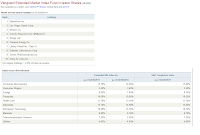

The top 10 high yield bond funds include American Funds American High Income, Vanguard High Yield Corporate, Fidelity Capital & Income, etc. More fund review can be found in my MEPB Financial website.

High Yield Bond Funds

High yield bond is also known as junk bond or speculative bond or non investment grade bond. To invest in high yield bond, you can choose either investing through individual bond, mutual fund, exchange traded fund (ETF), and closed end fund (CEF). Investing in individual bond may be difficult and risky for small investor. Also, most of individual bonds need $10,000 or higher initial investment fund to invest.

High yield bond is also known as junk bond or speculative bond or non investment grade bond. To invest in high yield bond, you can choose either investing through individual bond, mutual fund, exchange traded fund (ETF), and closed end fund (CEF). Investing in individual bond may be difficult and risky for small investor. Also, most of individual bonds need $10,000 or higher initial investment fund to invest.The most popular choice is investing in high yield bond mutual fund. Mutual fund usually invests in variety of bonds which can provide additional diversification to your financial asset portfolio. The following are the reasons why this best high yield bond fund is attractive:

- High risk means high reward

- The bond pays regular high distribution or yield (monthly or quarterly)

- It can provide additional asset diversification into non investment grade bond

- This type of bond doesn't have direct correlation with either investment-grade bonds or stocks

- High return or performance due to improve credit market condition or economy

- Hedge for higher interest rate since most of these fund has low duration

- The fund has high total net assets. The bigger the fund assets is equal to high confident for regular investor and institutional investor to invest in this fund

- It is ranked with 2 or higher star of Morningstar ratings

American Funds American High Income Fund

As part of American Funds fund family, the American Funds American High Income fund investment seeks to provide a high level of current income and capital appreciation. The fund invests most of its assets (>65%) in higher yielding debts including corporate loan obligations. It may also invest minority of its assets in foreign debts or outside the United States obligations. The fund has been managed by David D Barclay since 1989. The fund also has an annual expense ratio of 0.68%. There are also 0.22% 12b1 fee and 3.75% front end sales load. The minimum initial investment is $250 for regular brokerage account and $250 for IRA account. The fund also has a 3 stars rating from Morningstar. The current yield is 7.67% per year. The fund performance has returned 12.71% over the past year and 6.48% over the past 5 year.

The fund has been managed by David D Barclay since 1989. The fund also has an annual expense ratio of 0.68%. There are also 0.22% 12b1 fee and 3.75% front end sales load. The minimum initial investment is $250 for regular brokerage account and $250 for IRA account. The fund also has a 3 stars rating from Morningstar. The current yield is 7.67% per year. The fund performance has returned 12.71% over the past year and 6.48% over the past 5 year.This AHITX fund can be purchased from 74 brokerages such as ETrade Load Fee, Vanguard, JPMorgan, Schwab Institutional, Firstrade, Scottrade, etc. As of January 2011, the fund asset mix is as follows US Bonds (70.9%), Non U.S. Bonds (17.5%), Cash (9.5%), and US Equities (2.1%).

The Top 5 portfolio holdings include US Corporate Bonds (70.4%), Non US corporate and government bonds (17.7%), cash (5.8%), other (2.7%), and stocks (2.3%). The fund has an average duration of 3.3 years. This American Funds fund also an average life of 4.8 years. Investor or trader can also invest in many other different classes of this fund. Some fund classes may have lower fee.

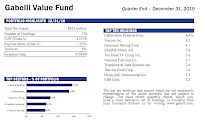

Vanguard High-Yield Corporate Fund

Vanguard has been known for its low cost fund approached. This Vanguard High Yield Corporate fund also has one of the lowest expense ratio (0.28%) per year among the listed fund. This Vanguard fund investment objective is to provide seeks a high current income by investing mainly in a diversified group of junk or speculative corporate debts with medium- and lower-range credit-quality ratings.

Vanguard has been known for its low cost fund approached. This Vanguard High Yield Corporate fund also has one of the lowest expense ratio (0.28%) per year among the listed fund. This Vanguard fund investment objective is to provide seeks a high current income by investing mainly in a diversified group of junk or speculative corporate debts with medium- and lower-range credit-quality ratings.The fund may not invest >20% of assets in bonds with credit ratings lower than B, preferred stocks, and convertible securities. Since 2008, Michael L. Hong has been the lead manager of this Vanguard fund.

The VWEHX fund also pays a yield of 7.25% per year. This top bond fund has returned 9.12% over the past three year and 6.17% over the past decade. One of the best ways to buy this top fund of 2012 is by opening Vanguard Brokerage Services account.

There is no fee to buy and sell this fund through Vanguard. There is also no 12b1 fee and front end sales load fee. To invest in this fund, you will need $3,000 initial investment fund for brokerage account and IRA (individual retirement account). You can also buy this fund through 78 brokerages network.

During the latest March report, the fund has 333 bonds in its holding. The average duration of the bonds is 4.6 years. The average maturity is 5.4 years. The fund has total net assets of 13.4 billion. Top 5 bond sectors are communication, finance, consumer non cyclical, consumer cyclical, and basic industry.

Fidelity Capital & Income Fund

The Fidelity Capital & Income fund is to provide income and capital growth. The fund usually invests in stock and debt securities, including defaulted bonds, with an emphasis on lower-quality debt securities. It may invest in troubled companies due to uncertain financial condition and in domestic & foreign issuers. The fund manager is Mark Notkin since 2003. Regular investor will be charged an annual expense ratio of 0.76%.There are no front end sales load fee and no 12b1 fee. The fund has returned 21.92% over the past year and 9.39% over the past decade. To buy this high yield bond fund, you can open Fidelity brokerage account. Retail investor also can find this fund through 69 brokerages network like UBS Financial Services, TIAA-CREF Brokerage Services, TD Ameritrade Institutional NTF, Schwab Retail, etc. You also need $2,500 initial balance to purchase this Fidelity fund.

