The following large growth stock fund is among the largest mutual funds in US with assets of $122.6 Billion. The Growth Fund of America is also popular among investor hence it offers in retirement account or regular brokerage account. Details about the fund’s review can be found below.

American Funds Growth Fund of America A (MUTF: AGTHX)

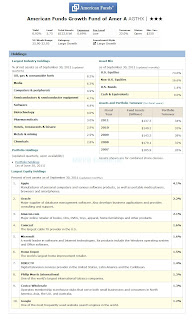

As part of American Funds fund family, the Growth Fund of America A fund objective is to deliver capital growth by investing in common stocks of best growth companies. The fund typically invest >65% of its assets in common stocks. It may also invest minority of its assets (<25%) in foreign stocks (outside the United States). This American Funds fund can invest in preferred stocks, convertibles, US Government securities, bonds, and cash equivalent. It also may invest <10% of assets in non-investment grade bonds or junk bonds.AGTHX Fund Details

|

| AGTHX fund details |

- Fund Inception Date: November 30, 1973

- Ticker Symbol: AGTHX (Class A)

- CUSIP: 399874 10 6

- Beta (3yr): 0.96

- Rank in category (YTD): 70%

- Category: Large Growth

- Distribution Rate/ Yield: 0.51%

- Net Assets: $ 159 Billion

- Sales Load: 5.75%

- Expense Ratio: 0.69%

- Capital Gains: N/A

- Number of Years Up: 31 years

- Number of Years Down: 6 years