Ten best ranked mid cap value stock mutual funds 2010 - Part 3, top equity fund. This is my third article for Top Performer Mid Cap Value Mutual Fund of 2010. If you miss my previous articles, please check the following

part 1 and

part 2.

Mid cap value funds usually consist of companies which have capitalization between $2 billion and $10 billion. Most of these companies are based domestically in US. Some of the funds may invest in foreign stock market like Europe, Emerging Markets, Mediterranean, Pacific, Australia, Japan, etc.

Mid Cap Value Stock Mutual Funds

These funds were selected based on their rank in 2010. The fund also has a minimum net asset of $500 million and more. This may provide another boost of confident for investor to invest in this fund. The fund also has 2 stars or more Morningstar Rating.

The

Ten Best Ranked Mid Cap Value Mutual Fund of 2010 (Part 3):

- Neuberger Berman Equity Income A

- MFS Mid Cap Value A

- Allianz NFJ Renaissance A

- AllianceBernstein Small-Mid Cap Value A

- Fidelity Mid Cap Value

- Goldman Sachs Mid Cap Value A

- Hartford MidCap Value HLS IA

- RidgeWorth Mid-Cap Value Equity A

- JPMorgan Mid Cap Value A

- Lord Abbett Mid-Cap Value A

- The Delafield Fund

- Vanguard Mid-Cap Value Index Inv

JPMorgan Mid Cap Value A (JAMCX)

JPMorgan Mid Cap Value fund investment pursues capital appreciation growth. This fund invests its net assets (include the borrowings for investment purposes) in equity securities of mid cap companies with market capitalizations between $1 billion and $20 billion at the time of purchase.

Since 1997, Jonathan E. Simon has managed the fund. The expense ratio of this fund is 1.23% per year. The 12b1 fee is 0.25% and the front end sales load is 5.25%. This JPMorgan fund has returned 19.47% over the past year and 8.68% over the past decade.

This minimum balance to invest in brokerage account of this fund is $1,000 (applies for JBMCX and JCMVX). No IRA account is available. This fund can be purchased from 106 brokerages include JPMorgan, Merrill Lynch, Edward Jones, Nationwide Retirement Innovator, Fidelity Retail FundsNetwork and Schwab Institutional NTF. The other class tickers of this fund are JBMCX, JCMVX, FLMVX, JMVZX and JMVSX. Some classes have lower expense ratio, such as 0.74% for FLMVX.

The top ten holdings of this fund as of February 28, 2011 are Energen Corp (2.1%), Republic Services Inc (1.9%), Loews Corp (1.8%), Devon Energy Corp (1.7%), The Gap Inc (1.7%), Fortune Brands Inc (1.6%), CMS Energy Corp (1.6%), Lincare Holdings Inc (1.6%), Ball Corp (1.5%), and Tyco Electronics Ltd (1.5%). These ten holdings make up a total of 17.0% of the portfolio.

Lord Abbett Mid-Cap Value A (LAVLX)

Lord Abbett Mid-Cap Value fund seeks to provide capital appreciation. The majority net assets investment is in equity securities of mid-sized companies. But this fund may also invest in warrants, common stocks, convertible preferred stocks and convertible bonds.

Jeff Diamond is the fund manager since June 25, 2008. This Lord Abbett fund has 1.15% annual expense ratio. The 12b1 fee of this fund is 0.35% and front end sales load of 5.75%. This fund has returned 1.54% over the past five years and 5.96% over the past ten years. The minimum initial investment for brokerage account is $1,000 and $250 for IRA account.

The other class tickers are LMCBX, LMCCX, LMCFX, LMCYX, LMCPX, LMCQX and LMCRX. LMCBX and LMCCX have the same minimum investment with LAVLX. The lowest expense ratio among the classes is LMCYX (0.8%).

As of Feb 28, 2011, the top ten largest holdings of this mid cap value fund are Interpublic Group of Co Inc (3.3%), Omnicom Group Inc (2.5%), Lazard Ltd (2.2%), El Paso Corp (2.1%), Mylan Laboratories Inc (2.0%), Bunge Ltd (2.0%), Fiserv Inc (1.9%), Weatherford International Ltd (1.8%), EQT Corp (1.7%), and City National Bank (1.5%).

The Delafield Fund (DEFIX)

As of September 28, 2009 The Delafield Fund is now part of the Tocqueville Trust. The investment in this Delafield Fund seeks long-term preservation of capital and growth of capital. The main net assets (>65%) investment is in the equity securities of undervalued domestic companies. The other assets investment is in debt securities and preferred stocks (35%) and in non-U.S. securities, including in ADRs, in both developed and emerging markets (25%).

Best Performer Growth Stock Mutual Funds 2012

J. Dennis Delafield is the CFA as well as Managing Director and fund manager of this fund since November 1993. The expense ratio of this mid cap value mutual fund is 1.27%. This is a no sales load fund. It has 0.25% of 12b1 fee. This fund has returned 8.60% over the past five years and 12.36% over the past decade. The minimum balance to invest in this fund is $1,000 for brokerage account and $250 for IRA account.

The top 10 holdings of this fund as of Dec 31, 2010 are Flextronics International Ltd (3.73%), Collective Brands Inc (2.82%), Owens-Illinois Inc (2.71%), Stanley Black & Decker Inc (2.57%), Checkpoint Systems Inc (2.56%), Ingersoll-Rand PLC (2.45%), Tyco International Ltd (2.34%), Albany International Corp (2.24%), Minerals Technologies, Inc (2.22%), and FMC Corp (2.17%).

Vanguard Mid-Cap Value Index Inv (VMVIX)

Vanguard Mid-Cap Value Index Investor investment doesn’t seek for capital growth. This fund tracks the performance of a benchmark index to measures the investment return of mid-capitalization value stocks. This VMVIX fund employs a passive management approach.

This Vanguard fund is passively managed by Donald M. Butler since August 2006. The expense ratio of this fund is among the lowest of all the funds mentioned in this article (0.26%). There is no 12b1 fee as well as no sales load. This

mid cap value fund has returned 26% over the past one year and 6.72% over the past three years. The minimum balance to invest in this fund for either brokerage or IRA account is $3,000. This fund can be purchased from 66 brokerages. The best way to invest in this Vanguard fund is by opening an account in Vanguard.

The top 10 holdings of this fund are Cliffs Natural Resources Inc, Dover Corp, Humana Inc, Goodrich Corp, Cooper Industries plc, Lincoln National Corp, Micron Technology Inc, Bunge Ltd, Cimarex Energy Co, and Regions Financial Corp. These ten companies make up to 9.2% of total net assets portfolio.

Disclosure: No Position

updated on 4/3/2011

Other Interesting articles:

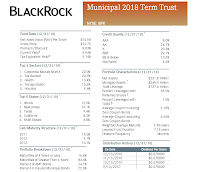

This Dodge & Cox Income fund (Ticker: DODIX) investment objective is to seek a high & stable rate of current income with consistent long term capital preservation. It also will try to take advantage of opportunities to realize capital appreciation. The fund invest majority of its assets in a high quality bond (i.e. investment grade bond) and other fixed income debts diversified portfolio.

This Dodge & Cox Income fund (Ticker: DODIX) investment objective is to seek a high & stable rate of current income with consistent long term capital preservation. It also will try to take advantage of opportunities to realize capital appreciation. The fund invest majority of its assets in a high quality bond (i.e. investment grade bond) and other fixed income debts diversified portfolio.