This article will provide the next 5 best international bond funds. These world bond funds can invest in many different countries such as developed countries and developing countries as well as emerging markets. The funds include PIMCO fund, Loomis Sayles fund, and more. The fund can provide additional tools to invest in 2011.

The Top 10 Best International Bond Funds are:

Intro

- Templeton Global Bond A

- Oppenheimer International Bond A

- American Funds Capital World Bond A

- PIMCO Foreign Bond (USD-Hedged) A

- AllianceBern Global Bond A

- PIMCO Foreign Bond (Unhedged) A (PFUAX)

- Loomis Sayles Global Bond Retail (LSGLX)

- Wells Fargo Advantage Intl Bond A (ESIYX)

- PIMCO Global Bond (Unhedged) D (PGBDX)

- Waddell & Reed Global Bond A (UNHHX)

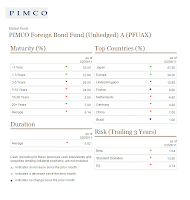

PIMCO Foreign Bond (Unhedged) A (PFUAX)

As well as seeking for a maximum total return, the investment in PIMCO Foreign Bond (Unhedged) considers the consistency with capital preservation and prudent investment management. This non-diversified fund has the major net assets investment in Fixed-Income Instruments that are tied economically to foreign countries, with a minimum of three foreign countries those can be exemplified by forwards or derivatives such as options, future contracts or swap agreements.

Best World Bond Mutual Funds 2012

Scott A. Mather has managed this fund since Feb 2008. The distribution rate of this fund is 6.06% with the last dividend as of Feb 2011 is 0.02%. This fund has 0.95% expense ratio per year. Should you are interested in this fund, please note that there is a 0.25% 12b1 fee applied and 3.75% of front-end sales charge fee.

The performance of this world bond mutual fund is 6.95% over the past one year and 7.84% over the past five years. The 5-year average return is 8.67%. The minimum initial investment is $1,000 for brokerage account (applies for PFRCX and PFRCX). No IRA account available. The other class tickers of this fund are PFUUX, PFRCX, PFBDX, PFUIX and PFUPX. Some asset classes of fund have lower expense ratio fee, and no front end sales charge fee.

The top countries as per the percentage of net assets invested are Japan (41.30%), Europe (34.50%), United Kingdom (12.80%), France (6.80%), Netherlands (4.80%), Germany (4.80%), China (1.00%) and Brazil (1.00%). The data is per Feb 28, 2011.

Loomis Sayles Global Bond Retail (LSGLX)

The investment in Loomis Sayles Global Bond seeks for high total investment return by combining high current income and capital appreciation. The major investment (at least 80%) is in fixed-income securities, with the larger portion for investment-grade fixed-income securities worldwide, and a smaller portion (up to 20%) in below investment-grade fixed-income securities. There is no maturity limitation for the fixed-income securities. This LSGLX fund may also invest in foreign currencies and there is an engaging possibility in other foreign currency transactions for investment or hedging purposes.David W. Rolley has been the lead manager of this fund for 10 years. The distribution rate is 3.41%. This LSGLX has a low annual holdings turnover rate (100%) of the average of 127.8%. the expense ratio of this fund is 1.0%. A $2,500 is required for the initial investment in brokerage account of this fund. Currently no IRA account available. The 12b1 fee is 0.25. This is a no-sales load fund.

This world bond mutual fund has returned 8.65% over the past one year and 6.95% over the past five years. This fund can be purchased from 96 brokerages such as Morgan Stanley Advisors, Schwab Institutional, Td Ameritrade, Inc., T. Rowe Price, Fidelity Retail FundsNetwork. There is only one other class in this fund which is Loomis Sayles Global Bond Institutional (LSGBX) with the minimum investment of $100.000 and 3.69% of yield.

