Top Municipal Bond Funds

Top Municipal Bond Funds

Municipal California intermediate mutual fund invests mainly in California municipal debts. This fixed income fund provides tax free income from federal taxes and California state taxes. It is attractive to residents of California. It invests in several bond sectors such as general obligation, local municipal, health, education, etc. This municipal California fund has durations of less than 7 years.From this best mutual funds list, you may find each individual fund review. Check the fund performance, expense ratio, and yield or dividend from the table below. The list is sorted based on fees, yield, fund returns, and potential for growth.

Best Muni California Intermediate Mutual Funds 2013 are:

- Vanguard California Intermediate Term Tax Exempt Fund (VCAIX)

- Franklin California Intermediate-Term Tax-Free Income Fund (FKCIX)

- Schwab California Long Term Tax Free Bond Fund (SWCAX)

- Managers California Intermediate Tax Free Fund (MCATX)

- Northern California Intermediate Tax-Exempt Fund (NCITX)

- Shelton Capital Management California Tax-Free Income Fund (CFNTX)

- Columbia California Intermediate Municipal Bond Fund (NACMX)

- Western Asset Intermediate Maturity CA Municipals Fund (ITCAX)

- SEI Tax-Exempt California Municipal Bond Fund (SBDAX)

- American Century California Intermediate-Term Tax-Free Bond Fund (BCIAX)

Vanguard California Intermediate Term Tax Exempt Fund (VCAIX)

This best muni California Intermediate mutual fund seeks to provide a higher level of current income than shorter-term bonds. It is intended for California residents only. The interest income is expected to be exempt from both federal and California personal income taxes. This Vanguard California Intermediate Term Tax Exempt fund has total net assets of $7.2 billion. The current fund managers are James M. D’Arcy and Adam M. Ferguson. The annual expense ratio is only 0.20%.

This best muni California Intermediate mutual fund seeks to provide a higher level of current income than shorter-term bonds. It is intended for California residents only. The interest income is expected to be exempt from both federal and California personal income taxes. This Vanguard California Intermediate Term Tax Exempt fund has total net assets of $7.2 billion. The current fund managers are James M. D’Arcy and Adam M. Ferguson. The annual expense ratio is only 0.20%.This municipal bond fund is ranked with 4-stars and Silver rating by Morningstar. It has YTD return of -2.35% as of July 3, 2013. Barclays Municipal CA Intermediate Index is the fund’s benchmark. Since the inception in 1994, the fund has recorded 16 years of positive return. The best return was in 2000 with 10.94%. The performance of this fund based on the load adjusted returns is as below:

- 1-year: 4.92%

- 3-year: 6.21%

- 5-year: 6.10%

- 10-year: 4.31%

Franklin California Intermediate-Term Tax-Free Income Fund (FKCIX)

This Franklin fund’s objective is to achieve as high income level exempt from federal income taxes and California personal income taxes as is consistent with prudent investment management and the capital preservation. It uses its total assets to purchase investment grade municipal securities whose interest is exempted from federal income taxes. Christopher Sperry and John Wiley are the current fund managers. It has a high dividend yield of 3.37%. The most recent distribution was given in May 2013 in the amount of $0.03 per share.Previous: Best Municipal Bond Mutual Funds September 2011

This best municipal California intermediate mutual fund has 5-year average return of 5.87%. The best 1-year total return was recorded in 2009 with 12.34%. Based on the load adjusted returns, the fund has returned 5.35% over the past 3-year and 4.10% over the past 10-year. It also has 3-stars rating from Morningstar. The 3-year beta risk is 1.06. The average duration is 5.21 years. Its average maturity is 8.90 years.

As of May 2013, the top sector breakdowns are General Obligation Bonds (23.00%), Tax Supported Debt (16.00%), Subject to Government Appropriation (15.00%), Utilities (14.00%) and Hospital & Health Care (12.00%).

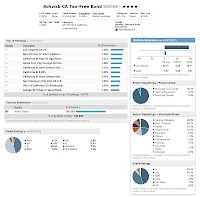

Schwab California Long Term Tax Free Bond Fund (SWCAX)

Schwab California Long Term Tax Free Bond Fund is managed by John Shelton and Kenneth Salinger. The fund is looking for high current income exempt from federal and California personal income tax. The fund was first introduced to the public in February 1992. It has total net assets of $455.6 million. The fund has an expense ratio of 0.49%.

