This domestic stock fund has a yield of 0.25%. Its expense fee is 1.01%. This fund has no sales load. The portfolio turnover rate is only 17%. With assets of $6.1 billion, the fund manager is Charles L. Myers.

July 1, 2015

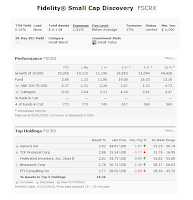

Fidelity Small Cap Discovery Fund (FSCRX)

Fidelity Small Cap Discovery Fund (FSCRX) is a popular U.S. stock mutual fund. This Fidelity fund invests mainly in equity of small market capitalizations companies. The companies are similar to those companies with market capitalizations similar to companies in the Russell 2000 Index or the S&P SmallCap 600 Index.

This domestic stock fund has a yield of 0.25%. Its expense fee is 1.01%. This fund has no sales load. The portfolio turnover rate is only 17%. With assets of $6.1 billion, the fund manager is Charles L. Myers.

This domestic stock fund has a yield of 0.25%. Its expense fee is 1.01%. This fund has no sales load. The portfolio turnover rate is only 17%. With assets of $6.1 billion, the fund manager is Charles L. Myers.

June 29, 2015

Top 12 Real Estate Mutual Funds 2015

Find top real estate mutual funds in 2015. Best funds are Baron Real Estate Fund, PIMCO RealEstateRealReturn Strategy Fund, etc.

From this best performing funds list, you may find each individual fund review. You can find the fund performance, expense ratio, and yield or dividend from the table below. The list is sorted based on its 5 year total returns up to May 17, 2015.

From this best performing funds list, you may find each individual fund review. You can find the fund performance, expense ratio, and yield or dividend from the table below. The list is sorted based on its 5 year total returns up to May 17, 2015.

Top 12 real estate mutual funds 2015 are:

Best Performing REIT Mutual Funds

Real estate mutual fund invests in businesses which involve real estate. It may invest in real estate investment trusts (REITs). This stock mutual fund may invest in companies which operate apartment complex, office buildings, shopping malls, hotels and even self-storage facilities. This mutual fund has higher yield than regular mutual fund. From this best performing funds list, you may find each individual fund review. You can find the fund performance, expense ratio, and yield or dividend from the table below. The list is sorted based on its 5 year total returns up to May 17, 2015.

From this best performing funds list, you may find each individual fund review. You can find the fund performance, expense ratio, and yield or dividend from the table below. The list is sorted based on its 5 year total returns up to May 17, 2015.Top 12 real estate mutual funds 2015 are:

- Baron Real Estate Fund (BREFX)

- PIMCO Real Estate Real Return Strategy Fund (PETAX)

- Phocas Real Estate Fund (PHREX)

- American Century Real Estate Fund (REACX)

- Lazard US Realty Equity Portfolio Open Shares (LREOX)

- AMG Managers Real Estate Securities Fund (MRESX)

- Cohen & Steers Real Estate Securities Fund (CSEIX)

- American Century Real Estate Fund (AREEX)

June 28, 2015

Rotate to Banks and Hospitals Stocks

Greece is going to default next week. Should you stay in stock markets? Should you rotate to banks and hospital stocks? Top stock market industries are hospitals, pacific regional banks, etc.

Top performing stock industries in week 26, 2015 (June 22, 2015 to June 28, 2015) are:

Best Bank Stocks

This post will look into the top performing stocks, industry, and sector. The S&P 500 index has a weekly return of -0.37%. NASDAQ Composite has a weekly return of -0.71%. Dow Jones Industrials Average has a weekly return of -0.38%. The small cap (Russell 2000) has a return of -0.31%.Top performing stock industries in week 26, 2015 (June 22, 2015 to June 28, 2015) are:

- Hospitals 8.09%

- Office Supplies 3.65%

- Processing Systems & Products 3.63%

- Foreign Regional Banks 3.48%

- Residential Construction 3.27%

- Regional - Southwest Banks 3.01%

- Drug Related Products 2.89%

- Telecom Services – Foreign 2.61%

- Textile - Apparel Footwear & Accessories 2.47%

- General Entertainment 2.38%

- Regional - Pacific Banks 2.25%

- Regional - Northeast Banks 2.13%

- Savings & Loans 1.99%

- Conglomerates 1.98%

- Beverages – Brewers 1.97%

June 27, 2015

Vanguard Target Retirement 2030 Fund (VTHRX)

Vanguard Target Retirement 2030 Fund (VTHRX) is a popular target date mutual fund. This Vanguard fund objective is to provide capital appreciation and current income consistent with its current asset allocation.

This mutual fund invests mainly in other Vanguard mutual funds according to an asset allocation strategy. This Vanguard fund is designed for investors planning to retire and leave the workforce in or within a few years of 2030.

This mutual fund invests mainly in other Vanguard mutual funds according to an asset allocation strategy. This Vanguard fund is designed for investors planning to retire and leave the workforce in or within a few years of 2030.

