Merger Fund (MERFX) is one of the best alternative mutual funds for financial investing. Its objective is to provide capital growth.

This next fund can provide an

alternative investment strategy to many investors. As part of market neutral category fund, Merger Fund invests in announced merger companies. This type of fund is usually less volatile and has a set of guarantee return. This fund is also featured in Kiplinger’s 25 Best Fund. This fund is being added recently in 2010 and will replace the previous Arbitrage Fund (Ticker:

ARBFX) in Kip 25. Arbitrage Fund is removed due to it is closed to new investor.

According to its website (www.mergerfund.com), Merger Fund is the first mutual fund dedicated entirely to merger arbitrage. This fund has been around since 1989. As discussed, it also has one of the lowest volatility for stock funds with beta of 0.10. This fund is also very popular to retail investors and institutional investors with $4.53 billion asset.

Altenative Mutual Fund

The investment in

Merger Fund is seeking for capital growth. The goal is achieved by engaging in merger arbitrage. The major net assets investment of this Merger Fund (at least 80%) is in the equity securities of merger-companies. The companies are involved in publicly announced mergers, tender offers, liquidation, spin-offs, takeovers, leveraged buyouts and other corporate reorganizations. This is a special investment approach to gain the most profit from the companies in such conditions.

Merger Fund MERFX Details

- Fund Inception Date: January 1989

- Ticker Symbol: MERFX

- CUSIP: 589509108

- Beta (3yr): 0.10

- Rank in category YTD: 12

- Category: Market Neutral

- Distribution: 0.32%

- Expense fee: 1.40%

- Turnover Rates: 182%

- Capital Gains: check website

- Number of Years Up: 19 years

- Number of Years Down: 2 years

Updated on May 2017

The

Merger Fund was the first mutual fund devoted exclusively to merger arbitrage.

Roy D. Behren has been the lead manager for this fund since 2007. Should you plan to invest in this fund, the minimum initial invest for either brokerage or IRA account is $2,000 and no minimum subsequent investment. This fund applies a 0.927% of management fee. MERFX is considered as a

no sales load fund. The fund can be purchased from 81 brokerages, include T Rowe Price, DATALynx, JP Morgan, E Trade Financial, TD Ameritrade Inc, etc. This fund has no other class.

MERFX Fund

The annual report of

expense ratio is 1.41%, which is lower than the average in the category (1.96%). Since its inception in 1989, this fund has experienced a total of 19 years up performance with the best total return in 2000 (17.58%) and 2 years of down period with the worst total return in 2002 (-5.67%). This fund receives

4-stars rating from Morningstar.

MERFX fund has returned 4.09% over the past year and 3.46% over the past ten years. The year to date (YTD) return is 2.41%.

- Year 2017: 1.47% (YTD)

- Year 2016: 2.61%

- Year 2015: -0.82%

- Year 2014: 1.43%

- Year 2013: 3.61%

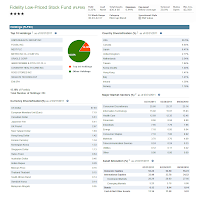

As of December 2010, the

top 10 equity holdings of this fund are

Alcon Inc,

Bucyrus International Inc,

McAfee Inc, Qwest Communications International Inc, King Pharmaceuticals, Inc, Alberto-Culver Company, Western Coal Corp, Genzyme Corporation, Potash Corporation of Saskatchewan and Undisclosed UK Media. The top countries in this fund include United States (77.14%), Europe (12.70%) and Canada (7.63%). The

top 5 sectors include health care (18.90%), industrials (17.98%), materials (16.18%), financials (11.71%) and consumer discretionary (11.55%).

Investing in this Merger Fund involves

principal risks such as:

- Reorganization risk

- Foreign investment risk

- Foreign currency risk

- Hedging risk

- High transaction cost due to high turnover rates

Disclosure: No Position

For details about this Merger Fund information, please check my

Kiplinger’s 25 Best Fund page. Other Kiplinger's Best Mutual Funds:

This Merger Fund (MERFX) was part of Kiplinger's 25 best mutual funds before.