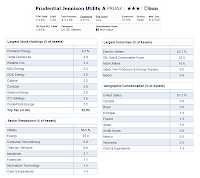

Prudential Jennison Utility Fund (PRUAX)

The investment objective of Prudential Jennison Utility Fund is to provide total return through a combination of capital appreciation and current income. The equity fund uses its assets to purchase equity and investment-grade debt securities of utility companies. The fund participates in the initial public offering (IPO) market. In deciding which stocks to buy, it uses what is known as a value investment style. The fund is non-diversified.

Fund Profile

|

| Prudential Fund |

- Fund Inception Date: January 21, 1990

- Ticker Symbol: PRUAX

- CUSIP: 74441P858

- Beta (3yr): 0.62

- Rank in category (YTD): 34%

- Category: Utilities

- Yield: 2.37%

- Capital Gains: 0%

- Expense Ratio: 0.87%

- Net Assets: $ 3.1 billion

- Number of Years Up: 18 years

- Number of Years Down: 4 years

- Annual Turnover Rate: 37%