Stocks picking is difficult task for regular investor. Choosing the mutual fund or ETF route may be easier. This article is about Ten Best Mutual Funds for 2012 and possibly for 2013. The top funds mentioned in this article include: DoubleLine Total Return Bond Fund, TIAA-CREF High-Yield fund, Permanent Portfolio fund, Tocqueville Gold fund, etc. Details about each fund review can be found below.

If you have followed this website, you have noticed I have reviewed several of mutual funds such stock funds, bond funds, balanced funds, commodity funds, money market funds, etc. These mutual funds can be divided into variety of classes such as domestic stock, international stock, taxable bond, non-taxable bond or municipal bond, conservative allocation balanced, moderate allocation balanced, emerging markets stock, and many more.

Update: Best Mutual Funds 2015

Selection Criteria Finding the right criteria might be difficult for regular investor. The following is my pick criteria in selecting these best mutual funds for 2012 (and possible 2013 and beyond).

- The funds have low cost (i.e. low expense ratio fee). If possible, there will be no sales load.

- The funds have long tenure management with 4 years or more. If the funds are part of index funds, this criterion will not be applied.

- They are recognized as the top fund by various financial website such as Morningstar, US News, Money, Forbes, etc.

- The fund should be opened to new investors. The mutual funds ratings are high such as 4 stars or 5 stars rating.

- The funds should have good long term performance. If possible, it should be consistently beaten the index benchmark for the past 5 years (i.e. provide outstanding performance). If not, it should very closely track the index performance (especially for index funds). The funds should be able to withstand various market conditions such as bear market or bull market or sideway market.

- In term of future trends, these best funds can provide steady capital appreciation and possible regular income stream through dividend income. If the yield is low, it should provide higher growth prospect for investor to take the risk.

More:

Best Mutual Funds for 2013

Top 10 Mutual Funds

The

top 10 best mutual Funds for 2012 & 2013 are:

- DoubleLine Total Return Bond Fund (DLTNX)

- TIAA-CREF High-Yield Retail (TIYRX)

- Wells Fargo Advantage Interm T/AmtF Inv (SIMBX)

- Permanent Portfolio (PRPFX)

- Vanguard Balanced Index Inv (VBINX)

- Amana Trust Income (AMANX)

- Sextant International (SSIFX)

- Lazard Emerging Markets Equity fund (LZOEX)

- Fidelity Select Software & Comp (FSCSX)

- Tocqueville Gold (TGLDX)

updated on 08/16/2015

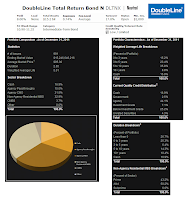

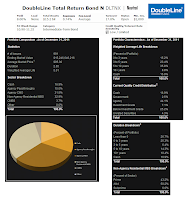

1. DoubleLine Total Return Bond Fund (DLTNX)

Top Stock Fund This best mutual fund also has a dividend yield of 8%, which is much larger than most high yielding mutual funds even stocks. The fund has total assets of $15.2 billion. There is no sales load for this fixed income fund.With current state of economy, investors need to find an investment with consistent capital growth and income.

The DoubleLine Total Return Bond Fund is relatively new. It was offered to investor since 2010. This bond fund is managed by

Jeffrey Gundlach and

Philip Barach. Gundlach, who previously managed TCW Total Return Bond fund (Symbol:

TGLMX), has a good long term performance record.

Investor can invest in the top mutual fund with $2,000 initial investment. Another class of this DoubleLine fund is Institutional I-share (Symbol:

DBLTX).

2. TIAA-CREF High-Yield Retail (TIYRX)

After the U.S. Federal Reserve announced longer period of low interest rate, this bond mutual fund may have the potential to be the perfect mutual fund with high yield. With dividend yield of 6.85%, this fund can consistently provide regular income for retiree and long term investors.

Best Performer Diversified Bond Mutual Funds 2012

This best high yield bond fund is rated with

4 stars rating by Morningstar. It has an expense ratio of 0.59%. Investor can invest in this fund with $2,500 initial funding. This best bond fund has returned 6.73% over the past 1 year, 19.09% over the past 3 year, and 7.75% over the past 5 year. The average duration is 4.91 years.