The top ten holdings of LSGLX as of Feb 28, 2011 are Japan-299 (4.4%), Japan-84 (3.9%), Canadian Government (2.8%), Offset-Us Long Bond (2.4%), Buoni Poliennali Del Tes (2.0%), Norwegian Government (1.9%), Bundesrepub. Deutschland (1.9%), Sweden Government (1.9%), Kingdom of Denmark (1.9%) and Finnish Government (1.6%). These top ten holdings make up to 24.7% of the total portfolio. The country distribution data is United States (26.53%), Japan (11.64%), Canada (8.36%), Germany (6.31%), United Kingdom (6.29%), Mexico (3.57%), Norway (3.39%), Cayman Islands (2.46%), Italy (2.39%) and Other (29.07%).

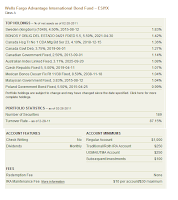

Wells Fargo Advantage International Bond A (ESIYX)

Wells Fargo Advantage International Bond investment is looking for total return including the income and capital appreciation. The major net assets investment of this fund is in foreign debt securities (35% in below-investment grade debt securities and up to 5% in debt securities denominated in developing countries’ currencies). The debt securities may include government obligations, corporate entities or supranational agencies, in various currencies domination.

Wells Fargo Advantage International Bond investment is looking for total return including the income and capital appreciation. The major net assets investment of this fund is in foreign debt securities (35% in below-investment grade debt securities and up to 5% in debt securities denominated in developing countries’ currencies). The debt securities may include government obligations, corporate entities or supranational agencies, in various currencies domination.This taxable bond fund is managed by Tony Norris since 1993. This fund has a 4.30% distribution rate, with a 1.08% of annual expense ratio. This fund has a comparison of 6:1 of up versus down performance in years. It has returned a 1.74% over the past one year and 4.72% over the past three years. There is no 12b1 fee applies for this fund. But there is a 4.50% of front-end sales charge fee. If you want to invest in this fund, you need to provide $1,000 for the minimum initial investment in brokerage account and $250 for IRA account.

The other class tickers of this best international bond fund are ESIUX, ESIVX, ESIDX and ESICX. With the same minimum investment, ESIUX has 3.45% of yield and ESIVX has 3.43%.

The top ten holdings for Wells Fargo Advantage International Bond Fund as of Feb 28, 2011 are Kingdom of Sweden 4.50% (1.83%), Bonos Y Oblig Del Estado 5.50% (1.42%), Canada Hsg Tr No 1 CDA Mtg Bd Ser 23, 4.10% (1.36%), Canada Government Deb, 3.75% (1.27%), Canadian Government Fixed, 2.50% (1.14%), Australian Index Linked Fixed, 3.11% (1.08%), Czech Republic Fixed 5, 5.00% (1.07%), Mexican Bonos Desarr Fix Rt 11/38 Fixed, 8.50% (1.04%), Malaysian Government Fixed, 3.83% (1.04%) and Poland Government Bond Fixed, 5.50% (0.99%).

PIMCO Global Bond (Unhedged) D (PGBDX)

The investment in PIMCO Global Bond (Unhedged) is looking for maximum total return. This PGBDX fund normally invests at least 80% of assets in fixed-income securities with at least three different countries as the issuer. It may invest all assets in derivative instruments, such as options, futures contracts or swap agreements, or in mortgage- or asset-backed securities. But it normally invests at least 25% in instruments that are tied economically to foreign (non-U.S.) countries and up to 10% in preferred stocks.Scott A. Mather has been the lead manager since 2008. This bond mutual fund has the highest yield of all the funds mentioned in this article (6.95%). This fund has a 0.95% of annual expense ratio. Although this is a no-sales load fund, but there is still a 0.25% of 12b fee. more: Top 10 Government Bond Mutual Funds 2012 The performance of this fund is 7.93% over the past ten years. The minimum balance to invest in this fund is $1,000. There is no IRA account available.

