This ETF's objective is to provide investment results that, before expenses, correspond generally to the price and yield performance of the S&P MidCap 400 Index. The index are companies with market cap in the range of US$ 1 billion to US$ 4.5 billion. Please check with your brokerage for additional commission.

June 27, 2017

SPDR S&P MidCap 400 ETF (MDY)

SPDR S&P MidCap 400 ETF (MDY) is an index stock ETF (Exchange Traded Fund). This SPDR ETF invests in US stocks of mid-sized companies.

This ETF's objective is to provide investment results that, before expenses, correspond generally to the price and yield performance of the S&P MidCap 400 Index. The index are companies with market cap in the range of US$ 1 billion to US$ 4.5 billion. Please check with your brokerage for additional commission.

This ETF's objective is to provide investment results that, before expenses, correspond generally to the price and yield performance of the S&P MidCap 400 Index. The index are companies with market cap in the range of US$ 1 billion to US$ 4.5 billion. Please check with your brokerage for additional commission.

June 20, 2017

Vanguard Short-Term Bond ETF (BSV)

This Vanguard Short-Term Bond ETF (BSV) is a popular short term fixed income exchange traded fund. Offered by Vanguard Group, this ETF provide decent yield for income.

This Vanguard fund seeks to track the performance of the Barclays U.S. 1-5 Year Government/ Credit Float Adjusted Index. This exchange traded fund follows a passively managed, index sampling approach.

Morningstar analysts rank this fund with 3-stars rating. The benchmark is Spliced Barclays US Aggregate float Adjusted Index. The expense ratio is only 0.07% per year. This fee is 88% lower than the average expense ratio of funds with similar holdings.

This Vanguard fund seeks to track the performance of the Barclays U.S. 1-5 Year Government/ Credit Float Adjusted Index. This exchange traded fund follows a passively managed, index sampling approach.

BSV Fund Profile

- Fund Inception Date: 04/03/2007

- Ticker Symbol: BSV

- CUSIP: 921937827

- Rank in category (YTD): check

- Category: Short-Term Bond

- Yield: 1.51%

- Capital Gains: -

- Expense Ratio: 0.07%

- Total Assets: $ 21.93 billion

- Annual Turnover Rate: 0%

Morningstar analysts rank this fund with 3-stars rating. The benchmark is Spliced Barclays US Aggregate float Adjusted Index. The expense ratio is only 0.07% per year. This fee is 88% lower than the average expense ratio of funds with similar holdings.

June 17, 2017

Core Four Portfolio

Core four portfolio is popularized by Rick Ferri. He mentioned the portfolio on Boglehead Forum.

This lazy portfolio is a buy-and-hold portfolio that contains a healthy allocation to US stocks, international stocks, REIT, and bonds.

This 4 fund portfolio is well like by followers in Bogleheads.

The portfolio can be applied with an investment in a low cost US total stock market index fund, along with direct investments in US, international stock, REIT, and bond market. It can also be implemented with low-cost ETFs (exchange-traded funds).

This lazy portfolio is a buy-and-hold portfolio that contains a healthy allocation to US stocks, international stocks, REIT, and bonds.

Who Is Rick Ferri?

Rick Ferri, also known as Richard Ferri, is a financial analyst, author, speaker, former adviser, and founder of Portfolio Solutions, LLC. He has written various financial articles.Rules Of Core Four Portfolio

The rules of Core Four Portfolio is simple. It invests its 60% allocation to stocks and 40% to bonds. It mainly invest in US, international stock, REIT, and bond market.This 4 fund portfolio is well like by followers in Bogleheads.

The portfolio can be applied with an investment in a low cost US total stock market index fund, along with direct investments in US, international stock, REIT, and bond market. It can also be implemented with low-cost ETFs (exchange-traded funds).

How to Invest

You can invest in this Core Four portfolio through Vanguard mutual funds or Vanguard ETFs (Exchange Traded Funds).June 13, 2017

iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD)

iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) is a popular bond exchange traded fund. This index fund invests in high quality U.S. corporate bonds.

This iShares fund is tracking track the investment results of an index composed of U.S. dollar-denominated, investment grade corporate bonds. This bond fund utilizes its assets to purchase U.S. investment grade corporate bonds. This ETF offer access to 1000+ high quality corporate bonds in a single fund.

This bond fund use to seek stability and pursue income. The 12-month yield is 3.25%. This top fund also has 0.15% annual expense ratio. The market price is currently traded at 0.03% discount of its NAV.

This iShares fund is tracking track the investment results of an index composed of U.S. dollar-denominated, investment grade corporate bonds. This bond fund utilizes its assets to purchase U.S. investment grade corporate bonds. This ETF offer access to 1000+ high quality corporate bonds in a single fund.

This bond fund use to seek stability and pursue income. The 12-month yield is 3.25%. This top fund also has 0.15% annual expense ratio. The market price is currently traded at 0.03% discount of its NAV.

