Artisan International Value Investor (ARTKX)

The investment objective of Artisan International Value fund is to pursue long term capital growth. This equity fund invests most of assets in undervalued Non-U.S companies of all market capitalizations. The fund’s performance is compared with the index benchmark, MSCI EAFE Index, over a full market cycle. This international stock fund typically holds about 40-60 stocks, diversified across most major sectors. It also invest in >5 countries. It may invest small part of its assets (<20%) in emerging markets countries.

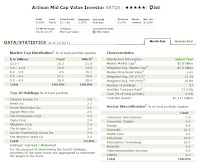

ARTKX Fund Details

|

| Artisan International Value fund |

- Fund Inception Date: 09/23/2002

- Ticker Symbol: ARTKX

- CUSIP: 04314H881

- Beta (3yr): 0.90

- Rank in category (2011): 3%

- Category: Foreign Large Blend

- Yield: 0.06%

- Net Assets: $ 2.5 billion

- Sales Load: 0%

- Expense Ratio: 1.18%

- Capital Gains: $0.0681 (2011)

- Number of Years Up: 6 years

- Number of Years Down: 3 years