The purchase of this fund is limited to 30 brokerages such as Schwab Institutional, JPMorgan, Fidelity Retail FundsNetwork-NTF, Vanguard NTF, Raymond James and TD Ameritrade Retail. The other class tickers of this fund are PADMX for Admin Class, PIGLX for the Institutional Class and PGOPX for Class P. Some asset classes of fund have lower expense ratio fee, and no front end sales charge fee.

The top countries of this PIMCO Global Bond (Unhedged) as of Feb 28, 2011 are Europe (34.60%), United States (27.50%), Japan (21.80%), United Kingdom (9.00%), France (1.70%), Brazil (1.40%) and Italy (1.20%).

Waddell & Reed Global Bond A (UNHHX)

Waddell & Reed Global Bond investment is prioritizing a high level of current income. Capital growth has become the secondary consideration. The main investment of the net assets (at least 80%) is in bonds. The priority is for the Organisation of Economic Co-Operation and Development countries member. Although there is a possibility of investing in emerging market countries. There is no maturity limitation for the bonds. It may invest up to 100% of total assets in securities denominated in currencies other than the U.S. dollar.The Senior VP of W&R Investment Management Co, Daniel J. Vrabac has been the lead manager of this fund since 2008. This fund has a 3.33% distribution rate. This fund has the highest expense ratio compared to the other funds mentioned here (1.19%). There is a 0.25% 12b1 fee and 5.75% of front-end sales load. This best international bond mutual fund has returned 5.0% over the past five years. While other funds normally requested for a minimum of $1,000, this UNHHX fund requested for only $500 for the minimum initial investment in brokerage account. No IRA account is available currently.

This fund can be purchased from only 16 selected brokerages, which are Schwab Institutional, Scottrade Load, JPMorgan, Schwab Retail, DATALynx, DATALynx NTF, Schwab Institutional Load Waived, Federated TrustConnect, SunGard Transaction Network, Robert W. Baird & Co., TRUSTlynx, Morgan Stanley - Ntwk/Rdm Only-Brokerage, ING Financial Advisers - SAS Funds, JP MORGAN LOAD, DailyAccess Corporation Mid-Atlantic and Waddell & Reed Choice MAP Flex. The other class tickers of this fund are WGBBX, WGBCX and WGBYX.

The largest ten holdings of this best mutual fund based on percentage of net assets as of Dec 31, 2010 are United States Treasury Notes, 1.1% (8.1%), United States Treasury Notes, 1.4% (2.5%), United States Treasury Notes, 2.6% (2.0%), Petroleum Geo-Services ASA, Convertible, 2.7% (1.3%), Norway Government Bonds, 6.0% (1.2%), Olam International Limited, 7.5% (1.1%), BFF International Limited, 7.3% (1.0%), Rio Tinto Finance (USA) Limited, 9.0% (1.0%), United States Treasury Notes, 3.5% (1.0%) and United States Treasury Notes, 0.6% (1.0%).

For the fund performance, please check my first article.

| No | Mutual Fund Description | Rank | Ticker | Morningstar Rating | Net Assets (Bil) | Yield | Expense Ratio | Min To Invest |

|---|---|---|---|---|---|---|---|---|

| 6 | PIMCO Foreign Bond (Unhedged) A | 19 | PFUAX | 5 | $3.05 | 6.06% | 0.95% | $1,000 |

| 7 | Loomis Sayles Global Bond Retail | 35 | LSGLX | 4 | $2.25 | 3.41% | 1.00% | $2,500 |

| 8 | Wells Fargo Advantage Intl Bond A | 44 | ESIYX | 3 | $1.65 | 4.30% | 1.08% | $1,000 |

| 9 | PIMCO Global Bond (Unhedged) D | 24 | PGBDX | 4 | $0.95 | 6.95% | 0.95% | $1,000 |

| 10 | Waddell & Reed Global Bond A | 40 | UNHHX | 2 | $0.85 | 3.33% | 1.19% | $500 |

No comments:

Post a Comment