Balanced funds or hybrid funds can be essential for portfolio diversification. The following World Allocation hybrid funds include Legg Mason Strategic Real Return A, Loomis Sayles Global Equity and Income A, Principal Global Diversified Income A, and more.

Intro

As we know from my previous articles, balanced fund is ideal for buy and hold investor. Balanced funds, also known as hybrid funds, can be classified into several categories: Conservative Allocation, Moderate Allocation, Aggressive Allocation, and World Allocation. The following article will focus on World Allocation balanced mutual fund. I think world allocation fund is extremely popular for regular investor (retail investor) or retiree.

This World Allocation fund usually seeks long term capital appreciation and regular income by investing in stocks, bonds, money market, and cash. This balanced fund will invest in domestic and foreign stocks / bonds. The fund will explore the whole world such as US, Canada, Japan, Europe (UK, German, France, Swiss), and possibly emerging markets to invest. This type of investment style will definitely provide an instant asset diversification to any investors.

Fund information is updated on May 26th, 2011

The minimum balance to invest in this fund is $1,000 for brokerage account and $250 for IRA account. There is a $50 minimum subsequent investment for both accounts. This fund do charges 0.25% 12b1 fee and 5.75% front-end sales load fee. LLRAX has recorded a higher annual expense ratio with 1.26% compared to the average in the category, 1.20%. It has returned 12.93% over the past one year. This fund hasn’t gotten any rank from Morningstar yet since it is a relatively new fund. It has 11.01% of year-to-date return for this year 2011. This fund also received Lipper Top Quartile 2011 awards from Lipper Rankings in Flexible Portfolio funds category.

Since May 1996, this Loomis Sayles fund has been managed by Daniel J. Fuss. This fund was formally introduced to retail investor in February 2006. The minimum balance to open a brokerage for this fund is $2,500 and for IRA account is $1,000 and a minimum of $100 for the subsequent investment. There is 12b1 fee of 0.25% and sales-load fee of 5.75% for investing in LGMAX. The annual expense ratio of this fund (1.25%) is a slightly higher than the average (1.20%).

Since January 2000, Mark R. MacDonald has managed this fund. The minimum initial investment for this fund is $250 for either brokerage or IRA account with $50 of subsequent investment. For investing in this fund, there is 0.24% management fee and 5.75% sales-load fee. This fund distributes 3.86% of dividend yearly. The last dividend distributed in March 2011 is 0.46%. The other classes of CAIBX are Class B (Ticker: CIBBX), Class C (Ticker: CIBCX), Class F-1 (Ticker: CIBFX) and Class F-2 (Ticker: CAIFX).

The investment in PIMCO All Asset All Authority is looking for maximum real return. PAUAX generally invests all of its assets in Institutional Class or, if available, Class M shares of any other fund of the trust. Some exceptions are the Global Multi-Asset, All Asset fund and the Real Retirement funds. The fund may invest in any underlying funds but not in all at any particular time. It may invests in some diversified underlying holdings despite PAUAX is a non-diversified fund.

The investment objective of Invesco Balanced Risk Allocation fund is to achieve total return with a low to moderate correlation to traditional financial market indices. The fund normally invests in derivatives and other financially-linked instruments whose performance is expected to correspond to U.S. and international fixed income, equity and commodity markets. It generally maintains 60% total assets in cash and cash equivalent instruments including affiliated money market funds. The fund may invest in derivatives and other financially-linked instruments such as futures, swap agreements, including total return swaps. It is non-diversified.

Intro

As we know from my previous articles, balanced fund is ideal for buy and hold investor. Balanced funds, also known as hybrid funds, can be classified into several categories: Conservative Allocation, Moderate Allocation, Aggressive Allocation, and World Allocation. The following article will focus on World Allocation balanced mutual fund. I think world allocation fund is extremely popular for regular investor (retail investor) or retiree.

|

| Top Performer Wold Allocation Funds |

According to Morningstar report, these funds also have comfortably outpaced world stocks funds over the trailing 3-, 5-, 10-, 15- year periods. The returns of these funds also look better relative to those of domestic large cap and foreign large cap funds. These funds also have less volatility than any pure stock funds and better long term risk reward profiles than other funds with broader world geographic range. The following top performers list is sorted based on its YTD performance.

