High Yield Bond Funds

High Yield Bond Funds

Closed end funds have been thriving since 2009. Facing the threat of the QE taper, the high yield closed end funds have dropped in value. The question is whether it is the right time to invest in these high-yield closed end funds yet. Personally, I think it is a great time to invest in some of these high-yield closed end funds. Based on several matrices, high yield closed end funds are attractive than mutual funds or exchange traded funds ETFs or even stocks.Bond closed end funds are traded like bond exchange traded funds (ETFs) or regular stock. They are divided into several categories such as municipal bond fund and taxable bond fund. Municipal bond closed end fund provides tax free income from federal tax rate and possible state & local tax.

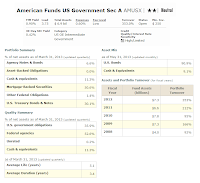

The taxable bond fund also provides interest income for investor however this income is subjected to federal income tax rate. The taxable bond fund divided into several classes such as multisector bond, government bond, mortgage bond, corporate bond, senior loan or bank loan, etc.