Convertible Bond Mutual Funds

|

| Top Funds |

Investors can buy this convertibles mutual fund from brokerage such as Vanguard, Fidelity, T. Rowe Price, and other brokers. This fund can be bought with as little as $1,000 or $250 for your investment account or retirement account. You can find the best performing convertibles mutual funds below.

These top performers are sorted based on its 1 year return (up to May 2013). You can find the fund review from this article. Other fund information can be found below such as expense ratio, Morningstar rating, fund’s NAV, managers, fund’s holdings, yield, etc.

The top performing convertibles mutual funds May 2013 are:

- Fidelity Convertible Securities fund (FCVSX)

- Putnam Convertible Securities fund (PCONX)

- Invesco Convertible Securities fund (CNSAX)

- AllianzGI Convertible fund (ANZAX)

- Columbia Convertible Securities fund (PACIX)

- Vanguard Convertible Securities fund (VCVSX)

- Lord Abbett Convertible fund (LACFX)

- Franklin Convertible Securities fund (FISCX)

- RBC BlueBay Global Convertible Bond I (RGCBX)

- MainStay Convertible fund (MCOAX)

- Victory Investment Grade Convertible fund (SBFCX)

- Calamos Convertible fund (CCVIX)

- Miller Convertible fund (MCFAX)

- Harbor Convertible Securities fund (HICSX)

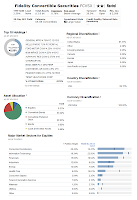

Fidelity Convertible Securities fund (FCVSX)

|

| fund profile |

More: Best Convertible Bond Securities Mutual Funds 2012

Ranked with 2-stars and Neutral rating by Morningstar, the fund has 8.53% year-to-date return as of April 30, 2013. This top performing convertibles mutual fund has recorded 20 years of positive return and 5 years of negative return. The best 1-year total return was achieved in 2009 with 64.11%. The worst was occurred in 2008 with -47.78%. Based on the load adjusted returns, the fund has returned 10.24% over the past 3-year and 8.70% over the past decade.

As part of Fidelity fund family, it has a total of 85 holdings. The top 10 holdings represent 42.55% of total portfolio. They are General Motors, Wells Fargo, Ford Motor, MGM Mirage, Alpha National Resources, Citigroup Inc, Bank America, Continental Air, Peabody Energy and Tenet Healthcare Group.

Putnam Convertible Securities fund (PCONX)

Managed by Eric N. Harthun and Robert L. Salvin, this Putnam fund has a yield of 2.77%. Putnam Convertible Securities fund aim is to provide income and capital growth. It uses its assets to buy in convertible securities of U.S. companies. Convertible securities combine the investment characteristics of bonds and common stocks.This PCONX fund was introduced to public since 1972. It has $694.3 million of total net assets. The annual expense ratio is 1.11% and the annual holdings turnover is 59.00% (as of April 11, 2013). This class A fund has a front-end sales load fee of 5.75%.

The mutual fund is rated with 3-stars rating by Morningstar. It has YTD return of 7.73%. The best 1-year total return was achieved in 2009 with 53.75%. The fund has a 5-year average return of 6.23%. The other classes are Class B (PCNBX), Class C (PRCCX), Class M (PCNMX), Class R (PCVRX) and Class Y (PCGYX). The fund uses BofA Merrill Lynch All U.S. Convertibles Index as the benchmark.

The top diversification across market sectors are Technology (18.9%), Financials (17.8%), Consumer Cyclical (17.5%) and Health Care (14.0%). The top asset allocation is 69.57% in Bonds and 25.58% in Stocks. The current fund’s shares price is $22.55.

Invesco Convertible Securities fund (CNSAX)

|

| fund details |

You can buy this top convertibles mutual fund from your brokerage for your retirement or 401k account. The minimum initial investment is $1,000 with $50 minimum subsequent investment. The fund’s NAV is currently $23.12 per share.

As one top performing convertibles mutual funds, it has 3-year beta risk of 1.05. Morningstar analysts rated this fund with 3-stars rating. The fund has recorded 10 years of positive return and 5 years of negative return since the inception. Based on the load adjusted returns, the fund’s performance is as below:

- 1-year: 3.18%

- 3-year: 8.15%

- 5-year: 5.85%

- 10-year: 7.51%

AllianzGI Convertible fund (ANZAX)

This AllianzGI Convertible fund utilizes its assets to buy convertible securities, which include, but are not limited to, corporate bonds, debentures, notes or preferred stocks and their hybrids. This ANZAX fund has an expense ratio of 1.01% per year. The dividend yield is 1.29% per year. The total net assets are $1.4 billion. The portfolio managers are Douglas G. Forsyth and Justin Kass. The average turnover in Convertibles category is only 56.30%.Ranked with 4-stars rating by Morningstar, this best performing convertibles mutual fund has YTD return of 9.38%. The investment style is Mid Blend. The fund’s benchmark is BofA Merrill Lynch All Convertibles Index. This Class A fund has just been incepted in 2010. The total return in 2012 was 11.59% and while in 2011, it is-2.59%. The 5-year average return was 8.28%.