3. Wells Fargo Advantage Intermediate Tax Free Inv (SIMBX)

Municipal bond fund can provide steady income stream for investors. One of the top rated Muni bond funds is Wells Fargo Advantage Intermediate Tax-Free fund. This fund provide dividend yield that is exempt from federal income tax. This best bond fund is managed by

Lyle J. Fitterer and

Robert J. Miller. The fund's

yield is 3.25%. The fund's expense ratio fee is 0.73%.

Best Bond Fund In term of performance, this best bond mutual fund has managed to outperform its index benchmark consistently (9 out of 10 years). This top mutual fund has ranked very highly for the past decade with 4% ranking. This fund has returned 9.21% for year 2011.

You can also pick your single state muni bond fund such as California municipal bond fund, NY muni bond fund, etc. This single state municipal bond fund may not be subjected to federal income tax and state income tax rate.

4. Permanent Portfolio (PRPFX)

This Permanent Portfolio fund is suitable for conservative investors. I like this mutual fund a lot hence; it can alter its assets according to market condition. This balanced fund or hybrid fund invests in stocks, bonds, precious metals, commodity, and money market fund. The fund is also rated with 5 stars rating by

Morningstar.

As one of the best mutual funds for 2012, it currently has 0.91% yield. The total assets are $15.4 Billion. The fund expense ratio is 0.77%. This best conservative allocation balanced fund has returned 9.44% over the past 5 years, and 11.56% over the past 10 year. The fund is managed by Michael J Cuggino since 2003.

As of January 2012, the

top 5 holdings include Gold - US Golden Eagles, Gold Canadian Maple Leaf, Gold Bullion Comex Eligible, Silver Bullion Comex Eligible, and US Treasury Bond 6%.

5. Vanguard Balanced Index Inv (VBINX)

If you are cost conscious, you will like this

Vanguard Balanced Index fund. This top balanced fund only has 0.26% expense ratio. It invests in equities, fixed incomes, convertibles, preferred, cash, etc. You can invest in this fund with $3,000 minimum initial investment. This moderate allocation balanced fund has total net assets of $11.5 billion. The 3 year beta of this fund is 0.95.

Morningstar has rated this fund with

4 stars rating. It also has a gold analyst rating from Morningstar. The Admiral shares of this fund is

VBIAX.

6. Amana Trust Income (AMANX) This Amana Trust Income fund is rated

5 stars rating. It also has an outstanding long term performance. For the past decade, it has ranked in top 1% among its peers. This fund has returned 4.64% over the past 5 years, and 8.62% over the past 10 year.

Nicholas Kaiser and

Monem Salam are the fund's managers. It also has a yield of 1.54%. It doesn't have any sales load. This U.S. domestic stock fund has 1.20% expense ratio.

7. Sextant International (SSIFX)

International stock funds have underperformed compare to US stock funds due to Europe debt crisis. Investing in this

Sextant International fund may provide a contrarian view for investor. You can start to invest in this top performer with $1,000 minimum initial funding.

This top foreign large blend equity fund is rated with 5 stars rating. This fund primarily invests in companies which are located outside the U.S. This Saturna fund a 3-year annualized return of 7.95%.

As of January 2012, the top 5 holdings

of this top performer fund are: Copa Holdings SA A, Teck Resources Ltd Class B, Novartis AG ADR, Shire PLC ADR, and ASML Holding NV. The top 5 sectors are: Basic Materials, Energy, Technology, Industrials, and Communication Services.

8. Lazard Emerging Markets Equity Open (LZOEX)

Emerging Markets economy has been the engine driver of global economy for the past decade. After the economic crisis in 2008, these emerging markets regions such as Brazil, China, India, Russia, Indonesia, etc have seen significant economic growth.

This Lazard Emerging Markets Equity Open fund's objective is to seek long term capital appreciation. It has been managed by James Donald since November 2011. It currently has $13.66 Billion total assets. The fund also has a dividend yield of 2.84%. The

top 5 stocks holdings are: Cielo SA, Redecard S.A., Banco do Brasil SA BB Brasil, Vale S.A. ADR, and Shinhan Financial Group Co., Ltd.

