There are several advantages for investors to invest in convertible securities mutual funds. One of them are getting a regular income. These posts will look into the

best convertible mutual funds of 2011 including: Calamos Convertible A, Fidelity Convertible Securities, Vanguard Convertible Securities Inv, etc.

Convertibles Mutual Funds

With interest rate hikes are looming, investing in convertible bonds can be attractive to investors and/or traders. Convertible bonds can provide additional investment portfolio diversification. There are several ways to invest in convertible bonds. Investors can invest in individual convertible bonds, mutual fund, closed end fund (CEF), and exchange traded fund (ETF).

Convertible bond buyers or investors usually invest in these asset classes in the hope of obtaining one or more of the following benefits:

- Investor can participate in upside movement should the stock price increase

- Investor can limit his/ her loss should the stock price decrease

- Convertible bonds provide higher yield than regular dividend from company's common stock

- The price movement of the bond is less volatile than common stock. Convertible bonds traditionally have had a low correlation with fixed income obligations and high, but imperfect, correlation with equities / stocks

- If the company files for bankruptcy, investor can claim on the issuer's assets senior first to that of the holders of the common stock

How are the funds selected?

These funds are rated based on their asset, Morningstar rating, and expense ratio. These funds have big assets. Big asset means the fund has attracted variety of retail investor and institutional investor to invest in these funds. Most of these funds also have a respectable Morningstar rating of 3 or more stars. With 3 or more star rating, this means the fund has consistently performed under any market condition (bear or bull market) and should perform better than many of its index benchmark. These funds also paid dividend either monthly or quarterly.

The 10 Best Convertible Bonds Mutual Fund of 2011 (Part 1):

- Calamos Convertible A

- Fidelity Convertible Securities

- Vanguard Convertible Securities Inv

- Franklin Convertible Securities A

- MainStay Convertible B

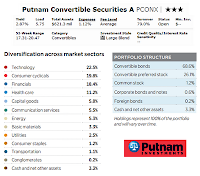

- Putnam Convertible Income-Growth A

- Allianz AGIC Convertible A

- Columbia Convertible Securities A

- Invesco Van Kampen Harbor A

- Lord Abbett Convertible A

Calamos Convertible A (CCVIX)

The investment in

Calamos Convertible fund primarily is seeking for current income while the capital growth is the secondary purpose. This fund invests the majority (around 80%) of its net assets in convertible securities issued by U.S. and foreign companies. There is no limitation of the market capitalization. The remaining assets might be invested in foreign securities. This fund will be closed to all purchases of shares and exchanges, with limited exceptions, as of January 28, 2011.

John Calamos the founder of Calamos Assets Management has managed this fund since 1985. The company is the 16th largest money manager in Chicagoland. This fund has 1.08% expense ratio per year.

The yield of this fund is 2.73%. There is 0.25% 12b1 fee and 4.75% of front-end sales load. This

convertibles fund has returned 11.74% over the past one year and 5.16% over the past five years.

The minimum balance to invest in this fund is $2,500 for brokerage account (same applies for CALBX and CCVCX) and $500 for IRA account. This fund can be purchased from 89 brokerages include Schwab Institutional, TD Ameritrade, Inc., Scottrade Load, JPMorgan, Vanguard and Schwab Retail. The other class tickers of this fund are CALBX, CCVCX, CICVX and CCVRX. Eventhough CALBX and CCVCX have the same minimum initial investment, but they have higher expense ratio (1.82%) compared to CCVIX.

The top 10 holdings of this fund are EMC Corp (4.6%), SanDisk Corp (3.4%), Intel Corp (2.6%), Archer-Daniels-Midland Company (2.6%), NetApp, Inc (2.4%), Apache Corp (2.2%), Teva Pharmaceutical Industries Ltd (1.9%), Gilead Sciences Inc (1.8%), Symantec Corp (1.6%), and Navistar International Corp (1.5%). These top 10 companies make up to 24.6% of its total assets. The top sectors of this fund are Information Technology (33.8%), Health Care (15.3%), Energy (10.3%), Industrials (8.4%), Materials (7.6%), Consumer Discretionary (6.6%), Consumer Staples (5.2%) and Financials (4.3%).