More: Top Performer Convertible Securities CEFs July 15 2012

As of first quarter of 2013, the top holdings of this fund are Gilead Sciences Inc (2.14%), Micron Technology Inc (1.8%), General Motors Corporation (1.74%), Bank of America Corporation (1.65%) and United Technologies Corporation (1.50%). The top sector is Technology (20.55%).

Vanguard Convertible Securities fund (VCVSX)

|

| Vanguard fund profile |

As one of the top performing convertibles mutual funds, its expense ratio is 0.52%. This fee is 58% lower than the category’s average expense ratio. The total net assets have $1.7 billion. It has a high dividend yield of 3.38%. The minimum initial investment is $3,000 for either brokerage or retirement (IRA) account.

This Vanguard fund has 4-stars and Gold rating from Morningstar. The YTD return as of April 30, 2013 is 7.45%. The best 1-year total return within 19 years of positive return was in 2009 with 40.81%. The worst was in 2008 with -29.79%. The average maturity is 6.1 years and the average duration is 5.2 years.

The top 10 largest holdings represent 21.3% of total net assets as of March 2013. They are Micron Technology Inc, Cobalt International Energy Inc, Salix Pharmaceuticals Ltd, Omnicare Inc, SanDisk Corp, Jarden Corp, Hornbeck Offshore Services Inc, Brookdale Senior Living Inc, Hologic Inc and SEACOR Holdings Inc.

Fund Information

| No | Fund Description | Ticker | Rating | Assets (MS) | Expense Ratio | Yield |

|---|---|---|---|---|---|---|

| 1 | Fidelity Convertible Securities | FCVSX | 2 | $2,000.0 | 0.76% | 2.59% |

| 2 | Putnam Convertible Securities A | PCONX | 3 | $694.3 | 1.11% | 2.77% |

| 3 | Invesco Convertible Securities A | CNSAX | 3 | $1,100.0 | 0.93% | 2.18% |

| 4 | AllianzGI Convertible A | ANZAX | 4 | $1,400.0 | 1.01% | 1.29% |

| 5 | Columbia Convertible Securities A | PACIX | 2 | $587.5 | 1.12% | 2.65% |

| 6 | Vanguard Convertible Securities Inv | VCVSX | 4 | $1,700.0 | 0.52% | 3.38% |

| 7 | Lord Abbett Convertible A | LACFX | 3 | $484.4 | 1.07% | 2.65% |

| 8 | Franklin Convertible Securities A | FISCX | 4 | $1,100.0 | 0.90% | 3.42% |

| 9 | RBC BlueBay Global Convertible Bd I | RGCBX | N/A | $17.8 | 1.00% | 2.24% |

| 10 | MainStay Convertible A | MCOAX | 3 | $683.5 | 1.00% | 2.41% |

| 11 | Victory Investment Grade Convertible A | SBFCX | 2 | $18.1 | 1.44% | 0.54% |

| 12 | Calamos Convertible A | CCVIX | 3 | $1,200.0 | 1.10% | 0.28% |

| 13 | Miller Convertible A | MCFAX | 3 | $296.5 | 1.48% | 1.96% |

| 14 | Harbor Convertible Securities Investor | HICSX | N/A | $163.4 | 1.20% | 2.12% |

Convertible Funds Performance

| No | Fund Description | YTD Return % | 1 Year Return % | 3 Year Return % | 5 Year Return % |

|---|---|---|---|---|---|

| 1 | Fidelity Convertible Securities | 8.53% | 14.82% | 8.54% | 3.95% |

| 2 | Putnam Convertible Securities A | 7.73% | 14.27% | 8.27% | 5.37% |

| 3 | Invesco Convertible Securities A | 7.90% | 13.40% | 8.46% | 7.57% |

| 4 | AllianzGI Convertible A | 9.38% | 12.66% | 9.75% | 7.51% |

| 5 | Columbia Convertible Securities A | 9.22% | 13.03% | 9.12% | 4.87% |

| 6 | Vanguard Convertible Securities Inv | 7.45% | 12.90% | 8.13% | 6.47% |

| 7 | Lord Abbett Convertible A | 8.03% | 11.68% | 6.24% | 4.02% |

| 8 | Franklin Convertible Securities A | 6.84% | 11.72% | 8.14% | 5.84% |

| 9 | RBC BlueBay Global Convertible Bd I | 5.93% | 10.64% | N/A | N/A |

| 10 | MainStay Convertible A | 7.60% | 9.12% | 6.66% | 4.92% |

| 11 | Victory Investment Grade Convertible A | 7.30% | 8.96% | 5.67% | 1.75% |

| 12 | Calamos Convertible A | 7.98% | 9.10% | 5.27% | 4.36% |

| 13 | Miller Convertible A | 7.67% | 8.30% | 6.89% | 6.16% |

| 14 | Harbor Convertible Securities Investor | 4.08% | 7.27% | N/A | N/A |

No comments:

Post a Comment