Mutual Funds or Investment funds can be used to provide asset diversification. To diversify your portfolio, you will need to invest in best rated fund. As we know, the Canadian Equity funds have outperformed its peer, the US Equity funds.

Top 8 Canadian Equity Mutual Funds 2011 are:

This investment fund was introduced to public in November 24, 2000. This fund is sponsored by Franklin Templeton Investments and is managed by Bissett Investment Management. The fund managers of this Bissett fund are Garey J. Aitken and Tim Caufield. This fund shares 1.47% dividend yield per year. It charges 2.52% annual expense ratio. This fund has total net assets of $2 billion. The minimum initial investment for this fund is 500 CAD. It uses S&P/TSX Composite TRI as the benchmark.

The performance of this fund since its inception is listed below:

The top ten holdings of this fund as of June 2011 are Royal Bank of Canada (4.31%), Bank of Nova Scotia (4.24%), Brookfield Asset Management Inc (4.09%), Canadian National Railway Co (4.06%), Thomson Reuters Corp (4.05%), Rogers Communications Inc (3.70%), TransCanada Corp (3.33%), Canadian Natural Resources Ltd (3.24%), Power Financial Corp (3.23%) and Canadian Imperial Bank of Commerce (3.17%). The top sector weightings are Financials (35.40%) and Energy (28.10%).

RBC O'Shaughnessy All Canadian Equity fund invest in Canadian companies equities based on Strategy Indexing, a rigorous and disciplined approach to stock selection based on characteristics associated with above average returns over long periods of time. Its objective is to provide a long-term total return, consisting of capital growth and current income.

This RBC fund was introduced to public in January 2007. This fund charges an expense ratio of 1.78%. There is no sales load fee. The turnover rate of this fund is quite high (99.8%). The dividend is distributed annually (1.01%) as well as the capital gains. This fund has total net assets of $225.4 million. To start investing in this RBC fund, you will need 500 CAD with 25 CAD for the next subsequent investment.

This fund has -7.37% YTD return. It has returned 11.82% over the past year and 2.21% over the past three years. The performance of this fund since its inception in 2007 is:

The Manulife Canadian Investment Class fund invests mainly in a diversified portfolio of undervalue & wealth-creating Canadian mid & large cap companies, with excellent management.

Jim Hall has been the fund’s manager since June 2008. The sub-advisor of this Manulife fund is Mawer Investment Management Ltd. It shares 2.56% dividend yield. The fund has 2.52% annual expense ratio. The minimum initial investment needed is 500 CAD.

This Manulife Canadian Investment fund has returned 9.97% over the past year and 2.53% over the past three years. The YTD return is -2.98%. This fund is on the 2nd rank of Canadian Equity Category (YTD). The best performance so far was in year 2009 with 28.71%. Morningstar has rated this fund with 5-stars rating.

The top 10 holdings of this fund as of July 2011 are Bank of Nova Scotia (4.9%), TD Bank (4.8%), Royal Bank of Canada (3.9%), Valeant Pharmaceuticals Intl. (3.8%), Brookfield Asset Management (3.7%), Saputo Inc. (3.5%), Canadian National Railway (3.4%), SNC-Lavalin Group (3.2%), Enbridge Inc. (3.0%) and TELUS Corp. (3.0%). These ten holdings represent 37.3% of the total portfolio. The top 2 sectors are Financials (36.8%) and Energy (20.1%).

This Mawer Canadian Fund was introduced to public in June 3, 1991. The fund is managed by Jim hall, Martin Ferguson and Vijay Viswanathan. The dividend yield of this fund is 1.21%. This Mawer fund has 19.6% of annual holdings turnover rate. This fund charges 1.24% annual expense ratio with no sales load fee. The total net assets of this fund are $797.2 million. The minimum initial investment for investing in this fund is $5,000.

Morningstar has rated this fund with 5-stars return rating. This fund has -2.30% YTD return. The performance of this fund is as below:

The LON Ethics (G) 100/100 fund seeks to provide long−term capital growth with moderate income.

This mutual fund is the family of London Life Insurance Co. This equity fund was introduced to public in May 2009. The fund is managed by GWL Investment Management team. This fund has an annual expense ratio of 3.13%. The turnover rate of this LON fund is 70.1%. To start investing in this Canadian equity fund, investor will need 500 CAD. The minimum subsequent investment is $100. This fund charges back-end sales fee.

This fund has returned 9.86% over the past year. This fund has -6.78% YTD return. The other series of this fund have also ranked in top performer, like LON Ethics (G) 75/100, LON Ethics (G) 75/75 and London Life Ethics (GWLIM).

