Fidelity Investments is one of financial service provider that offers to buy stock online with various trading platforms for its investors. In addition to low cost stock and options trading Fidelity also has investment management, retirement planning. Fidelity is the largest mutual fund company in the US. They also offer various accounts specialize in IRAs/Rollovers (Roth IRA, Traditional IRA and 401k), CDs, Bonds, and 529 Plans. Fidelity also offers mobile trading application.

|

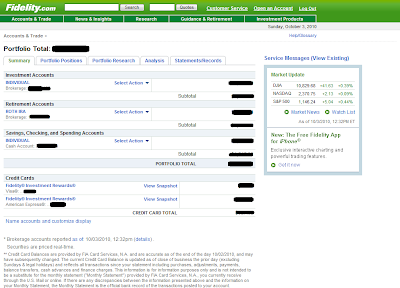

| Fidelity main page |

For me, the brokerage needs to satisfy the following requirement:

- Low commission fees to trade stocks, etf, mutual funds (if necessary)

- Reliable, can be access freely thru web, stable trading platform

- Offer ACH electronic transfer

- Responsive and contactable customer service

Fidelity definitely fit into my criteria. Ever since they offer 25 ishares ETF for free, my interest using fidelity is growing even more. I have been using my fidelity account for the past 3 years for Roth IRA, investment brokerage account and interest checking account. I also use their credit card which provides 2% cashback on any daily purchase. This is one of the best credit card cashback from my experience. Also please check my other brokerages review such as just2trade, vanguard, Lightspeed, E*trade, Scottrade and Zecco.

The following is the Fidelity details:

Products:

Stocks, bonds, mutual funds, annuities, insurance, commercial paper, CDs, IPOs, precious metals, managed portfolios Market Orders: $7.95 Limit Orders: $7.95

Phone FAST Orders: $12.95

Broker Assisted: $32.95

ishares ETFs Orders: $0.00 for 25 ishares ETFs Mutual Funds:

Maximum Margin Rate:

$0.00 for Fidelity & NTF funds. Non-NTF: $75.00. Options: $7.95/trade+$0.75/contract Minimum to Open: $2500 Inactivity Fee: $0.00 Some Other Fees: Tender Fee: $38.00. Maximum Margin Rate:

Based on proprietary base rate.

More detail can be read at hubpages: My Fidelity Brokerage Account Review

No comments:

Post a Comment