Prudential Jennison Utility Fund (PRUAX)

The investment objective of Prudential Jennison Utility Fund is to provide total return through a combination of capital appreciation and current income. The equity fund uses its assets to purchase equity and investment-grade debt securities of utility companies. The fund participates in the initial public offering (IPO) market. In deciding which stocks to buy, it uses what is known as a value investment style. The fund is non-diversified.

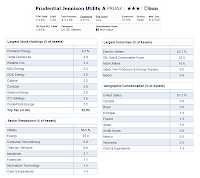

Fund Profile

|

| Prudential Fund |

- Fund Inception Date: January 21, 1990

- Ticker Symbol: PRUAX

- CUSIP: 74441P858

- Beta (3yr): 0.62

- Rank in category (YTD): 34%

- Category: Utilities

- Yield: 2.37%

- Capital Gains: 0%

- Expense Ratio: 0.87%

- Net Assets: $ 3.1 billion

- Number of Years Up: 18 years

- Number of Years Down: 4 years

- Annual Turnover Rate: 37%

This PRUAX fund is currently managed by Ubong “Bobby” Edemeka, Shaun Hong and Teresa Ho Kim. It has $3.1 billion of total net assets. The annual expense ratio is 0.87%. There is 0.30% of 12b1 fee and 5.50% of front-end sales load fee. The current yield is 2.14%. The annual holdings turnover is 37.0% as of April 29, 2013.

Sector Stock Fund

This Prudential Jennison Utility fund’s benchmark is Lipper Utility Funds Average. The fund uses Mid Value investment style. It has 3-stars and Bronze rating from Morningstar. As of May 9, 2013, it has 30-day SEC Yield of 1.85%. The YTD return is 17.05%. The fund has 18 years of positive return and 4 years of negative return. Based on the load adjusted returns, the past fund performance is as follow:- 1-year: 9.26%

- 3-year: 12.85%

- 5-year: 0.39%

- 10-year: 13.20%

More: Best Prudential Funds 2013

As of March 2013, the 10 largest stock holdings are Cheniere Energy (4.3%), Targa Resources (3.9%), Williams Cos (3.4%), NRG Energy (3.3%), OGE Energy (3.2%), Calpine (3.2%), Comcast (2.8%), Sempra Energy (2.8%), ITC Holdings (2.6%) and CenterPoint Energy (2.5%). They represent 32.0% of total assets out of 60 holdings. The top sector is Utilities (58.0%).

Principal risks of investing in the Fund include recent market events, risks of increase in expenses, utility sector risk, equity and equity-related securities risks, market risk, value style risk, foreign securities risk and currency risk.

Disclosure: No Position

No comments:

Post a Comment