- Legg Mason Strategic Real Return A (LRRAX)

- Loomis Sayles Global Equity and Income A (LGMAX)

- Principal Global Div Inc A (PGBAX)

- Thornburg Investment Income Builder A (TIBAX)

- American Funds Capital Income Bldr A (CAIBX)

- Invesco Van Kampen Global Tac Asset Allocation A (VGTAX)

- MFS Global Total Return A (MFWTX)

- Sector Rotation No Load (NAVFX)

- Templeton Income A (TINCX)

- PIMCO All Asset All Authority A (PAUAX)

updated on 5/26/2011

| No | Fund Description | Ticker | Yield | Morningstar Rating | Net Assets (Mil) | Expense Ratio | Min to Invest |

|---|---|---|---|---|---|---|---|

| 1 | Legg Mason Strategic Real Return A | LRRAX | 3.59% | N/A | $24 | 1.26% | $1,000 |

| 2 | Loomis Sayles Global Equity and Income A | LGMAX | 1.49% | 3 | $541 | 1.25% | $2,500 |

| 3 | Principal Global Div Inc A | PGBAX | 4.91% | N/A | $2,400 | 1.16% | $1,000 |

| 4 | Thornburg Investment Income Builder A | TIBAX | 5.64% | 3 | $8,530 | 1.25% | $5,000 |

| 5 | American Funds Capital Income Bldr A | CAIBX | 3.86% | 3 | $80,180 | 0.62% | $250 |

| 6 | Invesco Van Kampen Global Tac Asset Allocation A | VGTAX | 0.00% | N/A | $23 | 1.19% | $1,000 |

| 7 | MFS Global Total Return A | MFWTX | 2.49% | 3 | $805 | 1.25% | $1,000 |

| 8 | Sector Rotation No Load | NAVFX | 0.00% | N/A | $26 | 1.65% | $5,000 |

| 9 | Templeton Income A | TINCX | 3.16% | 3 | $1,220 | 1.20% | $1,000 |

| 10 | PIMCO All Asset All Authority A | PAUAX | 6.02% | 4 | $11,200 | 0.85% | $1,000 |

1. Legg Mason Strategic Real Return A (Ticker: LLRAX)

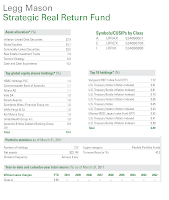

Legg Mason Strategic Real Return investment is looking for an attractive long-term real return. The assets investment strategy is to invest about 40% net assets in Inflation-Linked Debt Securities, 20% net assets in Commodity-Linked Securities, 20% net assets in Equity Securities, 10% net assets in Tactical Strategy, and 10% net assets in Real Estate Investment Trusts (REITs).

|

| LM Strategic Real Return |

This fund is managed by Adam J. Petryk since its inception in February 2010. LLRAX can be purchased from 23 brokerages include Scottrade Load, TD Ameritrade Institutional, JP Morgan, Raymond James, Ameriprise Brokerage, etc. The other classes of this fund are Class C (Ticker: LRRCX) and Institutional Class (Ticker: LRRIX).

As of October 2010, this fund annual turnover is 42.0%, while the average is as high as 150.60%. As May 2011, the fund assets are allocated: inflation linked debt securities (37%), global equities (24%), commodity linked securities (23%), REITs (8%), tactical strategy (7%), and cash (1%). The top global equity holdings of this fund as of first quarter of 2011 are HSBC Holdings (1.4%), Commonwealth Bank of Australia (1.1%), Allianz AG (1.1%), Vale SA (1.0%), Sanofi-Aventis (1.0%), Sumitomo Mitsui Financial Group Inc (1.0%), Wells Fargo & Co (1.0%), Kia Motors Corp (2.0%), United Health Group Inc (1.0%), and Australia & New Zealand Banking Group Ltd (0.9%).

