Intro

The following article will provide information for the next 5 of national muni bond closed end fund. The list was compiled from cefconnect and cefa website. Some of these funds do use leverage to provide higher yield or distribution rate. Please check my table below for details. If you miss my part 1 article, you can check the first article about Muni CEF. Closed End Fund (CEF) can become one of the popular investment vehicle to invest in Municipal bond funds or Muni-Bond funds. The following list only provide the national municipal bond funds.

Closed End Fund (CEF) can become one of the popular investment vehicle to invest in Municipal bond funds or Muni-Bond funds. The following list only provide the national municipal bond funds.The Top 10 Best National Municipal Bond Closed End Funds are:

- EV Municipal Income

- Invesco Van Kampen Municipal Opportunities Trust

- Invesco Van Kampen Municipal Investment Grade Trust

- EV Municipal Bond

- Invesco Van Kampen Advantage Muni Income II

- Invesco Van Kampen Select Sector Muni (VKL)

- BlackRock MuniVest Fund II (MVT)

- PIMCO Municipal Income III (PMX)

- Nuveen Muni Market Opportunities (NMO)

- Invesco Van Kampen Municipal Trust (VKQ)

Note: You can check the previous article: Best Municipal Bond Closed End Funds.

Invesco VanKampen Select Sector Muni

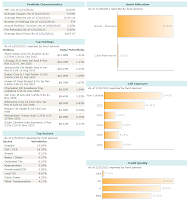

Invesco Van Kampen Select Sector Municipal Trust fund is part of long term maturity muni-bond fund offered by Invesco Advisers Inc. Invesco VanKampen Select Sector Municipal Trust fund objective is to provide a high level of current income exempt from federal income tax and to preserve the fund capital.This muni bond closed end fund is managed by Thomas Byron, Robert Stryker, and Robert Wimmel. As of January 2011, the fund adjusted duration is 11.12 years. The fund total expense ratio is 1.35% per year. The fund has total net assets of $296.80 million. Its market price is 0.55% higher than its fund NAV. The fund also holds 293 bonds.

The top 5 bond sectors include hospital bonds, IDR/PCR, appropriation, life care, and airport bond. The top 4 state allocation include California, Texas, Illinois, and Washington. The fund has a distribution rate of 7.93% per year which is equivalent to 12.20% per year for the highest level tax payer (35% tax bracket).

BlackRock MuniVest Fund II

This muni bond closed end fund is sponsored by BlackRock Advisors LLC. BlackRock MuniVest Fund II seeks to provide investors with a high level of current income exempt from federal income taxes as is consistent with its investment policies. This BlackRock fund invests most of its assets in a portfolio of long-term investment grade municipal obligations. |

| MVT Fund profile |

Top 10 National Municipal Bond Closed End Funds

As of January 2011, the top 5 state municipals include California, Illinois, Texas, New York, and Michigan. The top 5 bond sectors include tax backed bonds, health, transportation, corporate backed muni’s, and utility. The fund market price has returned 1.1% over the past year and 7.59% over the past decade.

PIMCO Municipal Income III

PIMCO Municipal Income III fund's objective is to provide tax free current income of Federal income tax. This PIMCO fund primarily invests investment grade municipal fixed income securities. The fund is managed by John Cummings. Regular investor will be charged 1.39% expense ratio per year for investing in this CEF. Investor or trader can buy this closed end fund through online brokerage account such as fidelity, TD Ameritrade, Scottrade, etc.Top CA Municipal Bond CEFs 2012

This municipal bond closed end fund usually sells at premium range between 2.47% and 24.57%. It has a total of $539 million and a yield of 7.95% per year. The fund pays this distribution rate monthly. The fund market price has gained 8.71% over the past year and 2.88% since its inception. The fund average duration is 26.15 years. There are 167 bonds in its asset.

As of January 2011, the top 10 bond sectors include hospital revenue, water & sewer, tobacco, industrial development / pollution control, power revenue, transportation, special tax, education revenue, and housing revenue. The top 6 state municipals are Michigan, Texas, California, Illinois, Washington, and New Jersey.

Nuveen Muni Market Opportunities

The investment aim of Nuveen Muni Market Opportunities fund is to provide current income exempt from regular federal income tax. The secondary investment objective is the enhancement of portfolio value. This Nuveen fund has an annual expense ratio of 1.62% including 1.41% baseline expense and 0.20% interest expense. The fund pays a distribution rate of 7.89% per year. The fund market price has returned -4.67% over the past year and 5.87% over the past three years. The average duration of the fund is 15.47 years. It consists of 229 bonds.Top Performer Municipal Bond Closed End Funds 2011

As of March 2011, the fund top 5 sectors include transportation, health care, limited tax obligation, general tax obligation, and utilities. The top 6 states allocation includes California, Illinois, Texas, Washington, and Ohio. To invest in this fund, you can try using a discount online brokerage such as Zecco, LightSpeed, Interactive Brokers (IB), etc.

|

| VKQ fund holdings |

As part of Invesco advisors fund, the Invesco Van Kampen Municipal Trust fund is seeking to provide current income exempt from federal income tax by investing in investment grade municipal bonds and inverse floating rate obligations.

This municipal debt fund is managed by Thomas Byron, Robert Stryker, and Robert Wimmel. As of January 2011, the fund average maturity is 17.16 years. The fund total expense ratio is 1.18% per year. The fund has total net assets of $800.29 million. Its market price is 2.02% higher than its fund NAV.

As of February 2011, this Invesco fund also holds 293 bonds or debts issued by states in USA. The top 5 state municipals include California, Florida, Texas, and New York. The Top 4 bond sectors are hospital, IDR/ PCR, airport, and life care bond.

Disclosure: No Position

Fund Performance

| No | Fund Name | Closing Price | NAV | YTD | 1 Year | 3 Year |

|---|---|---|---|---|---|---|

| 1 | EV Municipal Income | $11.22 | $9.97 | 3.12% | -0.76% | 2.95% |

| 2 | Invesco VK Muni Opps. Trust | $12.59 | $12.46 | -1.40% | 0.42% | 5.97% |

| 3 | Invesco VK Muni Invst. Grade T | $12.95 | $13.02 | -0.97% | 0.41% | 6.63% |

| 4 | EV Municipal Bond | $11.28 | $11.05 | -0.33% | -6.50% | 3.51% |

| 5 | Invesco VK Adv Muni Inc II | $10.92 | $11.11 | -1.83% | -1% | 5.75% |

| 6 | Invesco VK Select Sector Muni | $10.95 | $10.98 | -0.43% | -0.42% | 3.16% |

| 7 | BlackRock MuniVest Fund II | $13.30 | $13.29 | -3.04% | 1.57% | 7.25% |

| 8 | PIMCO Municipal Income III | $10.62 | $8.87 | 3.89% | 8.81% | -0.64% |

| 9 | Nuveen Muni Mkt Opportunities | $12.49 | $12.51 | -1% | -4.80% | 5.96% |

| 10 | Invesco VK Municipal Trust | $12.32 | $12.40 | 0.61% | -1.47% | 4.31% |

| 11 | BlackRock Municipal Income | $12.31 | $12.10 | -1.01% | 0.05% | 2.57% |

| 12 | Federated Premier Muni Income | $13.42 | $12.97 | 1.86% | -1.60% | 5.93% |

Other Closed End Funds post: