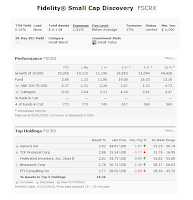

This domestic stock fund has a yield of 0.25%. Its expense fee is 1.01%. This fund has no sales load. The portfolio turnover rate is only 17%. With assets of $6.1 billion, the fund manager is Charles L. Myers.

FSCRX Fund Profile

- Fund Inception Date: 09/26/2000

- Ticker Symbol: FSCRX

- CUSIP: 315912600

- Beta (3yr): 1.08

- Rank in category (YTD): 46%

- Category: Small Blend

- Distribution Yield: 0.25%

- Capital Gains: -

- Expense Ratio: 1.01%

- Net Assets: $ 6.1 billion

- Number of Years Up: 11 years

- Number of Years Down: 3 years

- Annual Turnover Rate: 17%

Fidelity Small Cap Discovery Fund Performance

Morningstar has ranked this Fidelity mutual fund with 5 star and gold rating. This mutual fund has a 3 year annualized return of 18.67%. It has returned 10.62% over the past 1 year, and 15.90% over the past 5 year. Past 5 years performance:- Year 2015: 1.76% (YTD)

- Year 2014: 7%

- Year 2013: 38.22%

- Year 2012: 24.03%

- Year 2011: 0.36%

More: Best Fidelity Mutual Funds

Investing in this mutual fund involve risks. The investment risks are stock market risk, foreign market risk, small companies’ risk, interest rate risk, etc.

Pros:

- Fidelity Small Cap Discovery Fund has no sales load.

- The fund performance has been consistent for the past 5 years.

- None

More:

No comments:

Post a Comment