The top 10 stock holdings as of July 2011 are Toronto−Dominion Bank (5.44%), Royal Bank of Canada (5.30%), Bank of Nova Scotia (4.05%), Suncor Energy Inc (3.85%), Potash Corp of SAsk (3.63%), Central Fund of Canada Ltd Cla (3.54%), Canadian Natural Resources Ltd (3.26%), National Bank of Canada (3.20%), Canadian National Railway Co (2.79%) and Teck Resources Ltd Class B (2.57%). The top sector weightings of this fund are Financials Services (27.19%) and Oil and Gas (24.73%).

The investment objective of the Manulife Series R Class A Canadian Investment Fund is to invest for above average long-term rates of return from both capital returns and dividend returns from common shares of Canadian companies.

This fund is managed by Manulife Asset Management Ltd and is sponsored by Maritime Life Assurance Co. It was first introduced to public in July 2008. The fund’s manager is Jim Hall. He has managed this fund since its inception in July 2008. This fund is in the Canadian Equity category. It charges 2.89% annual expense ratio which include management fee of 2.48%. This is a no-load fund. The minimum amount needed to open a brokerage account with this fund is $500 with $500 minimum subsequent investment as well.

As of July 2011, the top 10 stocks in this fund are Bank of Nova Scotia (4.93%), TD Bank (4.81%), Royal Bank of Canada (3.85%), Valeant Pharmaceuticals International (3.79%), Brookfield Asset Management (3.68%), Saputo Inc (3.55%), Canadian National Railway (3.44%), SNC-Lavalin Group (3.25%) and Enbridge Inc (3.04%). The top equity sector weightings are Financials (38.75%) and Energy (20.08%).

This Exemplar Canadian Focus Portfolio A fund objective is to provide superior capital appreciation over both short and long term horizons. This Canadian Equity fund invests mainly through the selection and management of a concentrated group of long and short positions in Canadian equity securities and equity derivative securities.

This Exemplar Canadian Focus Portfolio fund is managed by Veronika Hirsch, CIO of BluMont Capital. This fund was incepted on May 20, 2008. The minimum initial purchase of this fund is $1,000 with $500 minimum subsequent purchase. The fund shares 0.61% dividend yield for the past 12 months. This fund charges 6.60% annual expense ratio. This fund is currently open for public.

Top 10 Canadian Mutual Funds 2011

The fund has returned 10.19% over the past three years and 6.66% over the past year. It has -7.11% YTD return. The other series of this fund are Series F (EXP 200) and Series R (EXP 400).

The top 10 long positions of this fund as of July 2011 are BCE Inc., Brookfield Asset Management Inc. 'A', Canadian National Railway Company, Canadian Western Bank, Canyon Services Group Inc., Detour Gold Corporation, Labrador Iron Ore Royalty Corporation Stapled, Units, National Bank of Canada, TMX Group Inc. and Valeant Pharmaceuticals International Inc. The top 2 sectors of this fund are Materials (24.64%) and Energy (21.53%).

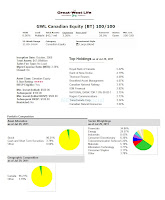

The objective of this GWL Canadian Equity (BT) 100/100 Fund is to deliver long-term above average capital appreciation or returns. This Fund invests mostly in stocks of Canadian companies. I may invest in foreign equity when deemed appropriate.

This Great-West Life fund was managed by Bissett Investment Management. It was introduced to public in October 2009. This 5 stars fund has no sales load fund. It doesn’t have any dividend yield. If you are investing in this fund, the annual expense ratio is 3.38%. The minimum account needed to start investing in this fund is $500. The minimum subsequent investment is $100.

The other best performed series of this fund are:

Disclosure: No Position

Other Investment funds:

Best Mutual Fund

The following article is about Top 10 Best Rated Canadian Equity Mutual Funds of 2011. These best rated funds include Bissett Canadian Equity Class A, RBC O'Shaughnessy All Canadian Equity, Manulife Canadian Investment Class, and more. |

| Top Canadian Equity Mutual Funds |

- Bissett Canadian Equity Class A

- RBC O'Shaughnessy All Canadian Equity

- Manulife Canadian Investment Class

- Mawer Canadian Equity

- LON Ethics (G) 100/100

- Manulife Sr R A Canadian Investment

- Exemplar Canadian Focus Port A

- GWL Canadian Equity (BT) 100/100

1. Bissett Canadian Equity Class A

This Bissett Canadian Equity Class A fund’s objective is to achieve long-term capital appreciation. This Bissett fund invests majority of assets in a diversified portfolio of mid-to large-cap Canadian stocks. |

