The top 10 Best Performer Mid Cap Blend Mutual Funds of 2010 (part 2) are:

- Principal MidCap Blend A (PEMGX)

- Nationwide Mid Cap Market Index A (GMXAX)

- Fidelity Spartan Extended Mkt Index Inv (FSEMX)

- Dreyfus Midcap Value A (DMCVX)

- Vanguard Extended Market Idx Inv (VEXMX)

Principal MidCap Blend A (PEMGX)

Principal MidCap Blend investment is seeking for long-term capital growth. The main net assets investment of this fund is in common stocks and other equity securities of medium-capitalization companies. These companies have the similar market capitalizations to those of companies in the Russell Midcap Index. Since 2000, K. William Nolin has been the fund portfolio manager. This mid cap blend stock fund has 1.14% yearly expense ratios. There are 0.25% 12b1 fee and 5.50% front-end sales load for this fund. The minimum balance to invest in this fund either in brokerage or IRA account is $1,000.

Since 2000, K. William Nolin has been the fund portfolio manager. This mid cap blend stock fund has 1.14% yearly expense ratios. There are 0.25% 12b1 fee and 5.50% front-end sales load for this fund. The minimum balance to invest in this fund either in brokerage or IRA account is $1,000.This fund can be purchased from 84 brokerages include E TRADE Financial, H&R Block Financial Advisors Inc., Morgan Stanley - Brokerage Accounts, Schwab Institutional and Td Ameritrade, Inc. This fund has returned 22.04% over the past one year and 4.23% over the past three years. The other class tickers of this fund are PRMBX, PMBCX, PCBIX, PMBJX, PMCPX, PMSBX, PMBNX, PMBMX, PMBSX and PMBPX.

new: Best Mid Cap Domestic Stock Mutual Funds 2012

The top 10 holdings of this fund as of Feb 28, 2011 are Liberty Media Corp., Capital Shs A (3.56%), O'Reilly Automotive, Inc. (3.04%), Iron Mountain, Inc. (2.67%), Loews Corporation (2.61%), Laboratory Corporation of America Holdings (2.36%), Markel Corporation (2.21%), EOG Resources (2.12%), Brookfield Asset Management, Inc. A (2.11%), DISH Network Corporation Class A (2.03%) and Leucadia National Corporation (1.91%).

Nationwide Mid Cap Market Index A (GMXAX)

The Nationwide Mid Cap Market Index fund investment is to provide capital growth. The fund investment tries to match the S&P Mid Cap 400 Index performance as closely as possible before the fund expenses deduction. The majority of the net assets (around 80%) are invested in equity securities of companies included in the S&P MidCap 400 Index.Edward Corallo has passively managed fund since 2010. This fund has low expense ratio which is 0.67%. The 12b1 fee of this fund is 0.25% and the front-end sales load charge is 5.75%. This fund has returned 4.11% over the past five years and 6.83% over the past ten years. The minimum balance to invest in this fund is $2,000 for brokerage account and $1,000 for IRA account. The other class tickers of this fund are GMCBX, GMCCX, GMXIX and GMXRX.

The top ten holdings of this mid cap blend fund as of Feb 28, 2011 are S&P Mid 400 Emini Future (3.59%), Cimarex Energy Co (0.80%), Edwards Lifesciences Corp (0.79%), Vertex Pharmaceutical Com (0.77%), Borg-Warner Inc (0.72%), New York Community Bancorp Inc (0.66%), Chipotle Mexican Grill Com (0.62%), Bucyrus International Inc (0.60%), Pride International Inc (0.59%), and Lubrizol Corp (0.58%).

Fidelity Spartan Extended Mkt Index Inv (FSEMX)

Fidelity Spartan Extended Market Index Investor investment is looking for capital growth as well as providing investment results. The results relate to the total return of mid-cap and small-cap United States companies stocks. The major net assets investment of this fund is in common stocks (including the Dow Jones U.S. Completion Total Stock Market Index). Jeffrey Adams has managed this fund since 2005. This fund has the lowest expense ratio from all the funds listed here (0.10%). This fund applies no 12b1 fee and it is a no sales load fund. The minimum balance to invest in brokerage account of this fund is $10,000. No IRA account is available. This fund has returned 5.67% over the past five years. The other class ticker of this fund is FSEVX, that has no 12b1 fee and no sales load as well.