2. Loomis Sayles Global Markets A (Ticker: LGMAX)

The investment in Loomis Sayles Global Markets fund is seeking high total investment return by providing a combination of current income and capital appreciation. The majority of its net assets (around 80%) are invested in equity and fixed-income securities of U.S. and foreign issuers. The fund as well invests a substantial percentage of its assets outside the U.S., including emerging market countries’ securities.

|

| LGMAX fund |

The performance of this fund is as below:

- 1-year: 19.63%

- 3-year: 4.58%

- 5-year: 7.82%

- 10-year: 9.53%

The LGMAX fund has 9.10% 5-year average return and 10.49% year-to-date return. Since its inception, the fund has 3 years of positive return (the best return occurred in 2009 with 42.09%) and 1 years of negative return in 2008 1 with -39.34%.

LGMAX can be purchased from 76 brokerages include JP Morgan, Scottrade Load, Morgan Stanley Advisors, Edward Jones, Fidelity Retail Funds Network, Schwab Institutional, Raymond James, Common Wealth Core, Prudential Retail, etc. The other classes of this fund are Class C (Ticker: LGMCX) and Class Y (Ticker: LGWWX).

The top 10 holdings of this fund are Apple Inc (4.0%), Standard Chartered PLC (2.7%), Amazon.com Inc (2.2%), Anadarko Pete Corp (2.05%), Google Inc (1.8%), Baidu.com (1.7%), Tencent Holdings Ltd (1.7%), Vale SA-SP ADR (1.7%), Priceline.com Inc (1.6%) and FMC Technologies (1.6%).

3. Principal Global Diversified Income A (PGBAX)

Principal Global Diversified Income fund seeks consistent cash income. To achieve its goal, this fund will focus on diversified, yield-focused investment strategy. The majority of the assets are invested in fixed income asset classes, such as preferred securities, high yield bonds, and emerging market debt securities. The fund tries to provide incremental yields over a portfolio of government securities. PGBAX may invest in equity securities of global companies primarily engaged in the real estate industry and value equities of global companies. It as well invests in master limited partnerships and other entities in the energy infrastructure sector.

Simon Hedger is this fund’s lead manager since its inception in December 2008. The expense ratio is 1.16% per year. This expense figure is a slightly lower than the average in the World Allocation category which is only 1.20%. Minimum balance requires to open a brokerage account in this fund is $1,000. The same amount applies for IRA account, with a $100 of minimum subsequent investment. Please note that there is a 0.25% 12b1 fee applies and 3.75% front-end sales load fee.

Since it is new fund, this top performer mutual fund hasn’t received any ranking from Morningstar yet. It has 6.0% year-to-date return. The best 1-year total return was recorded in 2009 with 39.74%. This past year (2010), the fund returned 16.90%. The other classes of this fund are Class C (Ticker: PGDCX), Class I (Ticker: PGDIX) and Class P (Ticker: PGDPX).

PGBAX fund can be purchased from 42 brokerages include Raymond James WRAP Eligible, JP Morgan, TD Ameritrade Retail NTF, Pershing FundCenter, Schwab Institutional, Ameriprise Brokerages, Schwab RPS All, Fidelity Retail Funds Network, etc. The other class of this fund is

The annual holdings turnover of this fund as per May 2011 is 75.50% (compared to the average 150.60%). The top ten holdings as of March 2011 are Enterprise Products Partners (0.93%), Energy Transfer Partners (0.88%), Magellan Midstream Partners (0.84%), Williams Partners (0.83%), Kinder Morgan Management (0.82%), Cobak ACB Pfd (0.73%), Claudius Limited, St. Helier (0.69%), Catlin Ins Co (0.63%), Nustar Energy (0.62%) and Nationwide Financial Services (0.61%). These ten holdings represent 7.59% of net assets.

