,000 for margin account using Lightspeed Web Trader. If you are using Lightspeed Trader which is software based platform, the minimum balance requirement is $10,000.

more can be read at: Top 10 Cheapest Online Discount Brokerage Account and More

October 20, 2010

My thought about the current market & my holding update

Although most indexes were in red, I still don't think any trader should turn bearish right away. Most bond is still up junk bond is still only down a little. Should be interesting to see what tomorrow will bring. A correction of 3-5% is expected after 12-15% run up for dow jones and S&P 500.

I have decided to post my holding for the first time. I'll try to track and update as I buy or sell my position. My current stock holding (small position) is:

updated on 10/20/2010

I have decided to post my holding for the first time. I'll try to track and update as I buy or sell my position. My current stock holding (small position) is:

- FLIR (Flir System) - Defense

- MCK (Mckesson Corp) - Drug Service

- URS (URS Corp) - Engineering Services

- ACL ( Alcon) - Drug / Healthcare

- MRK (Merck) - Drug /healthcare

- JNK - Junk Bond

- VMO - Muni Bond Closed End Fund (CEF)

- VGM - Muni Bond Closed End Fund (CEF)

- Cash -- Ton of them

updated on 10/20/2010

October 18, 2010

Another crash on SPY ETF or bad print?

Top 5 Emerging Market Mutual Funds

With developed countries (USA & Europe) economy is cooling down or at least slow down, everyone will look at growing sector or market to invest. One of these markets is diversified emerging market.

With developed countries (USA & Europe) economy is cooling down or at least slow down, everyone will look at growing sector or market to invest. One of these markets is diversified emerging market.Emerging market usually include most developing countries in Asia, Africa and Eastern Europe. Some of these countries are known as BRIC acronym (Brazil, Russia, India and China). Most analysts predict emerging market will drive all future growth for the next decade. Investor should look to invest in emerging market. Emerging market is part of international market; this mean investing in this emerging market can be volatile at the times. Please invest responsibly.

Best Emerging Markets Funds

I think emerging market should be part of your investment portfolio whether it is in your 401k retirement or brokerage account. The question is how to invest in emerging market; there are two easy ways to invest such as using ETF and Mutual Funds.The following article will discuss about Top 5 mutual funds in emerging market. The following is top 5 emerging market mutual funds in term of asset. What I like is usually big asset is equal to big confident by investor or institutional money to invest in this fund. I also like most of these asset managers as they are well known to many investors

- Vanguard Emerging Market Stock Index, VEIEX

- American Funds New World Fund A, NEWFX

- Lazard Emerging Markets Equity, LZOEZ

- Oppenheimer Developing Markets, ODMAX

- DFA Emerging Markets Value Portfolio DFEPX

Vanguard Emerging Market Stock Index

The Vanguard Emerging Market Stock Index portfolio tracks the MSCI Emerging Markets Index, which is weighted toward the largest companies in the largest emerging markets. The fund performance is as follows (VEIEX): 1 Year: 19.73% per year 3 Year: -2.19% per year 5 Year: 13.50% per year 10 Year: 13.66% per year.American Funds New World Fund

This American Funds’ New World Fund is a diversified international fund that has managed to stay less volatile than most other emerging-market rivals.Lazard Emerging Markets Equity

The Lazard Emerging Markets Equity Portfolio fund has performed better by picking undervalued stocks of companies based in a wide selection of emerging-market countries. The Lazard Emerging Markets Equity fund objective is to provide long-term capital appreciation by investing in companies with strong, sustainable financial productivity at attractive valuations.Oppenheimer Developing Markets Fund

The Oppenheimer Developing Markets investment aggressively seeks capital appreciation. The fund normally invests more than 80% of assets in equity securities of issuers whose principal activities are in at least three developing markets.DFA Emerging Markets Value Portfolio Fund

The primary objective is to seek long-term capital appreciation. The fund invests normally at least 80% of net assets in emerging markets investments that are defined as Approved Markets securities and may purchase emerging market equity securities across all market capitalizations whether it is large cap, mid cap and small cap.More can be read at: Top 5 Best and Popular Emerging Market Mutual funds

