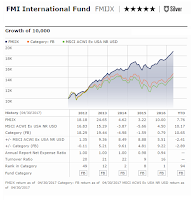

FMI International Fund (FMIJX) Profile

This FMI International Fund objective is to provide capital appreciation. The fund manager will invest mainly in a limited number of large capitalization (namely, companies with more than $5 billion market capitalization at the time of initial purchase) value stocks of foreign companies (also referred to as non-U.S. companies).This FMI fund typically invests at least 65% of its total assets in the equity securities of non-U.S. companies. The majority of the fund's investments will be in companies that have global operations rather than in companies whose business is limited to a particular country or geographic region. The fund is non-diversified.