Top American Funds

The investment objective of American Funds US Government Securities Fund is to achieve a high current income level consistent with prudent investment risk and capital preservation. It utilizes most of its assets to purchase securities that are guaranteed or sponsored by the U.S. government, including bonds and other debt securities denominated in U.S. dollars.As top bond fund, it may also invest in mortgage-backed securities issued by federal agencies and instrumentalities that are not backed by the full faith and credit of the U.S. government. The fund invests in debt securities with a wide range of maturities.

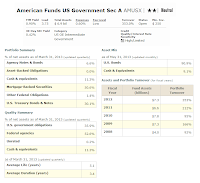

Fund Profile

- Fund Inception Date: 10/16/1985

- Ticker Symbol: AMUSX

- CUSIP: 026300103

- Beta (3yr): 0.99

- Rank in category (YTD): 49%

- Category: Intermediate Government

- Yield: 0.90%

- Capital Gains: 0%

- Expense Ratio: 0.60%

- Net Assets: $ 6.9 billion

- Number of Years Up: 25 years

- Number of Years Down: 2 years

- Average Duration: 3.4 years

- Annual Turnover Rate: 353%

Intermediate Government Mutual Fund

As one of the best performer in Intermediate Government, this American Funds US Government Securities Fund is managed by Kevin Adams, Thomas H. Hogh, Fergus N. MacDonald and Wesley K.-S. Phoa. The fund has 0.90% dividend yield that is distributed monthly. It has annual expense ratio of 0.60%. The average ratio in the category is 0.94%. The fund also has large assets of $6.9 billion.Morningstar analysts have ranked this American Funds with 2-stars and Neutral rating. Since its inception in 1985, the fund has recorded a total of 25 years of positive return and only 2 years of negative return. The best 1-year total return was achieved in 2000 with 11.98%. It has its worst 1-year return in 1999 with -1.67%. Based on the load adjusted returns, this intermediate government mutual fund has returned 3.80% over the past 5-year. The YTD return as of June 27, 2013 is -2.94%.

Besides this Class A fund, it is also available in many other classes such as Class B (UGSBX), Class C (UGSCX), Class F-1 (UGSFX), and many other more. The minimum initial investment is $250. It applies for brokerage and retirement (IRA) account. It also needs $50 for the next investment. The fund can be purchased from 80 brokerages. They are E Trade Financial, JP Morgan, Vanguard, Edward Jones, Merrill Lynch, Scottrade Load, Schwab Retail, etc.

Besides this Class A fund, it is also available in many other classes such as Class B (UGSBX), Class C (UGSCX), Class F-1 (UGSFX), and many other more. The minimum initial investment is $250. It applies for brokerage and retirement (IRA) account. It also needs $50 for the next investment. The fund can be purchased from 80 brokerages. They are E Trade Financial, JP Morgan, Vanguard, Edward Jones, Merrill Lynch, Scottrade Load, Schwab Retail, etc.The top portfolio summary as of March 2013 is Mortgage-Backed Securities (50.6%), U.S. Treasury Bonds & Notes (30.1%) and Cash & Equivalents (11.3%). The fund also has average life of 5.1 years and average duration of 3.4 years. The top asset mix as of May 2013 is U.S. Bonds (90.9%).

According to the fund’s website, the principal risks for investing in this AMUSX fund are market conditions, investing in bonds, investing in securities backed by the U.S. government and investing in mortgage-related securities.

Disclosure: No Position

No comments:

Post a Comment