Best Convertible Bond Mutual Funds

The following is part 2 of this article, this article will list the next 5 of 10 Best convertible bonds fund of 2011. The 10 Best convertible bond funds of 2011 (Part 2):- Calamos Convertible A

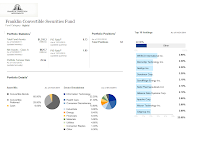

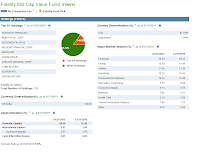

- Fidelity Convertible Securities

- Vanguard Convertible Securities Inv

- Franklin Convertible Securities A

- MainStay Convertible B

- Putnam Convertible Income-Growth A

- Allianz AGIC Convertible A

- Columbia Convertible Securities A

- Invesco Van Kampen Harbor A

- Lord Abbett Convertible A

Putnam Convertible Income-Growth A (PCONX)

Putnam Convertible Income-Growth investment is seeking for both current income and capital appreciation. It as well aims for conservation of capital. The major net assets investment is in convertible securities with below investment-grade rating and investment-grade rating. The maturity level of these securities is three years or longer (intermediate- to long-term stated maturities). Robert L. Salvin has managed this convertible bond fund since Dec 30, 2005. This fund has the 1.18% of annual expense ratio.The 12b1 fee is 0.25% and its front-end sales load is 5.75%. The minimum balance to invest in brokerage account of this fund is $500 (same applies for PCNBX, PRCCX and PCNMX), there is no IRA account available. The other class tickers of this fund are PCNBX, PRCCX, PCNMX, PCVRX and PCGYX. The PCGYX fund has the lowest expense ratio in this fund (0.93%).

Robert L. Salvin has managed this convertible bond fund since Dec 30, 2005. This fund has the 1.18% of annual expense ratio.The 12b1 fee is 0.25% and its front-end sales load is 5.75%. The minimum balance to invest in brokerage account of this fund is $500 (same applies for PCNBX, PRCCX and PCNMX), there is no IRA account available. The other class tickers of this fund are PCNBX, PRCCX, PCNMX, PCVRX and PCGYX. The PCGYX fund has the lowest expense ratio in this fund (0.93%).The top ten holdings as of February 28, 2011 are Emc Corp/Massachusetts, Safeguard Scientifics, Wells Fargo, Chesapeake Energy Corp, Citigroup, El Paso Corp, Hertz Global Holdings, Sandisk Corp, Medtronic and The Interpublic Group of Cos. The top industry sectors as of February 28, 2011 are Technology (19.00%), Financials (16.51%), Consumer Cyclicals (13.85%), Health Care (11.19%), Miscellaneous (10.45%), Communication Services (9.96%), Energy (6.79%), Capital Goods (5.36%), Basic Materials (4.97%) and Cash & Net Other Assets (1.92%).

Allianz AGIC Convertible A (ANZAX)

The investment in Allianz AGIC Convertible Fund seeks for maximum total return. It means that it is aiming for both capital appreciation and current income. The net assets investment of this fund is 80% in convertible securities of any size market capitalization and 20% in nonconvertible debt securities. The convertible securities may include debentures, corporate bonds, notes or preferred stocks and their hybrids.Douglas G. Forsyth has managed this fund since Dec 31, 1993. This fund has no yield distributed. The expense ratio of this fund is 0.96% per year. The 12b1 fee of this fund is 0.25% with 5.50% front-end sales load. This fund has returned 7.62% over the past three years and 6.22% over the past ten years. The minimum balance to invest in this best mutual fund is $1,000. No IRA account is available.

The purchase of this fund is limited to 19 brokerages such as Scottrade Load, JPMorgan, Fidelity Retail FundsNetwork, Ameriprise Brokerage, CommonWealth Core, Raymond James, CommonWealth Universe, RBC Wealth Management-Network Eligible, TD Ameritrade Retail and DailyAccess Corporation Mid-Atlantic. The other class tickers of this fund are ANNAX, ANZCX, ANZDX, ANNPX, ANCMX and ANZRX. Some asset classes of fund have lower expense ratio fee, and no front end sales charge fee.

The top sectors of this fund as of Feb 28, 2011 are Technology (19.93%), Healthcare (14.30%), Consumer Discretionary (13.82%), Industrials (10.55%) and Financials (10.24%). The top 10 holdings of this fund are EMC Corp (1.40%), Symantec Corp (1.40%), General Motors Co (1.37%), Liberty Media (1.36%), Fifth Third Bancorp (1.31%), Archer Daniels (1.30%), Stanley Black + Decker I (1.30%), Developers Divers R (1.30%), Enersys (1.28%) and Wesco International (1.28%).

Columbia Convertible Securities A (PACIX)

Columbia Convertible Securities investment seeks for total return consistent with capital appreciation and current income. The composition of the net assets investment of this fund is (up to) 80% in below investment-grade convertible securities, (up to) 15% in Eurodollar convertible securities and (up to) 20% in foreign securities.David L. King has managed this fund since Apr 6, 2010. This fund has 3.14% yield. The expense ratio of this fund is 1.20% per year. There is a 0.25% 12b1 fee and 5.75% front-end sales charge fee. This fund has returned 17.55% over the past one year and 3.45% over the past five years. The minimum balance to invest in the brokerage account of this fund is $2,500 (applies for other class) and $1,000 for IRA account. The other class tickers of this fund are NCVBX, PHIKX and NCIAX. Among all classes, only NCIAX doesn’t apply the 12b1 fee.