Fidelity Convertible Securities (FCVSX)

Fidelity Convertible Securities investment seeks for both current income and capital appreciation. The major net assets investment of this fund is in convertible securities with below investment-grade rating or unrated securities. This

best fund may also invest in corporate or U.S. government debt securities, preferred stocks, money-market instruments, and common stocks.

Thomas T. Soviero has been the lead manager since June 21, 2005. This fund has quite low annual expense ratio (0.59%) compared to the average in 1.41%. This fund has a total of $2.72 billion net assets. It doesn’t have any 12b1 fee and front-end sales load. This fund has returned 7.10% over the past five years and 6.80% over the past decade. The minimum balance to invest in this fund and the other class is $2,500 for brokerage account. You can also purchase this fund through Fidelity Advisors fund. The other class tickers of this fund are FCAVX, FCBVX, FCCVX, FICVX and FTCVX. Only FICVX doesn’t have any 12b1 fee and front-end sales load.

The top ten industry sectors of this fund as of Jan 31, 2011 are Energy (23.02%), Information Technology (17.74%), Consumer Discretionary (12.97%), Industrials (12.92%), Financials (12.89%), Health Care (6.99%), Consumer Staples (3.77%), Materials (3.45%) and Telecommunication Services (2.28%). The top ten company holdings are Peabody Energy Cv (4.75%), El Paso Corp (4.99%), Wells Fargo (7.5%), General Motors (4.75%), Ford Motor Conv (4.25%), Intel Conv (3.25%), Celanese Corp Ser A, Chesapeake Enrg Cv (2.5%), Hertz Global Conv (5.25%) and Alpha Nat Res Conv (2.375%). These top 10 holdings make up to 35.62% of the total net assets out of 132 total holdings.

Vanguard Convertible Securities Inv (VCVSX)

Vanguard Convertible Securities Investor investment is looking for both current income and long-term capital appreciation. The primary net assets investment is in convertible securities. These convertible securities have the below investment-grade rating and combine the investment characteristics of bonds and common stocks. They consist of corporate bonds and preferred stocks that are convertible into common stock.

This fund is managed by Larry Keele since Nov 1, 1996. This fund has 3.64% yield and 0.68% annual expense ratio (the lowest among all mentioned in this list). The minimum balance to invest in this fund is $10,000 for brokerage account and IRA account. This fund applies no 12b1 fee and no sales load. This fund has returned 23.85% over the past one year and 7.82% over the past ten years.

The top 10 holdings of this fund as of Feb 28, 2011 are Micron Technology Inc Cvt, SBA Communications Corp Cvt, General Motors Co Pfd, Interpublic Group of Cos Inc Cvt, Gilead Sciences Inc Cvt, MGM Resorts International Cvt, Equinix Inc Cvt, ArvinMeritor Inc Cvt, Lennar Corp Cvt and Owens-Brockway Glass Container Inc Cvt. These ten largest holdings make up to 22.5% of total net assets and 22.8% of equities.

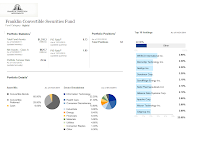

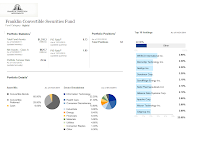

Franklin Convertible Securities A (FISCX)

Franklin Convertible Securities investment pursues for maximizing the total investment return with considering the consistent reasonable risk. The major net assets investment is in convertible securities including the common stocks received upon conversion of convertible securities. This fund may also invest in other securities, such as common or preferred stocks and non-convertible debt securities. As of Jan 31, 2011 the composition of its net assets investment is 65.00% in convertible bonds, 29.00% in convertible preferred and 6% in cash.

Alan Muschott has managed this fund since Jul 1, 2002. He is as well the vice president of the Franklin Advisers, Inc. This fund has 1.22 billion net assets. The yield for this fund is 3.23%. This fund has 0.90% annual expense ratio which is quite low compared to the average in 1.41%. The 12b1 fee is 0.25%. This fund has returned 5.67% over the past three year, with 5.64% of 5-year average return. Minimum balance to invest in brokerage account of this fund is $1,000 and $250 for IRA account.

