This next mutual fund has delivered a record of consistent dividend for the past 60 years. This fund is Franklin Income A fund. This fund is classified as conservative allocation balanced fund. More details on fund’s review can be found below.

Franklin Income A (MUTF: FKINX)

FKINX Fund Details |

| Franklin Income A fund details |

- Fund Inception Date: 08/31/1948

- Ticker Symbol: FKINX (Share Class A)

- CUSIP: 353496300

- Beta (3yr): 1.04

- Rank in category (YTD): 86%

- Category: Conservative Allocation

- Sales Load: 4.25%

- Yield: 5.11%

- Expense Fee: 0.61%

- Assets: $82.9 billion

- Number of Years Up: 50 years

- Number of Years Down: 12 years

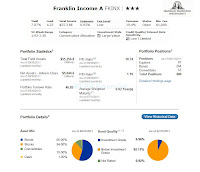

Charles B. Johnson (1957) and Edward D. Perks (2002) are the fund’s managers. As one the most popular balanced mutual fund, this conservative allocation currently has assets of $55 Billion. It also has a 12b1 fee of 0.15% and a sales-load fee of 4.25%. The dividend yield of this fund is 7.07%. The last dividend distributed in October 2011 with $0.01. It also has an expense ratio is 0.65% per year. The fund’s annual turnover is 47% as of October 2011.

This hybrid fund is rated 3 stars by Morningstar. The fund has its best 1 year total return in 2009 (35.01%). The fund has returned 6.44% over the past 3 year, 1.60% over the past 5 year, and 6.4% over the past decade.

Please check with your brokerage about how to buy this conservative allocation balanced fund. The initial investment is $1000 for brokerage account and $250 for tax deferred account (IRA). You can also invest in other classes such as Class B (FBICX), Class B1 (FICBX), Class C (FCISX), Class R (FISRX), and Advisor Class (FRIAX). The share class advisor has 0.50% expense ratio and no sales load.

- Year 2017: 3.48% (YTD)

- Year 2016: 16.29%

- Year 2015: -7.81%

- Year 2014: 4.12%

- Year 2013: 14.23%

As of September 2011, the fund has 81 equities, 264 bonds, and 55 convertibles in its portfolio. The assets are diversified with 55% in bonds, 34% in stocks, 10% in convertibles, and 1% in cash. The top 6 sectors are corporate bonds (45.6%), utilities (11.05%), financials (9.37%), loans (7.72%), energy (6.67%), and health care (6.59%). The top 5 bond holdings are Energy Future Holding Corp, CIT Group Inc, First Data Corp, Freescale Semiconductor Inc, and HCA Inc. The top 5 stock holdings include Roche Holdings AG, Merck & Company Inc, Johnson & Johnson, Wells Fargo & Co, and BP Plc.

Disclosure: No Position

Other balanced mutual funds article:

No comments:

Post a Comment