Putnam Convertible Securities A (PCONX)

The investment aim of Putnam Convertible Securities fund is to provide current income and capital appreciation. It also has a secondary objective which is capital conservation. This mutual fund invests majority of assets in convertible securities of U.S. companies. Convertible securities mix the investment characteristics of bonds and common stocks.

Convertible securities may include bonds, preferred stocks and other instruments that can be converted into or exchanged for common stock. Many convertible securities are below-investment-grade. The convertible bonds typically have average maturities about three years or longer.

Fund Profile

- Fund Inception Date: June 28, 1972

- Ticker Symbol: PCONX

- CUSIP: 746476100

- Beta (3yr): 1.13

- Rank in category (YTD): 7%

- Category: Convertibles

- Distribution: 2.87%

- Capital Gains: 0%

- Expense Ratio: 1.12%

- Net Assets: $ 611.75 million

- Number of Years Up: 29 years

- Number of Years Down: 10 years

- Annual Turnover Rate: 79%

This Putnam fund has total net assets of $611.75 million. It has 3-stars rating from Morningstar. The expense ratio is 1.12% per year. This fee is comparable to the average fee in the Convertibles category (1.13%). It also has 2.87% dividend yield. This dividend is paid quarterly. The second quarter payment was given in June 26, 2012 ($0.14). Robert L. Salvin has managed this convertible fund in December 2005.

Top Convertible Securities Mutual Funds

Since its inception in 1972, this balanced fund has recorded 29 years of positive return and 10 years of negative return. The best return was achieved in 2009 with 53.75%. Its worst performance was occurred in 2008 with -38.46%. This mutual fund has 5-year annualized return of 2.76%. The YTD return is currently 9.76%.

This PCONX fund is available for purchase from 129 brokerages. They are Merrill Lynch, JP Morgan, EP Fee Small, Schwab Retail, Royal Alliance, Raymond James, Edward Jones, E Trade Financial, Morgan Stanley Advisors, etc. The other classes of this fund are Class B (PCNBX), Class C (PRCCX), Class M (PCNMX), Class R (PCVRX) and Class Y (PCGYX).

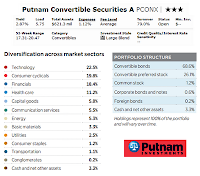

The diversification across market sectors are Technology (22.5%), Consumer cyclical (19.8%), Financials (18.4%), Health Care (11.2%) and Capital Goods (5.8%). The top portfolio structure is Convertible bonds (68.6%) and convertible preferred stock (26.1%). This balanced fund has total of 127 holdings as of June 2012.

According to the fund prospectus, the investment risks are general financial market conditions risk, credit risk, interest rate risk, management risk, etc.

Disclosure: No Position

No comments:

Post a Comment