This lazy portfolio is a buy-and-hold portfolio that contains a healthy allocation to US stocks, international stocks, REIT, and bonds.

Who Is Bill Schultheis?

Bill Schultheis is an author and financial adviser. He is also a bogleheads.org reading list author. He wrote a book which titled

Bill Schultheis is an author and financial adviser. He is also a bogleheads.org reading list author. He wrote a book which titled “The Coffeehouse Investor: How to Build Wealth, Ignore Wall Street, and Get On with Your Life.”

Rules of Coffeehouse Portfolio

The rules of Coffeehouse Portfolio is simple. It invests in 7 funds. It has 60% allocation to stocks and 40% to bonds. It mainly invest in US, international stock, REIT, and bond market.This 7 fund portfolio is well like by followers in Bogleheads.

The portfolio can be applied with an investment in a low cost US total stock market index fund, along with direct investments in US, international stock, REIT, and bond market. It can also be implemented with low-cost ETFs (exchange-traded funds).

How to Invest

You can invest in this coffehouse portfolio through Vanguard ETFs (Exchange Traded Funds).Below are the list. You can buy these investment funds through your brokerage.

Vanguard ETFs

| Vanguard Large Cap ETF (VV) | 10% |

|---|---|

| Vanguard Value ETF (VTV) | 10% |

| Vanguard Small Cap ETF (VB) | 10% |

| Vanguard Small Cap Value ETF (VBR) | 10% |

| Vanguard Total International Stock ETF (VXUS) | 10% |

| Vanguard REIT ETF (VNQ) | 10% |

| Vanguard Total Bond ETF (VB) | 40% |

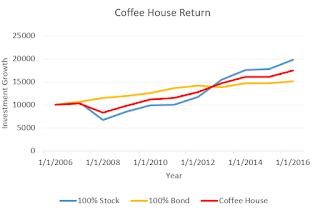

This coffeehouse portfolio has returned 6.00 percent over the three years, and 8.83 percent over the past five years. The past 5 years performance is as follows:

| Year | Return |

|---|---|

| 2012 | 11.63% |

| 2013 | 14.51% |

| 2014 | 9.62% |

| 2015 | -0.42% |

| 2016 | 8.80% |

Pros and Cons of Coffeehouse portfolio

Pros:- The fund is well balanced with exposure to US stock, International stock, and real estate.

- The investment portfolio has generate consistent returns for the past decade.

- The portfolio just simply divided evenly among large cap and small cap.

- Risk may be higher.

Betting on sports toto in California, MI, IN, NV & PA

ReplyDeleteSports 토토 사이트 모음 Betting on sports toto in California, MI, IN, NJ & PA bet on your favorite sports or find an awesome way to wager on your favorite sports!