This lazy portfolio is a buy-and-hold portfolio that contains a healthy allocation to gold. The portfolio holds equal allocations of gold, domestic stocks, short-term treasury bonds, and long term treasury bonds.

Who is Harry Browne?

Harry Browne was an American writer, politician, and investment advisor. He was the Libertarian Party's Presidential nominee in the U.S. elections of 1996 and 2000

Harry Browne was an American writer, politician, and investment advisor. He was the Libertarian Party's Presidential nominee in the U.S. elections of 1996 and 2000Rules of Permanent Portfolio

The rules of Permanent Portfolio is simple. It invests its 25% allocation gold, domestic stocks, short-term treasury bonds, and long term treasury bonds.This 4 fund portfolio is well like by followers in Bogleheads.

The portfolio can be applied with an investment in a low cost US total stock market index fund, along with direct investments in gold bullion coins, US treasury bills, and US treasury bonds. It can also be implemented with low-cost ETFs (exchange-traded funds).

How to Invest

You can invest in this permanent portfolio through iShares Exchange Traded Funds (ETFs) by BlackRock. Below are the list. You can buy these investment funds through your brokerage.You can also invest with other mutual funds or exchange traded fund to lower your cost.

iShares ETFs

- iShares Core S&P Total Market ETF (ITOT)

- iShares Gold Trust ETF (IAU)

- iShares 1-3 yr. Treasury Bond ETF (SHY)

- iShares 20+ yr. Treasury Bond ETF (TLT)

Performance Overview

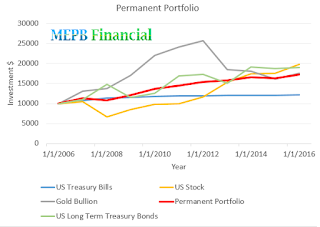

The permanent portfolio is considered as conservative allocation investment portfolio. It is often used as a simple benchmark for a balanced asset allocation. Traditionally, this portfolio mix has been shown to offer solid returns with a nice risk profile over the long-term.This permanent portfolio has returned 3.06 percent over the three years, and 3.64 percent over the past five years. The past 5 years performance is as follows:

Pros and Cons of Permanent Portfolio

Pros:- The fund has lower risk than 100% stock funds.

- The investment portfolio has generate consistent returns for the past decade.

- It may be slightly conservative than your typical balanced funds.

- There is no investment in international stocks.

No comments:

Post a Comment