The following large growth stock fund is among the largest mutual funds in US with assets of $122.6 Billion. The Growth Fund of America is also popular among investor hence it offers in retirement account or regular brokerage account. Details about the fund’s review can be found below.

American Funds Growth Fund of America A (MUTF: AGTHX)

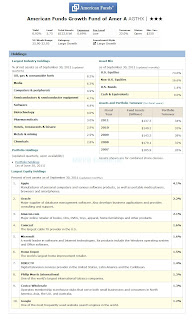

As part of American Funds fund family, the Growth Fund of America A fund objective is to deliver capital growth by investing in common stocks of best growth companies. The fund typically invest >65% of its assets in common stocks. It may also invest minority of its assets (<25%) in foreign stocks (outside the United States). This American Funds fund can invest in preferred stocks, convertibles, US Government securities, bonds, and cash equivalent. It also may invest <10% of assets in non-investment grade bonds or junk bonds.AGTHX Fund Details

|

| AGTHX fund details |

- Fund Inception Date: November 30, 1973

- Ticker Symbol: AGTHX (Class A)

- CUSIP: 399874 10 6

- Beta (3yr): 0.96

- Rank in category (YTD): 70%

- Category: Large Growth

- Distribution Rate/ Yield: 0.51%

- Net Assets: $ 159 Billion

- Sales Load: 5.75%

- Expense Ratio: 0.69%

- Capital Gains: N/A

- Number of Years Up: 31 years

- Number of Years Down: 6 years

The lead fund’s manager is James E. Drasdo since 1985. It also has portfolio counselors such as Donnalisa P. Barnum, Gordon Crawford, James F. Rothenberg, Gregg E. Ireland, Michael T Kerr, Bradley J Vogt et all. It currently has a yield of 0.92%. The last dividend was paid on December 2010 ($0.25). The fund’s expense ratio is 0.69% per year. This expense ratio fee is lower than category average which is 1.31%. The turnover rate is 22%.

This US domestic equity fund is rated 3 stars by Morningstar. Investor can start buying this fund with $250 minimum initial investment either for regular brokerage account or tax deferred account (IRA account). This AGTHX fund can be bought from 73 brokerages such as JPMorgan, E Trade Financial, TD Ameritrade Inc, Merrill Lynch, Schwab, Ameriprise Brokerage, etc.

This fund is also offered in most retirement account such as IRA, 401K fund, 403b, and 529 account selections. You may find some other classes that have lower expense ratio fee, and have no front end sales charge fee. Other tickers of American Funds Growth Fund of America fund are: AGRBX (Class B), GFACX (Class C), GFAFX (Class F-1), GFFFX (Class F-2), CGFAX (Class 529-A), CGFBX (Class 529-B), CGFCX (class 529-C), CGFEX (Class 529-E), CGFFX (Class 529-F-1), RGAGX, RGAFX, RGACX, RGXAX, RGABX, and RGAEX. For instance, the RGAGX fund or the class R6 fund has only 0.14% expense ratio and no front end sales load. The expense ratio of different classes of fund can be varied from 0.14% to 1.57%.

The fund performance is as follows (AGTHX):

- Year 2017: 10.23% (YTD)

- Year 2016: 8.46%

- Year 2015: 5.36%

- Year 2014: 9.30%

- Year 2013: 33.79%

The fund has its best 1-year total return in 1999 with 45.70% and it has the worst 1 year return in 2008 with -39.07%.

As of October 2011, this fund asset mix is 73% in US Equities, 16.6% in Non-US Equities, 1.4% in US bonds, and 9.0% in Cash & Equivalent. The top 10 industry sectors of this large growth fund are Oil | gas & consumable fuels, Media, Computers & peripherals, Semiconductors & semiconductor equipment, Software, Biotechnology, Pharmaceuticals, Hotels | restaurants & leisure, Metals & mining, and Chemicals. Top 10 largest equity holdings include Apple, Oracle, Amazon.com, Comcast, Microsoft, Home Depot, DIRECTV, Philip Morris International, Costco Wholesale, and Google.

According to the fund’s prospectus, the investment risks are market risk, growth stocks risk, foreign stocks risk, management style risk, etc.

Disclosure: No Position

Other US Stock Mutual Fund articles:

No comments:

Post a Comment