4. Thornburg Investment Income Builder A (Ticker: TIBAX)

Thornburg Investment Income Builder Fund objective is to provide current income which exceeds the average yield on U.S. Stocks generally. The second investment objective is capital appreciation in long-term period. The fund may invest in debt obligations of any kind, and it invests at least 50% in common stocks and at least 80% in income producing securities.

Jason J. Brady is the lead manager of this Thornburg fund. He has managed it since February 2007. The minimum balance to invest in this fund for brokerage account is $5,000 and for IRA account is $2,000 with $100 minimum subsequent investment. The 12b1 fee of this fund is 0.25% and 4.50% of front-end sales load fee. The annual expense ratio of this fund is 1.25%.

This world allocation mutual fund has a 3-stars rating from Morningstar and it has 8.01% year-to-date return. The total return in the previous years is 36.60% in 2009. It has returned 12.10% over the past one year and 6.45% over the past five years.

This top performer mutual fund can be purchased from 78 brokerages, include JP Morgan, Vanguard, Merrill Lynch, DATALynx, Schwab Retail, E Trade Financial, Morgan Stanley Advisors, etc.

5. American Funds Capital Income Builder A (CAIBX)

The investment in American Funds Capital Income Builder seeks for a level of current income and a growing stream of income over years; while capital growth is the secondary objective of this fund. The majority of the net assets (>90%) are invested in in income-producing securities, including common stocks and bonds (with at least 50% of assets in equity securities). CAIBX may also invest in securities issued by the companies outside of the U.S.

|

| CAIBX characteristics |

CAIBX has the lowest expense ratio annually compared to the other bonds described here. The expense ratio is 0.62% yearly. The fund’s annual turnover is 42.00% as of May 2011. CAIBX has 20 years of positive return since its inception; the best performance was in 1997 with 23.31% of total return. It can be purchased from 73 brokerages include Vanguard, JP Morgan, Merrill Lynch, Edward Jones, TD Ameritrade Inc, E Trade Financial, Schwab Institutional, Schwab Retail, etc.

The ten largest equity holdings of CAIBX as of April 2011 are Philip Morris International, AT&T, Royal Dutch Shell, Altria, Conoco Phillips, Novartis, GDF SUEZ, Kraft Foods, Scottish and Southern Energy and Merck.

6. PIMCO All Asset All Authority A (PAUAX)

|

| PAUAX details |

Robert D. Arnott is the fund manager since October 2003. The fund was introduced on July 2005. It distributes 6.02% per year dividend. The minimum initial investment of this fund is $1,000 for brokerage account. No IRA account available. The brokerage account requires a minimum of $50 for the subsequent investment. This fund applies 12b1 fee of 0.25% and front-end sales-load fee of 5.50%. It also has 0.85% annual expense ratio. The other class of this fund are Class C (Ticker: PAUCX), Class D (Ticker: PAUDX), Institutional Class (Ticker: PAUIX) and Class P (Ticker: PAUPX).

The performance of this fund is as below:

- 1-year: 5.40%

- 3-year: 5.43%

- 5-year: 6.46%

The fund has a year-to-date return of 5.72% with 5-year average return of 7.67%. The best 1-year total return among the 4 years of positive return was in 2009 with 18.65%. The worst was experienced in 2008 with -7.54%.

This PAUAX fund can be purchased from 83 brokerages, such as Merrill Lynch, Scottrade Load, JP Morgan, Vanguard, Edward Jones, Bear Stearns Load, Firstrade, Prudential Retail, Ameriprise Brokerage, etc.

The top strategies of this fund are 43.38% in alternative bond strategies, 31.28% in alternative equity strategies, 25.91% in inflation related strategies, 9.08% in US Bond strategies, 8.97% in long equity strategies and 8.02% in short-term strategies.

7. Managers AMG FQ Global Essentials Inv (MMAVX)

This fund has been managed by Dori John Levanoni since September 2009. The other classes are Institutional Class (Ticker: MMAFX) and Service Class (Ticker: MMASX).