Schwab California Long Term Tax Free Bond Fund is managed by John Shelton and Kenneth Salinger. The fund is looking for high current income exempt from federal and California personal income tax. The fund was first introduced to the public in February 1992. It has total net assets of $455.6 million. The fund has an expense ratio of 0.49%.As part of best municipal California intermediate mutual funds, it uses Barclays Municipal California Exempt TR as its benchmark. It has its best 1-year total return in year 2000 with 15.19%. The worst return was occurred in 1999 with -6.09%. This municipal bond fund is ranked with 4-stars rating by Morningstar analysts. It has YTD return of -2.27% as of July 3, 2013.

The top holdings of this SWCAX fund as of May 2013 are Los Angeles CA 5% (1.48%), Met Wtr Dist of Southern California (1.38%) and California St Hsg Fin Average Revenue (1.31%). The top sectors are General Obligation (28.0%), Miscellaneous Revenue (20.3%), Health (14.1%) and Water/ Sewer (12.3%).

Fund Information

| No | Fund Description | Ticker | Rating | Expense Ratio | Yield | Net Assets (mil) | Min to Invest |

|---|---|---|---|---|---|---|---|

| 1 | Vanguard CA Interm-Term Tax-Exempt Inv | VCAIX | 4 | 0.20% | 3.31% | $7,200 | $3,000 |

| 2 | Franklin CA Interm-Term Tx-Fr Income A | FKCIX | 3 | 0.64% | 3.27% | $1,200 | $1,000 |

| 3 | Schwab CA Tax-Free Bond | SWCAX | 4 | 0.49% | 2.52% | $456 | $100 |

| 4 | Managers CA Intermediate Tax-Free | MCATX | 4 | 0.55% | 3.53% | $29 | $2,000 |

| 5 | Northern CA Intermediate Tax-Exempt | NCITX | 3 | 0.45% | 2.99% | $403 | $2,500 |

| 6 | Shelton California Tax-Free Income | CFNTX | 4 | 0.72% | 3.41% | $103 | $1,000 |

| 7 | Columbia California Interm Muni Bd A | NACMX | 2 | 0.73% | 3.13% | $299 | $2,000 |

| 8 | Western Asset Interm Maturity CA Muni A | ITCAX | 3 | 0.75% | 3.16% | $208 | $1,000 |

| 9 | SEI Tax-Exempt CA Municipal Bond A | SBDAX | 3 | 0.61% | 2.64% | $204 | $100,000 |

| 10 | American Century CA Interm-T T-Fr Bd A | BCIAX | 2 | 0.72% | 2.33% | $1,300 | $5,000 |

Municipal Bond Fund Performance

| No | Fund Description | YTD Return | 1-Year Return % | 3-Year Return % | 5-Year Return % | 10-Year Return % |

|---|---|---|---|---|---|---|

| 1 | Vanguard CA Interm-Term Tax-Exempt Inv | -2.35% | 0.56% | 4.44% | 4.67% | 3.72% |

| 2 | Franklin CA Interm-Term Tx-Fr Income A | -2.16% | 0.55% | 4.51% | 4.60% | 3.83% |

| 3 | Schwab CA Tax-Free Bond | -2.27% | 0.27% | 4.09% | 4.45% | 3.90% |

| 4 | Managers CA Intermediate Tax-Free | -1.30% | 1.44% | 4.49% | 4.44% | 3.92% |

| 5 | Northern CA Intermediate Tax-Exempt | -3.53% | -0.52% | 3.83% | 4.26% | 3.41% |

| 6 | Shelton California Tax-Free Income | -1.87% | 0.62% | 4.05% | 4.23% | 3.27% |

| 7 | Columbia California Interm Muni Bd A | -2.80% | 0.00% | 4.10% | 4.78% | 3.55% |

| 8 | Western Asset Interm Maturity CA Muni A | -2.40% | 0.02% | 3.68% | 3.80% | 3.51% |

| 9 | SEI Tax-Exempt CA Municipal Bond A | -2.69% | -0.74% | 3.50% | 4.43% | 3.57% |

| 10 | American Century CA Interm-T T-Fr Bd A | -2.28% | -0.11% | 3.91% | 4.46% | 3.45% |

No comments:

Post a Comment