Top 7 Popular Best Fidelity Mutual Funds:

- Fidelity Contrafund

- Fidelity Spartan 500 Index

- Fidelity Diversified International

- Fidelity Growth Company

- Fidelity Low-Priced Stock

- Fidelity Puritan

- Fidelity Total Bond

1. Vanguard Total Stock Market (VTSMX)

1. Vanguard Total Stock Market (VTSMX) Stocks, bonds, mutual funds, options, CDs, insurance, annuities, foreign investments $8.95 / trade $8.95 / trade $49.95 & $0.00 for NTF funds. $8.95/trade+$0.75/contract $1000 for US-based accounts, $25000 or $10000 for foreign accounts $0.00 ACAT Out: $50.00. Based on proprietary base rate |

| Brokerages Logo |

With developed countries (USA & Europe) economy is cooling down or at least slow down, everyone will look at growing sector or market to invest. One of these markets is diversified emerging market.

With developed countries (USA & Europe) economy is cooling down or at least slow down, everyone will look at growing sector or market to invest. One of these markets is diversified emerging market. |

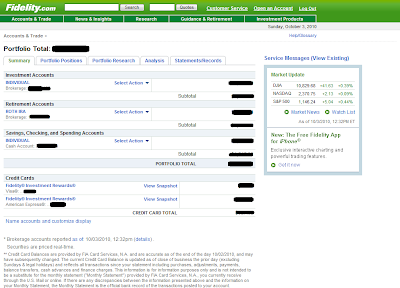

| Fidelity main page |

Stocks, bonds, mutual funds, annuities, insurance, commercial paper, CDs, IPOs, precious metals, managed portfolios Market Orders: $7.95 Limit Orders: $7.95 $0.00 for Fidelity & NTF funds. Non-NTF: $75.00. Options: $7.95/trade+$0.75/contract Minimum to Open: $2500 Inactivity Fee: $0.00 Some Other Fees: Tender Fee: $38.00. Based on proprietary base rate. Stocks, options, mutual funds, CDs, munis, Canadian stocks $7.00 Limit Orders: $7.00 $17.00. Load funds also incur a $17.00 redemption fee. Also has NTF funds. Options: $7.00/trade+$1.25/contract $500 Inactivity Fee: $0.00 Some Other Fees: Paper Statement: $2.00 per statement. ACAT In/ Out: $60.00. Based on proprietary base rateDiversification is a key principle in investing, and it's especially important in today's uncertain economic climate. By spreading y...