LQD Fund Profile

June 7, 2017

Permanent Portfolio: 4 Fund

Permanent portfolio is one of well-known 4-fund investment portfolios. This permanent portfolio is introduced by free-market investment analyst Harry Browne in 1980.

This lazy portfolio is a buy-and-hold portfolio that contains a healthy allocation to gold. The portfolio holds equal allocations of gold, domestic stocks, short-term treasury bonds, and long term treasury bonds.

Harry Browne was an American writer, politician, and investment advisor. He was the Libertarian Party's Presidential nominee in the U.S. elections of 1996 and 2000

Harry Browne was an American writer, politician, and investment advisor. He was the Libertarian Party's Presidential nominee in the U.S. elections of 1996 and 2000

This 4 fund portfolio is well like by followers in Bogleheads.

This lazy portfolio is a buy-and-hold portfolio that contains a healthy allocation to gold. The portfolio holds equal allocations of gold, domestic stocks, short-term treasury bonds, and long term treasury bonds.

Who is Harry Browne?

Harry Browne was an American writer, politician, and investment advisor. He was the Libertarian Party's Presidential nominee in the U.S. elections of 1996 and 2000

Harry Browne was an American writer, politician, and investment advisor. He was the Libertarian Party's Presidential nominee in the U.S. elections of 1996 and 2000Rules of Permanent Portfolio

The rules of Permanent Portfolio is simple. It invests its 25% allocation gold, domestic stocks, short-term treasury bonds, and long term treasury bonds.This 4 fund portfolio is well like by followers in Bogleheads.

June 3, 2017

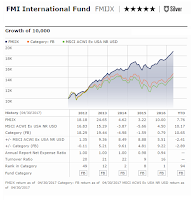

FMI International Fund (FMIJX)

FMI International Fund (FMIJX) is one of the best stock mutual funds. This mutual fund has delivered consistent performance. This equity mutual fund is popular among investors.

This FMI fund typically invests at least 65% of its total assets in the equity securities of non-U.S. companies. The majority of the fund's investments will be in companies that have global operations rather than in companies whose business is limited to a particular country or geographic region. The fund is non-diversified.

FMI International Fund (FMIJX) Profile

This FMI International Fund objective is to provide capital appreciation. The fund manager will invest mainly in a limited number of large capitalization (namely, companies with more than $5 billion market capitalization at the time of initial purchase) value stocks of foreign companies (also referred to as non-U.S. companies).This FMI fund typically invests at least 65% of its total assets in the equity securities of non-U.S. companies. The majority of the fund's investments will be in companies that have global operations rather than in companies whose business is limited to a particular country or geographic region. The fund is non-diversified.

FMIJX Fund Details

May 31, 2017

Couch Potato Portfolio

Couch Potato portfolio is one of well-known 3-fund investment portfolios. This coach potato portfolio is introduced by Scott Burns. It is also known as Andrew Tobias' Three Fund portfolio.

The rules of Scott Burns’ Couch Potato Portfolio is simple. It invests its 33% allocation to inflation-protected securities, 34% allocation to US stock market, and 33% to international stock market. It mainly invest in US, international stock, and bond market (TIPS).

The rules of Scott Burns’ Couch Potato Portfolio is simple. It invests its 33% allocation to inflation-protected securities, 34% allocation to US stock market, and 33% to international stock market. It mainly invest in US, international stock, and bond market (TIPS).

Who is Scott Burns?

Scott Burns is a newspaper columnist and author. He has covered personal finance and investments for over 30 years. He is known for creating the "Couch Potato Portfolio" investment strategy. This investment strategy advocates the use of index funds over managed funds or stock-picking.Rules of Couch Potato Portfolio

The rules of Scott Burns’ Couch Potato Portfolio is simple. It invests its 33% allocation to inflation-protected securities, 34% allocation to US stock market, and 33% to international stock market. It mainly invest in US, international stock, and bond market (TIPS).

The rules of Scott Burns’ Couch Potato Portfolio is simple. It invests its 33% allocation to inflation-protected securities, 34% allocation to US stock market, and 33% to international stock market. It mainly invest in US, international stock, and bond market (TIPS).How to Invest

You can invest in this Couch Potato Portfolio through mutual funds or Exchange Traded Funds (ETFs). Below are the list.

Subscribe to:

Comments (Atom)

The Importance of Diversification in Investing

Diversification is a key principle in investing, and it's especially important in today's uncertain economic climate. By spreading y...

-

Municipal bond investment can be done through variety of investment funds. One of them is using Closed End Funds or CEFs. These muni bond cl...

-

Fidelity Contrafund (FCNTX) Fund is a popular stock mutual fund. It invests mainly in US companies. This next fund, Fidelity Contrafund, i...

-

Hard assets are essential during this economic uncertainty period. Investing in gold and silver can provide a tools for investor to combat i...