Artisan Mid Cap Value Investor (ARTQX)

The investment objective of Artisan Mid Cap Value fund is to seek maximum long-term capital growth. This Artisan equity fund invests mainly in medium-sized U.S. companies. This means the company has a market capitalization greater than the market capitalization of the smallest company in the Russell Midcap Index and < 3 times the weighted average market capitalization of companies in that index.

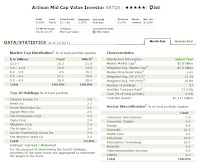

Fund Details

|

| Artisan Mid Cap Value Investor |

- Fund Inception Date: 03/28/2001

- Ticker Symbol: ARTQX (Investor Class)

- CUSIP: 04314H709

- Beta (3yr): 1.00

- Rank in category (1yr): 2%

- Category: Mid Cap Value

- Yield: 0.60%

- Net Assets: $ 7.1 Billion

- Sales Load: 0%

- Expense Ratio: 1.20%

- Capital Gains: N/A

- Number of Years Up: 7 years

- Number of Years Down: 2 years

This best rated US stock fund is managed by James C Kieffer since 2001. Kieffer is the managing director of Artisan and portfolio co-manager for Artisan Small Cap Value fund. The other fund’s co-managers are Scott C Satterwhite, and George O Setl Jr. It currently has a yield of 0.60%. The last dividend was paid on December 2010 ($0.25). This top stock fund has an expense ratio of 1.20%. This expense ratio fee is slightly lower than category average which is 1.31%. The turnover rate is 32%. The total fund’s assets are $7.1 Billion.

This ARTQX fund is rated with 5 star ratings by Morningstar. Morningstar analyst rating is Gold rating (the highest analyst rating). This best performing fund has returned 11% over the past 1 year, 23.08% over the past 3 year, 4.34% over the past 5 year, and 11.25% over the past decade. The last 5 year performance is listed below:

- Year 2011: 6.42%

- Year 2010: 14.37%

- Year 2009: 39.25%

- Year 2008: -27.56%

- Year 2007: 1.65%

As of October 2011, the top 5 major market sectors include Industrials (24.78%), Financial Services (21.82%), Technology (18.4%), Utilities (8.19%), and Consumer Cyclical (7.5%). The top 10 stock holdings are Cimarex Energy Co, Avnet Inc, Arrow Electronics Inc, Ingram Micro Inc, The Progressive Corp, Cigna Corp, Alleghany Corp, The Kroger Co, Jacobs Engineering Group Inc, and The Western Union Co. There are a total of 57 stocks in its holding.

Pros:

- It has no sales load

- It is rated as one of the best mid cap value fund

- limited to new investors

Investment Strategies & Risks

According to the fund’s prospectus, the principal investment strategies involve choosing attractive valuation, using sound financial condition, selecting attractive business economics, finding specific characteristics (including turnarounds story, transition companies, hidden assets and unrecognized companies, and earning shortfalls). The investment risks are: stock market risks, mid-size company risks, value investing risk, management risks, etc.

Disclosure: No Position

Other Mutual Funds article: