Top 6 high yield muni bond closed end funds are Pioneer Municipal High Income Advantage, Nuveen Municipal High Income Opportunity Fund, etc.

High Yield Municipal Bond Funds

High yield municipal bond funds use its assets to purchase lower rated municipal bonds. These bond funds provide tax free high yield income for investors. These funds are suitable for high income investor or retiree who seeks tax free income. These investment funds usually provide the distribution yield regularly (i.e. monthly or quarterly).

These high yield municipal bond funds have higher risk than investment grade municipal bond funds. The investment risks include market risk, interest risk, issuer risk, etc. There are 3 ways to invest in high yield muni funds such as through ETF, CEF, and mutual fund. I will focus on high yield muni closed end fund in this article.

Investing in high yield muni CEF can provide more opportunities for investors to enhance their returns and/or income. You can buy and sell this high yield muni fund using your brokerage hence this fund is traded like stocks. You can invest as little as $5 per share for regular investment account or retirement account. For your 401k account, please check with your fund administrator about this fund.

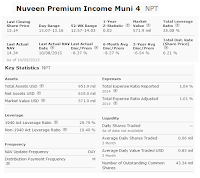

From this best performing funds list, you may find each individual fund review. You can find the fund performance, expense ratio, and yield or dividend from the table below. The list is sorted based on its year to date performance in 2014 (up to August 2014).

Top 6 high yield muni bond closed end funds are:

- Pioneer Municipal High Income Advantage

- Nuveen Municipal High Income Opportunity Fund

- Pioneer Municipal High Income

- MFS High Yield Municipal Trust