This article provides mutual fund review of Morgan Stanley Institutional Global Franchise fund. More details about the fund performance, fund details, yield, and more. As part of world stock fund, this Morgan Stanley fund has been one of the best world stock fund.

Morgan Stanley Institutional Global Franchise I (MSFAX)

The Morgan Stanley Institutional Global Franchise investment fund seeks to provide long-term capital appreciation. This Morgan Stanley fund invests mainly in world equity securities of companies that have resilient business franchises and growth potential. It typically invests in securities of issuers from >3 different countries, which may include the United States. The fund focuses its holdings in a relatively small number of companies and can invest <25% of assets in a single issuer. It can also invest in the equity securities of any size company and use derivative instruments.

MSFAX Fund Details

Morgan Stanley Institutional Global Franchise I (MSFAX)

The Morgan Stanley Institutional Global Franchise investment fund seeks to provide long-term capital appreciation. This Morgan Stanley fund invests mainly in world equity securities of companies that have resilient business franchises and growth potential. It typically invests in securities of issuers from >3 different countries, which may include the United States. The fund focuses its holdings in a relatively small number of companies and can invest <25% of assets in a single issuer. It can also invest in the equity securities of any size company and use derivative instruments.

MSFAX Fund Details

|

| Morgan Stanley Inst. Global Franchise |

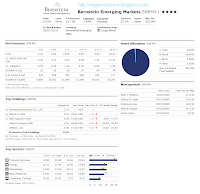

- Fund Inception Date: November 28, 2001

- Ticker Symbol: MSFAX

- CUSIP: 61744J283

- Beta (3yr): 0.64

- Rank in category (YTD): 1

- Category: World Stock

- Distribution Rate: 2.69%

- Net Assets: $ 179.21 million

- Sales Load: 0%

- Expense Ratio: 1.0%

- Capital Gains: N/A

- Number of Years Up: 8 years

- Number of Years Down: 1 year