Vanguard GNMA Investor (MUTF: VFIIX)

As one of the actively managed fund, this Vanguard GNMA fund is seeking to provide a moderate level of current income. This Vanguard fund typically invests majority of its assets (>80%) in GNMA pass-through certificates, which are fixed income securities representing part ownership in a pool of mortgage loans supported by the full faith and credit of the U.S. government. It may invest in other types of securities such as U.S. Treasury or other U.S. government agency securities. The fund’s dollar-weighted average maturity depends on homeowner prepayments of the underlying mortgages which normally fall within an intermediate-term range (3 to 10 years).

Note: GNMA is also known as Government National Mortgage Association or Ginnie Mae.

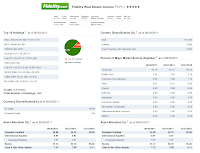

VFIIX Fund Details

|

| Vanguard GNMA fund details |

- Fund Inception Date: June 27, 1980

- Ticker Symbol: VFIIX

- CUSIP: 922031307

- Beta (3yr): 0.66

- Rank in category (YTD): 20

- Category: Intermediate Government

- Distribution rate: 3.22%

- Capital Gains: N/A

- Number of Years Up: 29 years

- Number of Years Down: 1 year

- Total Net Assets: $35.65 billion

- Average Maturity: 5.3 years

- Average Duration: 3.6 years

- Average Coupon: 4.9%