| Bissett Canadian Equity Class A |

This investment fund was introduced to public in November 24, 2000. This fund is sponsored by Franklin Templeton Investments and is managed by Bissett Investment Management. The fund managers of this Bissett fund are Garey J. Aitken and Tim Caufield. This fund shares 1.47% dividend yield per year. It charges 2.52% annual expense ratio. This fund has total net assets of $2 billion. The minimum initial investment for this fund is 500 CAD. It uses S&P/TSX Composite TRI as the benchmark.

The performance of this fund since its inception is listed below:

- Year 2010: 17.96%

- Year 2009: 38.72%

- Year 2008: -33.42%

- Year 2007: 0.30%

- Year 2006: 10.95%

- Year 2005: 19.10%

- Year 2004: 13.29%

- Year 2003: 15.51%

- Year 2002: -8.92%

- Year 2001: 2.74%

The top ten holdings of this fund as of June 2011 are Royal Bank of Canada (4.31%), Bank of Nova Scotia (4.24%), Brookfield Asset Management Inc (4.09%), Canadian National Railway Co (4.06%), Thomson Reuters Corp (4.05%), Rogers Communications Inc (3.70%), TransCanada Corp (3.33%), Canadian Natural Resources Ltd (3.24%), Power Financial Corp (3.23%) and Canadian Imperial Bank of Commerce (3.17%). The top sector weightings are Financials (35.40%) and Energy (28.10%).

2. RBC O'Shaughnessy All Canadian Equity

|

| RBC O'Shaughnessy All Canadian equity |

This RBC fund was introduced to public in January 2007. This fund charges an expense ratio of 1.78%. There is no sales load fee. The turnover rate of this fund is quite high (99.8%). The dividend is distributed annually (1.01%) as well as the capital gains. This fund has total net assets of $225.4 million. To start investing in this RBC fund, you will need 500 CAD with 25 CAD for the next subsequent investment.

This fund has -7.37% YTD return. It has returned 11.82% over the past year and 2.21% over the past three years. The performance of this fund since its inception in 2007 is:

- Year 2010: 23.95%

- Year 2009: 27.89%

- Year 2008: -31.68%

Stock Funds

As of July 2011, this fund has 190 total holdings. The top 10 stock holdings represent 14.0% of the total portfolio. These holdings are Alimentation Couche-Tard Inc. Sub Vtg (1.6%), Peyto Exploration & Development Corp (1.6%), Precision Drilling Corp (1.5%), Trinidad Drilling Ltd. (1.4%), CAE, Inc. (1.4%), Atco Ltd. Non Voting Share (1.3%), Baytex Energy Corp (1.3%), Keyera Corp (1.3%), Saputo, Inc. (1.3%) and Tim Hortons, Inc. (1.2%). The top 3 global equity sectors are Energy (34.1%), Materials (17.9%) and Financials (12.3%).3. Manulife Canadian Investment Class

|

| Manulife Canadian Inv. Cl. |

Jim Hall has been the fund’s manager since June 2008. The sub-advisor of this Manulife fund is Mawer Investment Management Ltd. It shares 2.56% dividend yield. The fund has 2.52% annual expense ratio. The minimum initial investment needed is 500 CAD.

This Manulife Canadian Investment fund has returned 9.97% over the past year and 2.53% over the past three years. The YTD return is -2.98%. This fund is on the 2nd rank of Canadian Equity Category (YTD). The best performance so far was in year 2009 with 28.71%. Morningstar has rated this fund with 5-stars rating.

The top 10 holdings of this fund as of July 2011 are Bank of Nova Scotia (4.9%), TD Bank (4.8%), Royal Bank of Canada (3.9%), Valeant Pharmaceuticals Intl. (3.8%), Brookfield Asset Management (3.7%), Saputo Inc. (3.5%), Canadian National Railway (3.4%), SNC-Lavalin Group (3.2%), Enbridge Inc. (3.0%) and TELUS Corp. (3.0%). These ten holdings represent 37.3% of the total portfolio. The top 2 sectors are Financials (36.8%) and Energy (20.1%).