October 14, 2010

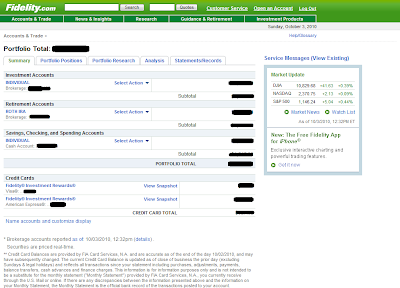

Fidelity Brokerage Account Review

Fidelity Investments is one of financial service provider that offers to buy stock online with various trading platforms for its investors. In addition to low cost stock and options trading Fidelity also has investment management, retirement planning. Fidelity is the largest mutual fund company in the US. They also offer various accounts specialize in IRAs/Rollovers (Roth IRA, Traditional IRA and 401k), CDs, Bonds, and 529 Plans. Fidelity also offers mobile trading application.

|

| Fidelity main page |

For me, the brokerage needs to satisfy the following requirement:

- Low commission fees to trade stocks, etf, mutual funds (if necessary)

- Reliable, can be access freely thru web, stable trading platform

- Offer ACH electronic transfer

- Responsive and contactable customer service

Fidelity definitely fit into my criteria. Ever since they offer 25 ishares ETF for free, my interest using fidelity is growing even more. I have been using my fidelity account for the past 3 years for Roth IRA, investment brokerage account and interest checking account. I also use their credit card which provides 2% cashback on any daily purchase. This is one of the best credit card cashback from my experience. Also please check my other brokerages review such as just2trade, vanguard, Lightspeed, E*trade, Scottrade and Zecco.

The following is the Fidelity details:

Products:

Stocks, bonds, mutual funds, annuities, insurance, commercial paper, CDs, IPOs, precious metals, managed portfolios Market Orders: $7.95 Limit Orders: $7.95

Phone FAST Orders: $12.95

Broker Assisted: $32.95

ishares ETFs Orders: $0.00 for 25 ishares ETFs Mutual Funds:

Maximum Margin Rate:

$0.00 for Fidelity & NTF funds. Non-NTF: $75.00. Options: $7.95/trade+$0.75/contract Minimum to Open: $2500 Inactivity Fee: $0.00 Some Other Fees: Tender Fee: $38.00. Maximum Margin Rate:

Based on proprietary base rate.

More detail can be read at hubpages: My Fidelity Brokerage Account Review

October 8, 2010

Scottrade Stock Brokerage Review

If you are investor or trader and buy stock online as well as buy mutual fund online, you probably know about Scottrade. Scottrade is an online brokerage site that offers various products such as stocks, options and mutual funds. They offer their low cost commissions of $7.00 per trade on three different trading platforms: Scottrade, Scottrade Elite, and Scottrade OptionsFirst.

Also, Scottrade has over 480 branch offices throughout the United States and has had a consistent track record of being recognized as an industry leader by several different magazines and review groups. While not one of the cheapest online trading platform, Scottrade has been known by investor as well as trader due to its platform, research and community.

Also, Scottrade has over 480 branch offices throughout the United States and has had a consistent track record of being recognized as an industry leader by several different magazines and review groups. While not one of the cheapest online trading platform, Scottrade has been known by investor as well as trader due to its platform, research and community.

Products:

Stocks, options, mutual funds, CDs, munis, Canadian stocks

Market Orders:

$7.00 Limit Orders: $7.00

Broker Assisted: $27, Touchtone IVR Phone system: $17

Mutual Funds:

$17.00. Load funds also incur a $17.00 redemption fee. Also has NTF funds. Options: $7.00/trade+$1.25/contract

Minimum to Open:

Maximum Margin Rate:

$500 Inactivity Fee: $0.00 Some Other Fees: Paper Statement: $2.00 per statement. ACAT In/ Out: $60.00. Maximum Margin Rate:

Based on proprietary base rate

more details can be read on Hubpages: My Scottrade Brokerage Account Review

October 5, 2010

E*Trade Online Full Brokerage Review

E*TRADE is an online brokerage site that specialize in stock, option, bond, future and mutual fund. E*trade also provides many additional banking financial services such as High Yield Saving accounts, checking account & mortgage. Etrade also offers a wide selection of trading tools for their customers, as well as low trading commissions.

