One of the highest paying dividend sector mutual funds is Real Estate sector funds. This Real Estate fund is also known as REIT mutual fund. Fidelity Real Estate Income is one of the best sector equity fund. You can use this fund to diversify your asset allocation. Details about the fund's review is below.

Fidelity Real Estate Income Fund (MUTF: FRIFX)

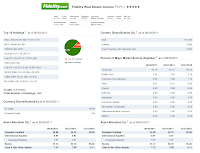

The Fidelity Real Estate Income fund objective is to provide higher than average income. This Fidelity fund generally invests its assets primarily in REIT preferred and common stocks; real estate entities debt obligations or bonds; and commercial and other mortgage-backed securities, with an emphasis on lower-quality debt securities. It invests >80% of assets in securities of companies principally engaged in the real estate industry and other real estate related investments. The fund may invest in foreign issuers and domestic issuers.

FRIFX Fund Details

Fidelity Real Estate Income Fund (MUTF: FRIFX)

The Fidelity Real Estate Income fund objective is to provide higher than average income. This Fidelity fund generally invests its assets primarily in REIT preferred and common stocks; real estate entities debt obligations or bonds; and commercial and other mortgage-backed securities, with an emphasis on lower-quality debt securities. It invests >80% of assets in securities of companies principally engaged in the real estate industry and other real estate related investments. The fund may invest in foreign issuers and domestic issuers.

FRIFX Fund Details

|

| Fidelity Real Estate Income Fund |

- Fund Inception Date: February 4, 2003

- Ticker Symbol: FRIFX

- CUSIP: 316389865

- Beta (3yr): 0.59

- Rank in category (YTD): 95

- Category: Real Estate

- Distribution: 4.72%

- Capital Gains: N/A

- Number of Years Up: 5 years

- Number of Years Down: 2 years

- Total Net Assets: $1.77 billion