4. Mawer Canadian Equity

The investment objective of Mawer Canadian Equity Fund is to invest in Canadian companies securities to achieve above average long-term returns. This fund also may invest in Treasury bills or short-term investments, not exceeding three years to maturity. This is a larger capitalization investment fund. |

| Mawer Canadian Equity |

Morningstar has rated this fund with 5-stars return rating. This fund has -2.30% YTD return. The performance of this fund is as below:

- 1-year: 10.87%

- 3-year: 2.42%

- 5-year: 3.97%

- 10-year: 7.91%

5. LON Ethics (G) 100/100

|

| LON Ethics (G) 100/100 |

This mutual fund is the family of London Life Insurance Co. This equity fund was introduced to public in May 2009. The fund is managed by GWL Investment Management team. This fund has an annual expense ratio of 3.13%. The turnover rate of this LON fund is 70.1%. To start investing in this Canadian equity fund, investor will need 500 CAD. The minimum subsequent investment is $100. This fund charges back-end sales fee.

This fund has returned 9.86% over the past year. This fund has -6.78% YTD return. The other series of this fund have also ranked in top performer, like LON Ethics (G) 75/100, LON Ethics (G) 75/75 and London Life Ethics (GWLIM).

The top 10 stock holdings as of July 2011 are Toronto−Dominion Bank (5.44%), Royal Bank of Canada (5.30%), Bank of Nova Scotia (4.05%), Suncor Energy Inc (3.85%), Potash Corp of SAsk (3.63%), Central Fund of Canada Ltd Cla (3.54%), Canadian Natural Resources Ltd (3.26%), National Bank of Canada (3.20%), Canadian National Railway Co (2.79%) and Teck Resources Ltd Class B (2.57%). The top sector weightings of this fund are Financials Services (27.19%) and Oil and Gas (24.73%).

6. Manulife Sr R A Canadian Investment

|

| Manulife Sr R A Canadian Investment |

This fund is managed by Manulife Asset Management Ltd and is sponsored by Maritime Life Assurance Co. It was first introduced to public in July 2008. The fund’s manager is Jim Hall. He has managed this fund since its inception in July 2008. This fund is in the Canadian Equity category. It charges 2.89% annual expense ratio which include management fee of 2.48%. This is a no-load fund. The minimum amount needed to open a brokerage account with this fund is $500 with $500 minimum subsequent investment as well.

As of July 2011, the top 10 stocks in this fund are Bank of Nova Scotia (4.93%), TD Bank (4.81%), Royal Bank of Canada (3.85%), Valeant Pharmaceuticals International (3.79%), Brookfield Asset Management (3.68%), Saputo Inc (3.55%), Canadian National Railway (3.44%), SNC-Lavalin Group (3.25%) and Enbridge Inc (3.04%). The top equity sector weightings are Financials (38.75%) and Energy (20.08%).

7. Exemplar Canadian Focus Portfolio A

|

| Exemplar Canadian Focus Port A |

This Exemplar Canadian Focus Portfolio fund is managed by Veronika Hirsch, CIO of BluMont Capital. This fund was incepted on May 20, 2008. The minimum initial purchase of this fund is $1,000 with $500 minimum subsequent purchase. The fund shares 0.61% dividend yield for the past 12 months. This fund charges 6.60% annual expense ratio. This fund is currently open for public.

Top 10 Canadian Mutual Funds 2011

The fund has returned 10.19% over the past three years and 6.66% over the past year. It has -7.11% YTD return. The other series of this fund are Series F (EXP 200) and Series R (EXP 400).

The top 10 long positions of this fund as of July 2011 are BCE Inc., Brookfield Asset Management Inc. 'A', Canadian National Railway Company, Canadian Western Bank, Canyon Services Group Inc., Detour Gold Corporation, Labrador Iron Ore Royalty Corporation Stapled, Units, National Bank of Canada, TMX Group Inc. and Valeant Pharmaceuticals International Inc. The top 2 sectors of this fund are Materials (24.64%) and Energy (21.53%).

8. GWL Canadian Equity (BT) 100/100

|

| GWL Canadian Equity (BT) 100/100 |

This Great-West Life fund was managed by Bissett Investment Management. It was introduced to public in October 2009. This 5 stars fund has no sales load fund. It doesn’t have any dividend yield. If you are investing in this fund, the annual expense ratio is 3.38%. The minimum account needed to start investing in this fund is $500. The minimum subsequent investment is $100.

The other best performed series of this fund are:

- GWL Canadian Equity (BT) 75/100

- GWL Canadian Equity (BT) 75/75

- GWL Canadian Equity (BT) DSC

- GWL Canadian Equity (BT) NL

Disclosure: No Position

Other Investment funds:

No comments:

Post a Comment