Investing in this fund may provide additional portfolio diversification. You may also check other Kip 25 fund in Mid Cap stock category such as Akre Focus, Meridian Growth, and Vanguard Selected Value. Rule of thumb is to have 5-10% total asset in this category.

As one of the Fidelity Fund Pick, the Fidelity Low-Priced Stock fund also has the longest tenured manager managing this fund. This fund also has assets totaling $36.42 billion. This fund was closed to new investors in December 2003 and has reopened in December 2008. This fund also received variety of awards such as Kiplinger’s 25 Best Funds, Bronze Award for Mid Cap Domestic Equity by Standard & Poor’s 2010 Mutual Fund Excellence Awards, and Top Value Line Overall Rank.

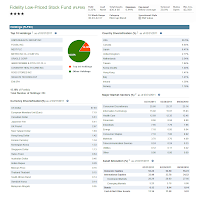

Fidelity Low-Priced Stock (Ticker: FLPSX)

Fidelity Low-Priced Stock fund seeks for capital appreciation. It normally invests the majority of the net assets in common stocks and low-priced stocks. This Fidelity Low-Priced Stock fund usually buys the stocks whose price is at or below $35 per share and most of these stocks are part of small and medium sized companies (i.e. small cap and mid cap). It may invest in stocks issued by either domestic or foreign issuers, either growth or value stocks or both. This fund may also invest in stocks not considered low-priced. FLPSX Fund Details

FLPSX Fund Details

- Fund Inception Date: December 1989

- Ticker Symbol: FLPSX

- CUSIP: 316345305

- Beta (3yr): 1.08

- Rank in category (YTD): 51

- Category: Mid-Cap Blend

- Yield: 0.37%

- Capital Gains: 0.0%

- Number of Years Up: 18 years

- Number of Years Down: 3 years

This fund is managed by Joel C. Tilinghast since its inception in 1989. The minimum initial investment for this fund is $2,500 for brokerage and IRA account. There is no minimum subsequent investment. If you are interested to invest in this fund, it doesn’t have any management fee (12b1) and any transaction fee (i.e. no sales-load). The expense ratio of this fund is 0.99% yearly. The fund can be purchased from 68 brokerages, include JP Morgan, T. Rowe Price, Schwab Institutional, TD Ameritrade, Vanguard, Schwab Retail, etc.

FLPSX fund has returned 18.29% over the past one year, 7.20% over the past three years and 4.94% over the past five years. With 4-stars rating from Morningstar, this fund performance has been very consistent especially over long term horizon. It has experienced 18 years of positive turnover and 3 years with negative turnover. The worst turnover was experienced in 2008, recorded at -36.17% and its best was in 2003, recorded in 40.85%.

As of March 31, 2011, the top 10 holdings of this top mid cap blend stock fund are United Health Group Inc, Fossil Inc, Next PLC, Metro Inc CL A SUB VTG, Oracle Corp, Abercrombie & Fitch Co CL A, Coventry Health Care Inc, Ross stores Inc, Seagate Technology, and Eni SPA. These ten holdings make up to 15.18% of the total net assets from the total of 884 holdings. The top 5 countries include USA (66.5%), Canada (6.64%), Japan (6.41%), United Kingdom (2.77%), and Netherlands (2.54%). Top 6 major market sectors are consumer discretionary, information technology, health care, financials, industrials, and energy.

Disclosure: No Position

Details about other Kiplinger's 25 Best Mutual Fund can be found in my main page.