This post is about the S&P 500 Bullish % Index ($BPSPX).

The chart is looking overbought. You can find more information inside.

Looks like thing is very overextended.

|

| $BPSPX |

The primary portfolio consist of intermediate term investment grade bond either government bond / treasury, mortgage bond, investment grade corporate bond, high yield corporate bond, emerging markets, municipal bond and other instrument. If you choose this fund, please note that some fund classes have a front end sales load of 3.75%.

The primary portfolio consist of intermediate term investment grade bond either government bond / treasury, mortgage bond, investment grade corporate bond, high yield corporate bond, emerging markets, municipal bond and other instrument. If you choose this fund, please note that some fund classes have a front end sales load of 3.75%. The primary portfolio consists of growth stocks. The top 3 sectors of fund as June 2010 are Oil & Gas energy sector, software technology sector and Metal & mining sector. Top 10 largest equity holdings for this fund include Google, Oracle, Microsoft, Apple, JP Morgan Chase, Barrick Gold, Cisco systems, Union Pacific, Apache, and Suncor.

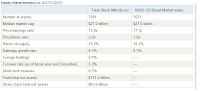

The primary portfolio consists of growth stocks. The top 3 sectors of fund as June 2010 are Oil & Gas energy sector, software technology sector and Metal & mining sector. Top 10 largest equity holdings for this fund include Google, Oracle, Microsoft, Apple, JP Morgan Chase, Barrick Gold, Cisco systems, Union Pacific, Apache, and Suncor.  The Fund seeks to track the performance of a benchmark index that measures the investment return of the overall stock market in US stock market (MSCI US Broad Market Index). The fund Invests in more than 3,000 stocks representative of the whole U.S. market. As Typical Vanguard fund, Vanguard Total Stock Market also has a low expense ratio.

The Fund seeks to track the performance of a benchmark index that measures the investment return of the overall stock market in US stock market (MSCI US Broad Market Index). The fund Invests in more than 3,000 stocks representative of the whole U.S. market. As Typical Vanguard fund, Vanguard Total Stock Market also has a low expense ratio. This fund is also offered in most 401K fund selection. In my 401k account, I can choose American Europacific Fund with REREX ticker. There is no front end load for this fund class. Other tickers of American Europacific Growth fund are: AEPGX, AEPCX, AEGBX, CEUFX, CEUCX, RERCX, RERFX, CEUEX, AEGFX, RERAX, CEUBX, REREX, RERGX, CEUAX, and AEPFX.

This fund is also offered in most 401K fund selection. In my 401k account, I can choose American Europacific Fund with REREX ticker. There is no front end load for this fund class. Other tickers of American Europacific Growth fund are: AEPGX, AEPCX, AEGBX, CEUFX, CEUCX, RERCX, RERFX, CEUEX, AEGFX, RERAX, CEUBX, REREX, RERGX, CEUAX, and AEPFX. The primary portfolio consists of large cap blend stocks. The top 3 sectors of fund as August 2010 are Technology, Financial and Healthcare sector. Top 10 largest equity holdings for this fund include Exxon Mobil, Apple, Microsoft, Procter & Gamble, General Electric, International Business Machines (IBM), Johnson & Johnson, JP Morgan Chase, AT&T and Chevron.

The primary portfolio consists of large cap blend stocks. The top 3 sectors of fund as August 2010 are Technology, Financial and Healthcare sector. Top 10 largest equity holdings for this fund include Exxon Mobil, Apple, Microsoft, Procter & Gamble, General Electric, International Business Machines (IBM), Johnson & Johnson, JP Morgan Chase, AT&T and Chevron. In my previous article, I have described my experience using Vanguard Brokerage Services (VBS) in details. If you want to buy ETFs, you should consider opening a Vanguard Brokerage account. Opening Vanguard account is fast and easy. Setting up an electronic transfer between my bank checking account and vanguard account is also quick. Buying and selling Vanguard ETF using VBS is free, though there is a limit of 25 trades per year for each ETF. Also there is

In my previous article, I have described my experience using Vanguard Brokerage Services (VBS) in details. If you want to buy ETFs, you should consider opening a Vanguard Brokerage account. Opening Vanguard account is fast and easy. Setting up an electronic transfer between my bank checking account and vanguard account is also quick. Buying and selling Vanguard ETF using VBS is free, though there is a limit of 25 trades per year for each ETF. Also there is  |

| Vanguard ETFs |

Vanguard Brokerage Services offer Stock, ETF, Bond, Mutual Fund, and CD. As mentioned above, the commission fees for trading is $7.00 per trade up to 25 trades and $20 for subsequent trades. The best deal of using Vanguard is their offering of ETF and Mutual fund. You get free trade to buy or sell vanguard ETF up to 25 trades per year for each ETF. The following is the details fees related to Vanguard brokerage Services:

Vanguard Brokerage Services offer Stock, ETF, Bond, Mutual Fund, and CD. As mentioned above, the commission fees for trading is $7.00 per trade up to 25 trades and $20 for subsequent trades. The best deal of using Vanguard is their offering of ETF and Mutual fund. You get free trade to buy or sell vanguard ETF up to 25 trades per year for each ETF. The following is the details fees related to Vanguard brokerage Services: Opening account is very straight forward by filling its online application. Most people will get their account information within 10 minutes after application submission. To apply for margin account, option trading account and Money Market Sweep Account, you will need to fill separate form. You need to mail in the forms for this application. For foreigner, you might need to check with Vanguard customer services. It is possible to open an account with filling the application form manually.

Opening account is very straight forward by filling its online application. Most people will get their account information within 10 minutes after application submission. To apply for margin account, option trading account and Money Market Sweep Account, you will need to fill separate form. You need to mail in the forms for this application. For foreigner, you might need to check with Vanguard customer services. It is possible to open an account with filling the application form manually. Opening Vanguard account is fast and easy. It took me 10 minutes to fill the application online and open my account. ACH electronic transfer also can be setup through online easily. Vanguard also offers various mutual funds as well as ETF for my account. One of the most famous things with vanguard is the low expense ratio of the funds. This can be very significant for long term investor most of the funds have lower than 0.50% expense ratio. For example Vanguard Total Stock Market ETF (VTI) only has 0.07% expense ratio. This means if you have invested $10,000 in this ETF, your expense for holding this ETF is only $7.00. There are currently 46 ETFs are offered by Vanguard.

Opening Vanguard account is fast and easy. It took me 10 minutes to fill the application online and open my account. ACH electronic transfer also can be setup through online easily. Vanguard also offers various mutual funds as well as ETF for my account. One of the most famous things with vanguard is the low expense ratio of the funds. This can be very significant for long term investor most of the funds have lower than 0.50% expense ratio. For example Vanguard Total Stock Market ETF (VTI) only has 0.07% expense ratio. This means if you have invested $10,000 in this ETF, your expense for holding this ETF is only $7.00. There are currently 46 ETFs are offered by Vanguard.

Diversification is a key principle in investing, and it's especially important in today's uncertain economic climate. By spreading y...