Invesco European Growth Fund (AEDAX)

The Invesco European Growth Fund objective is to seek long-term capital growth. The fund utilizes its assets to purchase a portfolio of securities of European issuers, and in derivatives and other instruments that have economic characteristics similar to such securities. It invests mainly in equity securities and depositary receipts. The fund may invest in the securities of issuers of all capitalization sizes; however, the fund may invest a significant amount of its net assets in the securities of small- and mid-capitalization issuers.

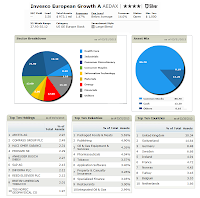

Fund Profile

|

| Invesco fund profile |

- Fund Inception Date: 11/2/1997

- Ticker Symbol: AEDAX

- CUSIP: 008882854

- Beta (3yr): 0.91

- Rank in category (YTD): 12%

- Category: Europe Stock

- Distribution: 1.72%

- Capital Gains: 0%

- Expense Ratio: 1.47%

- Net Assets: $ 973.1 million

- Number of Years Up: 10 years

- Number of Years Down: 5 years

- Annual Turnover Rate: 14%

The fund’s portfolio managers are Jason T. Holzer, Clas G. Olsson, Matthew W. Dennis, Borge Endresen and Richard Nield. This Europe stock mutual fund has a dividend yield of 1.72%. The fund’s shares price is $35.76. In 2012, it is distributed a total dividend of $0.60. Its annual expense ratio is 1.47%. The average ratio in the category is slightly higher with 1.65%. The total net assets of this fund are $973.1 million.

More: Top Performing Europe Stock Mutual Funds February 2013

This Invesco European Growth fund adopts the Large Blend investment style. It has 4-stars and Silver rating from Morningstar. The YTD return as of April 18, 2013 is 3.28%. Based on the load adjusted returns, this equity fund has returned 9.85% over the past 3-year and 12.80% over the past decade. The best 1-year total return was in 1999 with 66.62%.

There are 144 brokerages that provide this fund for purchase. You can buy it from E Trade Financial, Protected Investors of America, JP Morgan, Scottrade Load, Pershing Fund Center, Morgan Stanley Advisors, Royal Alliance, etc. The minimum initial investment for brokerage account is $1,000 and $250 for retirement (IRA) account. The other classes of this fund are Class B (AEDBX), Class C (AEDCX), Investor Class (EGINX), Class R (AEDRX) and Class Y (AEDYX).

The top 10 holdings of this Invesco fund as of March 2013 are Aryzta AG (2.97%), Compass Group PLC (2.49%), Haci Omer Sabanci (2.31%), Prosafe SE (2.29%), Anheuser Busch Inbev (2.27%), SAP AG (2.15%), Informa PLC (2.12%), Reed Elsevier PLC (2.12%), British American Tobacco (2.01%) and TGS Nopec Geophysical Co (1.97%). The top sectors are Consumer Discretionary (22.60%) and Industrials (19.40%).

Investing in this fund does provide some principal risks. The major investment risks are depositary receipts risk, derivatives risk, developing/ emerging markets securities risk, foreign securities risk, geographic focus risk, growth investing risk, investing in European Union risk, management risk, market risk and small-and mid-capitalization risks.

Disclosure: No Position

No comments:

Post a Comment