Jeffrey Adams has managed this fund since 2005. This fund has the lowest expense ratio from all the funds listed here (0.10%). This fund applies no 12b1 fee and it is a no sales load fund. The minimum balance to invest in brokerage account of this fund is $10,000. No IRA account is available. This fund has returned 5.67% over the past five years. The other class ticker of this fund is FSEVX, that has no 12b1 fee and no sales load as well.The top ten holdings of this fund as of Dec 31, 2010 are Las Vegas Sands Corp, General Motors Co, Blackrock Inc., Lyondellbasell Inds Class A, Mosaic Co, Annaly Capital Mgmt Inc REIT, Crown Castle Intl Corp, Southern Copper Corp, Marvell Technology Group Ltd and Delta Air Inc.

Dreyfus Midcap Value A (DMCVX)

The investment in Dreyfus Midcap Value seeks to equal the Standard & Poor's MidCap 400 Index performance. The general choice of net assets investment of this fund is in all 400 stocks in the S&P MidCap 400 with index proportional consideration. These are the common stocks of medium-size companies with $750 million to $3.3 billion market capitalization.Top Performer US Domestic Stock Mutual Funds of 2011

This mid cap blend stock mutual fund is managed by Thomas J. Durante since 2000. The expense ratio of this fund (0.50%) is quite low compared to the average in the category. There is neither 12b1 fee nor sales load for this fund. This fund has returned 32.15% over the past one year and 5.56% over the past five years. The minimum balance to invest in brokerage account of this fund is $2,500 and $750 for IRA account. The other class tickers for this fund are PESPX, DVLCX and DVLIX. The minimum balance to invest in DVLCX and DVLIX brokerage account is $1,000. This fund also has 4 stars rating from Morningstar.

The top holdings of this fund are Td Ameritrade Holding (3.16 %), Alliance Data Systems (3.14 %), Newell Rubbermaid (3.04 %), St. Jude Medical (2.77 %), Stanley Black & Decker (2.61 %), Cb Richard Ellis Group – A (2.60 %), Avery Dennison (2.54 %), Textron (2.52 %), Synopsys (2.25 %) and Tyco Electronics (2.18 %).

Vanguard Extended Market Idx Inv (VEXMX)

Vanguard Extended Market Index Investor fund seeks performance tracking of a benchmark index. This index measures the investment return of small-cap and mid-cap stocks. This fund invests majority of its net assets in stocks of the targeted index. It uses a passive management strategy planned to track the performance of the S&P Completion Index.

Vanguard Extended Market Index Investor fund seeks performance tracking of a benchmark index. This index measures the investment return of small-cap and mid-cap stocks. This fund invests majority of its net assets in stocks of the targeted index. It uses a passive management strategy planned to track the performance of the S&P Completion Index.This domestic stock mutual fund is managed by Donald M. Butler since 1997. The expense ratio of this fund is 0.26% per year. There is no 12b1 fee applied for this fund. And it is as well a no sales load fund. The performance of this fund over the past three years is 7.58%. The minimum balance to invest in this fund either in brokerage or IRA account is $3,000. The other class tickers of this fund are VEXAX, VIEIX and VEMSX. Some asset classes of fund have lower expense ratio fee, and no front end sales charge fee.

The top 10 holdings of this fund as of Feb 28, 2011 are BlackRock Inc., Las Vegas Sands Corp., Mosaic Co., Concho Resources Inc./Midland TX, Bunge Ltd., Cimarex Energy Co., Liberty Global Inc. Class A, Edwards Lifesciences Corp., Vertex Pharmaceuticals Inc. and Delta Air Lines Inc. These ten largest holdings make up to 4.0% of total net assets.

Disclosure: I don't have any position in these funds. Please do your own research for additional details. Please trade and invest responsibly. Past Performance is No Guarantee of Future Results.

Fund Performance

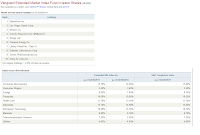

| No | Mutual Funds Description | Rank | Ticker | Yield | Morningstar Rating | Net Assets (Mil) | Expense Ratio | Min To Invest |

|---|---|---|---|---|---|---|---|---|

| 6 | Principal MidCap Blend A | 13 | PEMGX | 0.94% | 4 | $1,550 | 1.14% | $1,000 |

| 7 | Nationwide Mid Cap Market Index A | 21 | GMXAX | 0.65% | 3 | $1,090 | 0.67% | $2,000 |

| 8 | Fidelity Spartan Extended Mkt Index Inv | 23 | FSEMX | 0.88% | 3 | $5,970 | 0.10% | $10,000 |

| 9 | Dreyfus Midcap Value A | 24 | DMCVX | 0.74% | 4 | $2,680 | 0.50% | $2,500 |

| 10 | Vanguard Extended Market Idx Inv | 31 | VEXMX | 0.80% | 3 | $19,180 | 0.26% | $3,000 |

No comments:

Post a Comment