During the crisis situation or not, balanced mutual funds has remained steady. These balanced funds, also known as hybrid funds, invest in stocks (equities), bonds (fixed income), money market fund (cash), convertible, preferred, etc. Depending upon the fund’s objective, the asset allocation is distributed accordingly. Some of the

top performer balanced funds of 2011 are Federated Muni and Stock Advantage A, FBR Balanced Investor, Value Line Asset Allocation, Invesco Balanced-Risk Allocation A, etc.

Balanced Mutual Funds

|

| Top Performer Balanced funds of 2011 |

This balanced fund can be used to diversify investor’s portfolio. Asset diversification is important during volatile market. Based on its asset allocation, the Balanced Funds can be divided into 4 main categories such

conservative allocation,

moderate allocation,

aggressive allocation, and

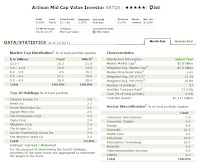

world allocation. There are other classes of balanced funds as well such as retirement income, and target-date funds. I also will highlight some of the main characteristics from these top performing funds such as expense ratio fee, Morningstar rating, analyst rating, sales load, dividend yield, turnover rate, management, top holding, etc.