Best Convertible Securities Mutual Funds of 2012

The top holdings of this fund as of Dec 31, 2010 are Citigroup (2.8%), Invitrogen (2.5%), Gilead Sciences (2.4%), General Motors Co (2.1%), Ford Motor Company (1.9%), EMC CORP (1.7%), Micron Technology (1.5%), MGM Mirage (1.5%), Alexandria Real Estate (1.5%) and Dollar Financial Corporation (1.5%). The assets allocation of this fund is as below convertible bonds (73.3%), preferred stock (22.0%), common stock (1.0%), corporate bonds (0.5%) and cash & equivalents (3.3%).

Invesco Van Kampen Harbor A (ACHBX)

The investment in Invesco Van Kampen Harbor seeks for both current income and capital appreciation, consistent with capital preservation. This ACHBX fund invests at least 50% in convertible debt securities, up to 45% in common stocks and up to 25% in foreign securities. For the investment reason, this fund may buy and then sell certain derivative instruments (options, futures contracts and options on futures contracts). This convertibles fund is managed by Ellen Gold since Aug 23, 2001. The yield for this fund is 3.27%. The expense ratio is 1.04% annually. The 12b1 fee is 0.25% with 5.50% front-end sales charge fee. This fund has returned 6.78% over the past three years and 4.45% over the past ten years. The minimum balance to invest in either brokerage or IRA account of this fund is $1,000. The other class tickers of this fund are ACHAX, ACHCX, ACHJX and ACHIX . The ACHIX has the highest yield among all (3.48%) with no 12b1 fee and no sales load.

This convertibles fund is managed by Ellen Gold since Aug 23, 2001. The yield for this fund is 3.27%. The expense ratio is 1.04% annually. The 12b1 fee is 0.25% with 5.50% front-end sales charge fee. This fund has returned 6.78% over the past three years and 4.45% over the past ten years. The minimum balance to invest in either brokerage or IRA account of this fund is $1,000. The other class tickers of this fund are ACHAX, ACHCX, ACHJX and ACHIX . The ACHIX has the highest yield among all (3.48%) with no 12b1 fee and no sales load.The top 10 holdings of this fund as of Feb 28, 2011 are Nielsen Holdings NV, EMC Corp, SBA Communication Corp., Virgin Media Inc., Micron Technology Inc., Chesepeake Energy Corp., Endo Pharmaceut Holdings In, Ciena Corp., Symantec Corp and Alliance Data Sys Corp. The top industrial sectors are Semiconductors (5.52%), Biotechnology (4.90%), Health Care Equipment (3.96%), Pharmaceuticals (3.79%), Internet Software & Services (3.55%), Wireless Telecommunication Services (3.12%), Computer Storage and Peripherals (3.09%), System Software (2.68%), Communication Equipments (2.45%) and Health Care Services (2.32%).

Lord Abbett Convertible A (LACFX)

Lord Abbett Convertible investment seeks for both current income and capital appreciation to result in a high total return. The net assets investment composition of this fund is at least 80% of net assets in convertible securities, up to 25% in investment grade convertible securities, up to 20% in non-convertible debt or equity securities and max of 20% in foreign securities and lower-rated convertible securities.

Lord Abbett Convertible investment seeks for both current income and capital appreciation to result in a high total return. The net assets investment composition of this fund is at least 80% of net assets in convertible securities, up to 25% in investment grade convertible securities, up to 20% in non-convertible debt or equity securities and max of 20% in foreign securities and lower-rated convertible securities.This balanced fund has been managed by Christopher J. Towle since Jun 30, 2003. This fund has the highest yield among the other mentioned in this list (3.79%). The expense ratio of this fund is the same as the average in the category (1.41%). There is a 0.20% 12b1 fee and 2.25% front-end sales charge fee.

This convertible bond fund has returned 4.33% over the past three years and 4.32% over the past five years. The minimum balance to invest in this fund is $1,000 for brokerage account and $250 for IRA account. This fund can be purchased from 92 brokerages such as Morgan Stanley Advisors, Pershing FundCenter, Schwab Institutional, Td Ameritrade, Inc., Scottrade Load, Merrill Lynch and Edward Jones. The other class tickers of this fund are LBCFX, LACCX, LBFFX, LCFYX, LCFPX, LBCQX and LCFRX. With the minimum investment of $1,000,000, LCFYX has the highest yield in the class (4.09%).

The ten largest holdings as of Feb 28, 2011 are Affiliated Manager Group, Inc. (2.1%), Informatica Corp. (2.0%), Ford Motor Co. (1.7%), Citigroup, Inc. (1.7%), Central Euro Distribution Co. (1.7%), General Motors Co. (1.6%), Archer-Daniels-Midland Co. (1.6%), Intel Corp. (1.5%), Apache Corp. (1.5%) and Bank of America Corp. (1.4%).

Disclosure: No Position

Fund Information

| No | Mutual Funds Description | Ticker | Yield | Morningstar Rating | Net Assets (Mil) | Expense Ratio | Min to Invest |

|---|---|---|---|---|---|---|---|

| 6 | Putnam Convertible Income-Growth A | PCONX | 2.68% | 3 | $718 | 1.18% | $500 |

| 7 | Allianz AGIC Convertible A | ANZAX | N/A | 4 | $641 | 0.96% | $1,000 |

| 8 | Columbia Convertible Securities A | PACIX | 3.14% | 3 | $510 | 1.20% | $2,500 |

| 9 | Invesco Van Kampen Harbor A | ACHBX | 3.27% | 4 | $359 | 1.04% | $1,000 |

| 10 | Lord Abbett Convertible A | LACFX | 3.79% | 3 | $352 | 1.41% | $1,000 |