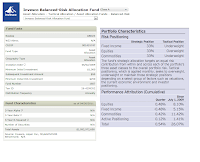

8. Invesco Balanced-Risk Allocation A (Ticker: ABRZX)

|

| Invesco Balanced Risk Allocation |

Christian Ulrich has managed this top performer world allocation mutual fund since its inception in June 2009. The minimum balance to invest in this fund for brokerage account is $1,000 and for IRA accounts $250. There is a minimum of $50 subsequent investment needed for brokerage account and $25 for IRA account. The 12b1 fee is 0.25% and there is front-end sales load of 5.50%. This ABRZX fund has 1.04% annual expense ratio, which is slightly lower compared to the average in the World Allocation category (1.20%).

This fund has returned 5.82% over the past one year. Last year it had 12.92% return. ABRZX hasn’t got any star rating from Morningstar yet. The other classes of this fund is Class B (Ticker: ABRBX), Class C (Ticker: ABRCX), Class Y (Ticker: ABRYX), Class R (Ticker: ABRRX) and Class I (ABRIX). This fund can be purchased from 30 brokerages, such as Raymond James, RBC Wealth Management-Network, Pershing FundCenter, Schwab Institutional, Fidelity Retail Funds Network, ING Financial Advisers – SAS Funds, etc.

15. PIMCO Global Multi-Asset A (Ticker: PGMAX)

PIMCO Global Multi-Asset fund seeks to provide a high total return. The investment strategies are as below 1) developing a target asset allocation; 2) increasing a series of relative value strategies intended to increase value beyond the target allocation; and 3) developing hedging techniques to cope with risks. These strategies are evaluated daily and varying combinations of acquired funds and or direct investment are used to implement in the fund. It may invests in some diversified underlying holdings as well.

Vineer Bhansali has managed this fund since October 2008. The expense ratio is 1.29% per year. This expense figure is a bit higher than the average in the World Allocation category which is only 1.20%. Minimum balance requires to open a brokerage account in this fund is $10,000 with a $50 of minimum subsequent investment. No IRA account available. Please note that there is a 0.25% 12b1 fee applies and 5.50% front-end sales load fee.

PGMAX has not yet gotten any rank from morning star. The best 1-year total return was recorded in 2009 with 19.16%. It has returned 10.34% over the past one year.

PGMAX fund can be purchased from 50 brokerages include Morgan Stanley - Brokerage Accounts, Scottrade Load, JPMorgan, Vanguard, CommonWealth PPS, Fidelity Retail FundsNetwork, Ameriprise Brokerage, Nationwide Retirement Resource, Raymond James, etc.

The annual holdings turnover of this fund as per May 2011 is 71.00% (compared to the average 150.60%).

First Eagle Global A (Ticker: SGENX)

Disclosure: No Position

First Eagle Global A (Ticker: SGENX)

First Eagle Global fund investment has the objective to provide long-term capital growth by investing in a range of asset classes from markets (U.S. and the world). The primary assets investment is in common stocks of U.S. and foreign companies (in any size company). In the normal market conditions, the fund invests around 40% or more of its assets in foreign investments.

This First Eagle fund has been managed by Matthew McLennan since September 2008. This fund also has a dividend of 1.29%. The minimum balance required to open a brokerage account in this fund is $2,500 and $1,000 for IRA account available. The fund has annual expense ratio of 1.16%. The 12b1 fee of this fund is 0.25%, and the front-end sales-load fee is 5.00%.

The fund has a four star rating from Morningstar. It has recorded 35 years positive performance with the best total return in 2003 with 37.64% and the worst in 2008 with -21.06%. It has returned 12.59% over the past decade and 6.67% over the past five years.

You can buy this SGENX fund through 93 brokerages such as Morgan Stanley Advisors, Pershing FundCenter, Schwab Institutional, Td Ameritrade Inc, Scottrade Load, JPMorgan, Merrill Lynch,

Edward Jones, Fidelity Retail FundsNetwork, etc.

Disclosure: No Position

No comments:

Post a Comment