E*TRADE also allows its investors or traders to trade stocks on their smart phones such as iPhone and BlackBerry with the use of E*Trade Mobile Pro. They are one of the largest financial brokers in the world with > 4.5 million accounts in about 40 countries with customer assets in excess of $100 billion.

E*TRADE also allows its investors or traders to trade stocks on their smart phones such as iPhone and BlackBerry with the use of E*Trade Mobile Pro. They are one of the largest financial brokers in the world with > 4.5 million accounts in about 40 countries with customer assets in excess of $100 billion.

The following is the standard pricing for etrade:

Products:

Stocks, options, futures, bonds & mutual fund Market/Limit Orders: $9.99 for stock and/or etf Options: $9.99/trade+$0.75/contract

Futures: $9.99/trade+$2.99/contract Mutual Funds: $0.00 (No Load, NTF) & $19.99 (Transaction-fee Fund)

Broker Assisted: Add $45 (ex: Market order = $54.99)

Minimum to Open:

Some Other Fees:

Maximum Margin Rate:

$500 Inactivity Fee: $0.00 with exceptionSome Other Fees:

Paper Statement: $2.00 per statement; ACAT Out: $60.00. Maximum Margin Rate:

Based on proprietary base rate

Opening an account

Opening account is straight forward; you just need to fill the online application through etrade website. You can open individual, joint, and Individual Retirement accounts (IRA). The following accounts are being offered by etrade such as Employee Stock Plans, Business, Corporate/LCC, Trust & Estate, incestment club, rollover IRA, traditional IRA, Roth IRA, beneficiary IRA, etc. They may require you to submit some identification as well. The application only takes about 10-15 minute. Once you are done, you’ll need to wait for their approval. Then, you can setup how you want to fund your account.

What are the advantages using etrade?

- Offer several premium services such as excellent trader platform Power Etrade Pro 5.0

- Best mobile trading application Etrade Mobile Pro for blackberry & Apple iphone

- Etrade website is very user friendly.

- There are additional banking services such as Online High Yield Saving account (complete savings), and Checking account (Max-Rate Checking & e*trade checking).

- Offer international market for trading such as Canada, France, Germany, Hong Kong, Japan, and the United Kingdom.

- Also offer after hour trading either it is pre market and post market hour.

- Offer complex and conditional buy or sell order

- Have an excellent Dividend Reinvestment Plan (DRIP) program

Disadvantages

- Compare to other brokerage the $9.99 trades is more expensive than discounted competitors such as Fidelity, Charles Schwab, Lightspeed, Just2trade, Vanguard.

- Some of the premium feature such as Power Etrade Pro is not available to all clients.

- Account maintenance fees of $25 per quarter for some investor

October 2, 2010

Lightspeed Trading Web Trader Brokerage Review

Choosing the right brokerage account is essential for traders or investors. Lightspeed brokerage is one of the top rated discount brokerage account for you. More brokerage review can be found below.

Intro

With current trading and/or investing situation, finding a good online discount brokerage to buy stock online or build investment portfolio is important. The process of choosing the right brokerage can be a headache. One of my regular discount brokerage I have been using is Lightspeed Web Trader. In this article, I’ll describe my knowledge using Lightspeed Web Trader. I have been using this trading platform for the past 2 months.

One of the reasons I choose Lightspeed trading is their low commission for trading as well as their low balance requirement. It only costs $0.0045/share with $1.00 minimum per trade (i.e. 100 shares or less = $1.00) for trading. Lightspeed Trading offers several trading platforms for trading stock, buying option or buying future contract as well as Forex such as:

Compare to other brokerages such as TradeKing, Scottrade, etrade & optionsXpress, lightspeed trading is very competitive.

