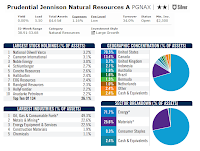

Prudential Jennison Natural Resources Fund (PGNAX)

The investment objective of Prudential Jennison Natural Resources Fund is to seek long-term capital growth. The mutual fund utilizes its assets to purchase equity securities of natural resource companies and in asset-based securities. Natural resource companies are U.S. and foreign (non-U.S. based) companies that own, explore, mine, process or otherwise develop, or provide goods and services with respect to, natural resources. Asset-based securities are stocks, the values of which are related to the market value of a natural resource. It mainly invests in common stocks. It is non-diversified.

Fund Profile

- Fund Inception Date: 10/21/1990

- Ticker Symbol: PGNAX

- CUSIP: 74441K107

- Beta (3yr): 1.36

- Rank in category (YTD): 84%

- Category: Natural Resources

- Distribution: 0.00%

- Capital Gains: 0%

- Expense Ratio: 1.16%

- Net Assets: $ 4.59 billion

- Number of Years Up: 15 years

- Number of Years Down: 6 years

- Annual Turnover Rate: 34%

As one of the Prudential Funds fund, it has total net assets of $4.59 million. This natural resources mutual fund was first introduced to public in January 1990. Neil P. Brown has started managing this fund in July 2006. He is the Principal of Jennison. The other members of the portfolio management team are Jay Saunders, David Kiefer, Jennison Associates as Subadviser and Abhi Kamerkar as Fund Portfolio Adviser. The annual expense ratio is 1.16%. It also has annual holdings turnover of 34.00% as of December 29, 2011. There is a 0.30% management fee, and 5.50% front-end sales load fee.

Best Natural Resource Mutual Funds 2012

The best 1-year total return within 15 years of positive returns year was occurred in 2009 with 73.17%. The worst 1-year return was occurred in 2008 with -52.87%. Based on the load adjusted returns, this domestic stock fund has returned 14.93% over the past 10-year and 1.75% over the past 3-year. It also has YTD return of -3.45%. Morningstar analysts rated this domestic stock fund with 2-stars rating and Silver rating. Lipper Global Natural Resources Index is the benchmark of this fund.

Investors can buy this mutual fund with $2,500 initial funding for brokerage account and $1,000 for retirement account. The minimum subsequent investment needed is $100. This equity fund is available for purchase through a wide selection of 124 brokerages. They are Schwab Retail, Merrill Lynch, JP Morgan, Td Ameritrade Inc, Fidelity Retail Funds Network, Scottrade Load, Morgan Stanley Advisors, etc. The other classes of this fund are Class B (PRGNX), Class C (PNRCX), Class Q (PJNQX), Class R (JNRRX) and Class Z (PNRZX).

The top 10 stock holdings of 134 holdings are National Oilwell Varco (3.2%), Cameron International (3.1%), Noble Energy (3.0%), Schlumberger (2.7%), Concho Resources (2.6%), Halliburton (2.4%), EOG Resources (2.4%), Randgold Resources (2.3%), HollyFrontier (2.2%) and Anadarko Petroleum (2.2%). The top largest industries per percentage of assets are Oil, Gas & Consumable Fuels (49.3%), Metals & Mining (22.6%) and Energy Equipment & Services (22.5%).

According to the fund prospectus, the principal risks of investing in this fund are market risk, natural resources companies risk, non-diversification risk, management risk, equity and equity-Related securities risk, foreign securities risk, etc.

Disclosure: No Position

No comments:

Post a Comment