As of January 2011, the fund top 8 bond holdings are GMAC LLC Mtn bond, Sprint Cap Corp, HCA holdings Inc, Teck Resources Ltd, TRW automotive holdings corp, Intelsat Pik, Wind Acqui, and LyondellBasell Industries. This Fidelity fund consists of 581 bonds. Top 5 portfolio diversifications are corporate bond (65.2%), equities (18.6%), bank debt (10.1%), cash (4.0%), and convertible preferred stocks (0.7%).

Top 8 major market sectors include telecommunications, energy, technology, automotive, diversified financial services, healthcare, banks & thrifts, and electric utilities. The fund annual turnover rate as of end of October 2010 is 52%.

Other Related High Yield Bond Funds:

- Top Performer High Yield Bond CEF: Pt 1

- Top Performing High Yield Taxable Bond Funds 2011

- T. Rowe Price High Yield Fund, PRHYX

PIMCO High Yield A

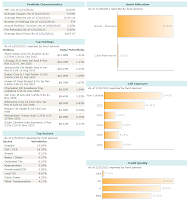

The PIMCO High Yield fund is part of PIMCO mutual fund offerings. The PIMCO High Yield fund seeks maximum total return with capital preservation using prudent investment management. The fund invests >80% of assets in a diversified portfolio of high yield obligations or junk bonds. It may invest the rest of the assets in investment-grade fixed income debts.The average portfolio duration of this fund normally varies from 2 to 6 years based on PIMCO forecast for interest rate. This PIMCO fund is managed by Andrew Jessop since 2010. He is an executive vice president and high yield portfolio manager in the PIMCO Newport Beach office. Based on load adjusted returns, this PHDAX fund has returned 10.78% over the past year and 7.64% over the past 3 year.

This fund also has a yield of 6.96% per year. The fund expense ratio is 0.90% per year. There are 3.75% front end sales load fee and 0.25% 12b1 fee. To invest in this fund, you will need $1,000 initial investment fund for brokerage account. This PIMCO fund can be purchased from 112 brokerages like E*Trade Financial, Wells Fargo Advisors, Fidelity Retail FundsNetwork, Merrill Lynch, etc.

This fund also has a yield of 6.96% per year. The fund expense ratio is 0.90% per year. There are 3.75% front end sales load fee and 0.25% 12b1 fee. To invest in this fund, you will need $1,000 initial investment fund for brokerage account. This PIMCO fund can be purchased from 112 brokerages like E*Trade Financial, Wells Fargo Advisors, Fidelity Retail FundsNetwork, Merrill Lynch, etc.As of January 2011, the top 5 sectors of this fund include high yield credit (78%), Non US Developed bond (7%), Investment Grade Credit (6%), Other (3%), and Mortgage (3%). Top 5 industry exposures are healthcare, electric utility, non captive consumer finance, banks, and wireless. The fund effective durations is 3.97 years. The effective maturity is 5.97 years.

JPMorgan High Yield A

The JPMorgan High yield fund objective is to provide a high level of current income. It also tries to provide capital appreciation as its secondary objective. The fund invests most of its assets (>65%) in higher yielding debts including corporate loan obligations. It may also invest minority of its assets in foreign debts or outside the United States obligations.William Morgan is the fund manager since 1998. The fund expense ratio is 1.14% per year. Also, there are 0.25% 12b1 fee and 3.75% front end sales load. The minimum initial investment is $1,000 for regular brokerage account and $1,000 for IRA account. The fund is rated with 3 stars Morningstar rating. The current fund distribution is 7.49% per year.

Based on load adjusted returns, this JPMorgan fund performance has returned 10.49% over the past three year and 7.90% over the past 5 year. The fund has $8.81 billion total net asset. This high yield bond fund can be purchased from 99 brokerages like ETrade Financial, TD Ameritrade, Schwab Institutional NTF, Wells Fargo Advisors, etc.

As of January 2011, the top 5 industries of this OHYAX fund are media, oil / gas & consumable fuels, hotels & restaurant, diversified financial services, diversified financial services, and diversified telecommunication services. The top 5 sectors include consumer discretionary, financials, industrials, energy, and materials.

The top bond holding of this fund include Liberty Mutual Group Inc, GMAC Inc, Nextel Communications, Capmark Financial Group, Sprint Nextel Corp, Caesars Entertainment Operating Co, Newpage Corp, Intelsat Luxembourg SA, Clearwire Communication Llc, and Claire Stores Inc. This JPMorgan fund also has 508 issuers. The fund average duration is 4.81 years. Other classes of this fund may have lower expense fee.

Top Performing High Yield Bond Funds:

- American Funds American High Income Fund (AHITX) - 12.71%

- Vanguard High-Yield Corporate Fund (VWEHX) - 15.08%

- Fidelity Capital & Income Fund (FAGIX) - 21.92%

- PIMCO High Yield Fund (PHDAX) - 10.78%

- JPMorgan High Yield Fund (OHYAX) - 12.83%

- Fidelity High Income Fund (SPHIX) - 16.60%

- T. Rowe Price High-Yield Fund (PRHYX) - 17.18%

- MainStay High Yield Corporate Bond Fund (MHCAX) - 8.66%

- Goldman Sachs High Yield Fund (GSHAX) - 10.69%

- Northern High Yield Fixed Income Fund (NHFIX) - 16.92%

Article: Top Performer High Yield Bond Funds of 2012