This fund can be purchased from 60 brokerages such as Morgan Stanley Advisors, Pershing FundCenter, Schwab Institutional, Td Ameritrade, Inc., JPMorgan and Merrill Lynch. The other class tickers of this fund are FCSZX and FROTX. The expense ratio for FCSZX is 0.65% and 1.65% for FROTX.

Best Convertible Securities Mutual Funds of 2012

Top 10 holdings of this fund as of Jan 31, 2011 are WESCO International Inc (2.90%), Microchip Technology Inc (2.30%), NetApp Inc (2.30%), Dendreon Corp (2.20%), SandRidge Energy Inc (2.10%), Salix Pharmaceuticals Ltd (2.10%), Alliance Data Systems Corp (2.10%), Apache Corp (2.00%), Micron Technology Inc (2.00%), and Citigroup Inc (2.00%). These top 10 holdings make up to 22.00% of the total portfolio. The top sectors breakdown are Information Technology (22.20%), Health Care (21.30%), Consumer Discretionary (13.60%), Industrials (9.90%), Energy (8.40%), Financials (6.40%), Materials (5.90%), Utilities (4.60%) and Consumer Staples (1.40%).

MainStay Convertible B (MCSVX)

The investment in MainStay Convertible is looking for both current income and capital appreciation. The primary net assets investment (at least 80% of total) is in investment-grade convertible securities. The other investment options include equity securities, nonconvertible corporate debt, cash or cash equivalents and U.S. government securities. This fund has a total of 1.04 billion net assets.

Edward Silverstein has been the fund manager since May 1, 2001. This fund has 1.18% yield. The expense ratio of this fund is 2.03% per year. This fund has 1.00% of 12b1 fee but no sales load. The minimum balance to invest in either brokerage or IRA account of this fund is $1,000. The other class tickers of this fund are MCOAX, MCCVX, MCNVX and MCINX. Some other class has lower expense ratio.

Top ten holdings of this fund are JPMorgan Chase & Co (3.5%), Core Laboratories LP (2.7%), Cameron International Corp (2.6%), Teva Pharmaceutical Finance Co BV (2.5%), Citigroup Inc (2.2%), Fisher Scientific International Inc (2.1%), Incyte Corp Ltd (2.0%), BioMarin Pharmaceuticals Inc (2.0%), Peabody Energy Corp (2.0%), and Allegheny Technologies Inc (1.9%). The top sectors of this fund are Consumer Non-Cyclical (24.8%), Energy (21.1%), Communications (11.0%), Technology (9.7%), Consumer Cyclical (9.7%), Industrials (6.5%), Financials (6.2%), Asset-Backed Securities (1.9%), Basic Materials (1.7%) and Utilities (0.6%).

Disclosure: No Position.

Fund Info

| No | Mutual Funds Description | Ticker | Yield | Morningstar Rating | Net Assets (Mil) | Expense Ratio | Min to Invest |

|---|

| 1 | Calamos Convertible A | CCVIX | 2.73% | 4 | $3,660 | 1.08% | $2,500 |

| 2 | Fidelity Convertible Secs | FCVSX | 2.81% | 2 | $2,720 | 0.59% | $2,500 |

| 3 | Vanguard Convertible Securities Inv | VCVSX | 3.64% | 5 | $2,130 | 0.68% | $10,000 |

| 4 | Franklin Convertible Securities A | FISCX | 3.23% | 3 | $1,220 | 0.90% | $1,000 |

| 5 | MainStay Convertible B | MCSVX | 1.18% | 3 | $1,040 | 2.03% | $1,000 |

Details on next 5 funds can be found on

Top Convertible Bond Mutual Funds pt 2. The following table show the fund performance for 1 year, 3 year, 5 year, and 10 years. Please check my part 2 for the next 5 of these convertible bond funds.

updated on 4/28/2012