Products and Services

Lightspeed web trader offers product such as stocks and options. Lightspeed Web Trader has similar platform as Noble Trading web platform since Lightspeed acquired Noble Trading early this year. Minimum balance to open an account for web trader is $1,000 for cash account and $2,000 for margin account. There is no inactivity fee. For foreigner (non US citizen), you can open lightspeed account as well by submitting paper application. Lightspeed provides accounts to individuals, joint holders, retirement accounts (Traditional IRA, Roth, Rollover) etc.

New Pricing on 1/15/2012

There will be new commission schedule for Lightspeed WebTrader user on 1/15/2012.

|

| Lightspeed Brokerage |

With current trading and/or investing situation, finding a good online discount brokerage to buy stock online or build investment portfolio is important. The process of choosing the right brokerage can be a headache. One of my regular discount brokerage I have been using is Lightspeed Web Trader. In this article, I’ll describe my knowledge using Lightspeed Web Trader. I have been using this trading platform for the past 2 months.

One of the reasons I choose Lightspeed trading is their low commission for trading as well as their low balance requirement. It only costs $0.0045/share with $1.00 minimum per trade (i.e. 100 shares or less = $1.00) for trading. Lightspeed Trading offers several trading platforms for trading stock, buying option or buying future contract as well as Forex such as:

- Lightspeed Trader – This is a software trading platform for mainly active trader

- Lightspeed Gateway – This is their algorithmic-based or Automated Trading platform for high frequency trading strategies

- Lightspeed Web Trader – Web browser based trading platform. I’ll provide this web based review.

- Lightspeed Forex – This is another software trading platform for forex trader through FOREXTrader Pro

Compare to other brokerages such as TradeKing, Scottrade, etrade & optionsXpress, lightspeed trading is very competitive.

Products and Services

Lightspeed web trader offers product such as stocks and options. Lightspeed Web Trader has similar platform as Noble Trading web platform since Lightspeed acquired Noble Trading early this year. Minimum balance to open an account for web trader is $1,000 for cash account and $2,000 for margin account. There is no inactivity fee. For foreigner (non US citizen), you can open lightspeed account as well by submitting paper application. Lightspeed provides accounts to individuals, joint holders, retirement accounts (Traditional IRA, Roth, Rollover) etc.

- Products Offering: Stocks, Options, Future (separate account), Forex (Separate account)

- Market Orders: $3.00 per trade

- Limit Orders: $3.00 per trade

- OTCBB and PINK sheet Stocks: $10 (up to 20,000 shares)

- Options: $0.60/contract ($3.00 min)

- Futures: $0.60/contract

- Phone Order: $20 per order

- Minimum fund to Open: $1,000 (Cash) & $2,000 (Margin)

- Account Inactivity Fee: $0.00

- Other Fees: Wire Fee: $20.00 (domestic) ACAT Out: $50.00.

- Maximum Margin Rate: Please refer to lightspeed trading website

New Pricing on 1/15/2012

There will be new commission schedule for Lightspeed WebTrader user on 1/15/2012.

- Lightspeed will eliminate the per-share rate plan. Any customer on per-share rate will be switched to the new per-trade plan.

- Lightspeed will reduce the current per-trade plan from $4.50 per trade to $3.00 per trade.

- For equities, $3.00 per trade with 50,000 share maximum order size

- For options, $0.60 per contract ($3.00 minimum commission)

Subscribe to:

Posts (Atom)

The Importance of Diversification in Investing

Diversification is a key principle in investing, and it's especially important in today's uncertain economic climate. By spreading y...

-

Municipal bond investment can be done through variety of investment funds. One of them is using Closed End Funds or CEFs. These muni bond cl...

-

One of the leading banks in Northeast and Southeast America is TD Bank. TD Bank has expanded its business. As part of TD Bank Financial Grou...

-

Investing European market is essential for investor portfolio diversification. Using Europe stock mutual funds, investors can achieve their ...