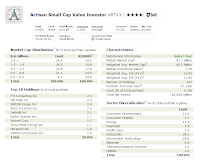

Artisan Small Cap Value Investor (ARTVX)

This Artisan Small Cap Value fund objective is to seek long-term capital growth. This fund invests primarily in undervalued small U.S. companies. This equity fund performance is benchmarked against the Russell 2000 Value Index.

This top rated fund uses the following strategies to select the companies: attractive valuation small companies, companies with sound financial condition, and companies with attractive business economics.

ARTKX Fund Details

|

| Artisan Small Cap Value fund |

- Fund Inception Date: 09/29/1997

- Ticker Symbol: ARTKX

- CUSIP: 04314H501

- Beta (3yr): 1.20

- Rank in category (2011): 48%

- Category: Small Blend

- Yield: 0.04%

- Net Assets: $ 2.8 billion

- Sales Load: 0%

- Expense Ratio: 1.20%

- Capital Gains: $1.3485 (Dec 2011)

- Number of Years Up: 9 years

- Number of Years Down: 3 years