TCW Core Fixed-Income N (MUF: TGFNX)

The TCW Core Fixed Income fund seeks to maximize current income and achieve above average total return consistent with prudent investment management over a full market cycle. This TCW fund invests most of net assets (>80%) in debt securities or bonds. These debt securities include but are not limited to securities issued or guaranteed by the United States government, its agencies, instrumentalities or sponsored corporations; corporate obligations (including convertible securities); mortgage-backed securities; asset backed securities; foreign securities (corporate and government); and other securities bearing fixed or variable interest rates of any maturity. It may also invest in junk bonds or high yield bonds.

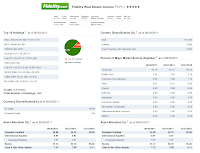

TGFNX Fund Details

|

| TCW Core Fixed-Income fund |

- Fund Inception Date: March 1, 1999

- Ticker Symbol: TGFNX

- CUSIP: 87234N724

- Beta (3yr): 0.86

- Rank in category (YTD): 29

- Category: Intermediate-Term Bond

- Distribution Rate: 4.23%

- Capital Gains: N/A

- Sales Load: 0% (No load)

- Number of Years Up: 11 years

- Number of Years Down: 0 years

- Total Net Assets: $350.27 million

- Effective Duration: 4.3 years

- Average Maturity: 6.4 years