VTHRX Fund Profile

- Fund Inception Date: 06/07/2006

- Ticker Symbol: VTHRX

- CUSIP: 92202E888

- Beta (3yr): 1.23

- Rank in category (YTD): 40%

- Category: Target Date 2026-2030

- Distribution Yield: 1.85%

- Capital Gains: -

- Expense Ratio: 0.17%

- Net Assets: $ 25.8 billion

- Number of Years Up: 6 years

- Number of Years Down: 2 years

- Annual Turnover Rate: 7%

June 25, 2015

Top Government Bond Closed End Funds 2015

Find top performing government bond closed end funds 2015. Best funds are AllianceBernstein Income Fund, Federated Enhanced Treasury Income Fund, etc.

These bond funds may be rated among the best by variety of sites. Popular financial sites are Morningstar, US News, Yahoo Finance, etc.

Top performing government bond closed end funds 2015 are:

Best Performing Closed End Funds in 2015

These best performing value stock closed end funds are sorted based on its 1 year total return up to May, 1 2015. You may find other fund review information: expense ratio, fund’s NAV, management, objective, yield, top holdings, etc.These bond funds may be rated among the best by variety of sites. Popular financial sites are Morningstar, US News, Yahoo Finance, etc.

Top performing government bond closed end funds 2015 are:

June 23, 2015

T Rowe Price Retirement 2020 Fund (TRRBX)

T Rowe Price Retirement 2020 Fund (TRRBX) is a popular target date mutual fund. This balanced fund invests in a diversified portfolio of other T. Rowe Price stock and bond funds. It may invest in various asset classes and sectors.

This T Rowe Price Retirement 2020 Fund is managed based on the specific retirement year (target date 2020) included in its name and assumes a retirement age of 65. It may provide yield for income.

This T Rowe Price Retirement 2020 Fund is managed based on the specific retirement year (target date 2020) included in its name and assumes a retirement age of 65. It may provide yield for income.

TRRBX Fund Profile

- Fund Inception Date: 09/30/2002

- Ticker Symbol: TRRBX

- CUSIP: 74149P200

- Beta (3yr): 1.15

- Rank in category (YTD): 4%

- Category: Target Date 2016-2020

- Yield: 1.64%

- Capital Gains: -

- Expense Ratio: 0.67%

- Net Assets: $ 25.25 billion

- Number of Years Up: 10 years

- Number of Years Down: 2 years

- Annual Turnover Rate: 14%

June 21, 2015

Top Performing Financial Mutual Funds 2015

Find top financial mutual funds in 2015. Best funds are Fidelity Select Brokerage & Investment Management Portfolio, T. Rowe Price Financial Services Fund, etc.

From this best performing funds list, you may find each individual fund review. The fund is sorted based on its past 3 year performance (up to June 2015). Whether it is for your brokerage account or retirement account or 401k plan, you need to find the right fund for your long term plan. You can find the fund performance, expense ratio, and yield or dividend from the table below.

Top performing financial mutual funds 2015 are:

Top performing financial mutual funds 2015 are:

Top Bank Funds

Financial mutual funds objective is to seek capital appreciation. The funds use its assets to purchase equity securities of U.S. or non-U.S. financial-services companies. The financial companies include banks, brokerage firms, insurance companies, and consumer credit providers.From this best performing funds list, you may find each individual fund review. The fund is sorted based on its past 3 year performance (up to June 2015). Whether it is for your brokerage account or retirement account or 401k plan, you need to find the right fund for your long term plan. You can find the fund performance, expense ratio, and yield or dividend from the table below.

Top performing financial mutual funds 2015 are:

Top performing financial mutual funds 2015 are:- Fidelity Select Brokerage & Investment Management Portfolio (FSLBX)

- T. Rowe Price Financial Services Fund (PRISX)

- Emerald Banking and Finance Fund (FFBFX)

- John Hancock Financial Industries Fund (FIDAX)

- Royce Financial Services Fund (RYFSX)

- Fidelity Select Insurance Portfolio (FSPCX)

- Hennessy Large Cap Financial Fund (HLFNX)

- John Hancock Regional Bank Fund (FRBAX)

- Schwab Financial Services Fund (SWFFX)

- Diamond Hill Financial Long Short Fund (BANCX)

Subscribe to:

Comments (Atom)

The Importance of Diversification in Investing

Diversification is a key principle in investing, and it's especially important in today's uncertain economic climate. By spreading y...

-

Municipal bond investment can be done through variety of investment funds. One of them is using Closed End Funds or CEFs. These muni bond cl...

-

Fidelity Contrafund (FCNTX) Fund is a popular stock mutual fund. It invests mainly in US companies. This next fund, Fidelity Contrafund, i...

-

Hard assets are essential during this economic uncertainty period. Investing in gold and silver can provide a tools for investor to combat i...