The market performance for the month of October has been outstanding. Most indices have produced double digits return whether it is international indices (DAX, Nikkei, FTSE 100, etc) or domestic indices (S&P 500, Nasdaq, NYSE, Dow Jones Industrial, Russell 2000, etc). On my previous article, I have provided the top performer mutual funds (leveraged version). This top performer list will only provide a list for non-leveraged mutual funds.

The 12 Monthly Top Performer Non Leveraged Mutual Funds of October 2011 are:

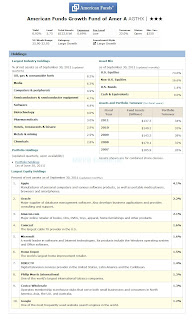

|

| Top Performer Mutual Funds 2011 (NL) |

- BlackRock Energy & Resources Inv A

- Integrity Williston Bsn/Md-N Amer Stk A

- Schneider Small Cap Value

- Pacific Advisors Small Cap Value A

- Oracle Mutual A

- Rydex Energy Services Inv

- Dreyfus Emerging Leaders

- Dreyfus Small Cap A

- Dreyfus Opportunistic Small Cap

- Pacific Advisors Mid Cap Value A

- Saratoga Energy & Basic Materials A

- Rydex Energy Inv