This article will provide another Muni bond CEF with slightly longer average duration. This also means this fund is riskier and more volatile with interest rate hikes. This intermediate term Muni bond closed end fund is BlackRock Municipal 2018 Term Trust fund (Ticker: BPK).

BlackRock Municipal 2018 Term Trust (BPK)

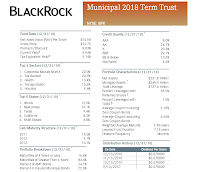

The BlackRock Municipal 2018 Term Trust fund seeks tax exempt current income by investing in undervalued municipal bonds of investment grade. This BlackRock fund also will return the initial capital of USD 15 per share by 31-Dec-2018. The fund may invest some of its assets in non investment grade Muni bonds which rated as Ba/BB or B. The bond rating will be based on Moody's, S&P, Fitch rating, and BlackRock’s judgment. This BlackRock fund is managed by Jaeckel Jr (since 2006), O’Connor (since 2006), and Downs (since 2007). This fund also has total net assets of $231.6 million. As part leverage Muni bond fund, this fund has 37.38% effective leverage. The fund charges 0.88% annual expense ratio. This annual expense includes 0.63 management fees, 0.23% other expenses and 0.01% interest expense. The fiscal year end is December 31st every year. As leveraged fund, it also has preferred shareholder distributions of 0.22%.

As part leverage Muni bond fund, this fund has 37.38% effective leverage. The fund charges 0.88% annual expense ratio. This annual expense includes 0.63 management fees, 0.23% other expenses and 0.01% interest expense. The fiscal year end is December 31st every year. As leveraged fund, it also has preferred shareholder distributions of 0.22%.As of March 2011, this fund pays monthly distribution of $0.0780 per share. This means it has a yield of 6.03%. The average credit quality of this fund is A (investment grade). The average duration is 7.18 years. The average coupon is 5.10%. This BlackRock CEF consists of 107 bonds.

Best California Muni Bond Closed End Funds

As of January 2011, the fund top 5 states include Illinois (12.5%), New Jersey (10.1%), Texas (9.4%), California (8.2%), and Multi States (6.0%). The top 5 bond sectors are corporate-backed Muni’s, tax-backed, health, transportation, and housing.

As of March 30th 2011, the fund market price is traded 7.04% premium of its fund NAV. This is slightly higher than 52 weeks average of 6.92% premium. This BlackRock Municipal 2018 Term Trust fund is rated 5 stars by Morningstar. The fund market price has returned 5.94% over the past year and 5.55% over the past five years.

Disclosure: No Position

No comments:

Post a Comment