Emerging Markets countries has been the main global economic growth for the past 10 years. After the economic crisis, these emerging markets countries have been outperformed many developed countries. You can invest in this emerging markets stocks using mutual funds. The following is the fund review of best emerging markets stock fund.

Bernstein Emerging Markets (Ticker: SNEMX)

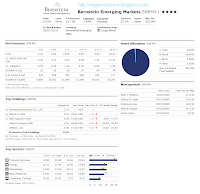

The Bernstein Emerging Markets fund objective is to provide long-term capital growth. The fund normally invests at least 80% of assets in securities of companies in emerging markets. It invests approximately 50% of assets in emerging markets value stocks and 50% of assets in emerging markets growth stocks. This EM stock fund may invest in more developed country markets.

This AllianceBernstein fund is managed by Seth Masters since its inception in December 1995. This is a no load fund, it means there is no 12b1 fee as well no sales load fee (either front-end sales load or deferred sales load). It has an annual holdings turnover of 67% as of July 2011. This fund has total net assets of $1.79 billion.

more: Top Performer Diversified Emerging Markets Stock Funds May 2011

This fund is currently positioned on the rank 52nd in the Diversified Emerging Markets category. The SNEMX fund has -1.14% YTD return. The performance of this fund is as below:

As of May 2011, the top holdings of this SNEMX fund are Samsung Electronics Co, Ltd (3.14%), Vales SA ADR (3.12%), OAO Gazprom ADR (3.04%), Lukoil Company ADR (1.91%) and CNOOC Ltd (1.85%). Majority of the assets are invested in stocks (98.85%). The top sectors are Financial Services (24.90%), Energy (16.13%), Technology (15.65%), Basic Materials (13.42%) and Consumer Cyclical (10.22%).

Disclosure: No Position

Related Articles on Emerging Market Stock Funds:

Bernstein Emerging Markets (Ticker: SNEMX)

|

| Bernstein Emerging Markets |

This AllianceBernstein fund is managed by Seth Masters since its inception in December 1995. This is a no load fund, it means there is no 12b1 fee as well no sales load fee (either front-end sales load or deferred sales load). It has an annual holdings turnover of 67% as of July 2011. This fund has total net assets of $1.79 billion.

more: Top Performer Diversified Emerging Markets Stock Funds May 2011

This fund is currently positioned on the rank 52nd in the Diversified Emerging Markets category. The SNEMX fund has -1.14% YTD return. The performance of this fund is as below:

- 1-year: 14.66%

- 3-year: 3.66%

- 5-year: 8.32%

- 10-year: 18.21%

As of May 2011, the top holdings of this SNEMX fund are Samsung Electronics Co, Ltd (3.14%), Vales SA ADR (3.12%), OAO Gazprom ADR (3.04%), Lukoil Company ADR (1.91%) and CNOOC Ltd (1.85%). Majority of the assets are invested in stocks (98.85%). The top sectors are Financial Services (24.90%), Energy (16.13%), Technology (15.65%), Basic Materials (13.42%) and Consumer Cyclical (10.22%).

Disclosure: No Position

Related Articles on Emerging Market Stock Funds:

No comments:

Post a Comment