9. Fidelity Select Software and Computer Service Portfolio (FSCSX)

Technology sector may provide an attractive sector for investors for the next decade. With new technology IPO being introduced, majority of technology companies also generate a lot of cash. This cash may provide some cushion in case the economy doesn't pick up in near future. To invest in this sector, Fidelity Select Software & Computer Service fund is among the best equity sector fund.

This best equity sector fund is rated with

5 stars rating. This

Fidelity fund has returned 29.45% over the past 3 years, 8.35% over the past 5 years, and 7.67% over the past decade. The fund's expense ratio is 0.84%.

As of January 2012, the

top 10 stocks holdings include Google Inc, Microsoft Corp, Apple Inc, Oracle Corp, International Business Machine Corp, Accenture Plc, Cognizant Technology Solutions, Ebay Inc, Citrix Systems Inc, and Mastercard Inc.

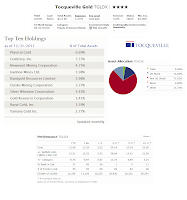

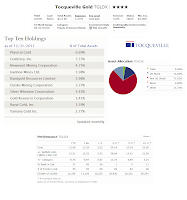

This equity precious metals mutual fund has been the top performer over the past decade with a 10-year annualized return of 23.95%. This fund also has an expense ratio of 1.25%.

This investment fund has performed amazingly, and it will continue to perform with gold becoming more of a flight-to-safety investment for investors. This fund is managed by

John Hathaway and

Douglas B. Groh.

Other Best Mutual Funds for 2012 & 2013

Unfortunately, there are other best funds which should be considered for this list. I'll leave these funds for your additional research. The following is the list:

Disclosure: As of January 2012, I don't have any positions in these funds.

Fund Performance

| No | Fund Name | Ticker | Yield | Expense Ratio | 1 Year Return % | 3 Year Return % | 5 Year Return % |

|---|

| 1 | DoubleLine Total Return Bond Fund | DLTNX | 8.00% | 0.74% | 9.34% | - | - |

| 2 | TIAA-CREF High-Yield Retail | TIYRX | 6.85% | 0.59% | 6.73% | 19.09% | 7.75% |

| 3 | Wells Fargo Advantage Interm T/AmtF Inv | SIMBX | 3.25% | 0.73% | 11.98% | 8.26% | 5.29% |

| 4 | Permanent Portfolio | PRPFX | 0.91% | 0.77% | 9.38% | 16.54% | 9.44% |

| 5 | Vanguard Balanced Index Inv | VBINX | 2.19% | 0.26% | 5.60% | 14.90% | 3.81% |

| 6 | Amana Trust Income | AMANX | 1.54% | 1.20% | 3.24% | 14.81% | 4.64% |

| 7 | Sextant International | SSIFX | 0.86% | 1.03% | -5.06% | 11.07% | 2.37% |

| 8 | Lazard Emerging Markets Equity Open | LZOEX | 2.84% | 1.49% | -5.57% | 27.43% | 5.64% |

| 9 | Fidelity Select Software & Comp | FSCSX | 0.00% | 0.83% | 5.94% | 29.45% | 8.35% |

| 10 | Tocqueville Gold | TGLDX | 0.00% | 1.25% | 2.53% | 39.14% | 15.24% |

Note: I'll review the funds' performance throughout the year of 2012 and 2013.

Update: 12/29/2012

The following is the updated table for the best mutual funds up to 12/30/2012.

| No | Fund Name | Ticker | Yield | YTD Return % |

|---|

| 1 | DoubleLine Total Return Bond Fund | DLTNX | 6.09% | 8.96% |

| 2 | TIAA-CREF High-Yield Retail | TIYRX | 5.81% | 13.98% |

| 3 | Wells Fargo Advantage Interm T/AmtF Inv | SIMBX | 2.63% | 6.48% |

| 4 | Permanent Portfolio | PRPFX | 0.85% | 6.01% |

| 5 | Vanguard Balanced Index Inv | VBINX | 1.93% | 10.30% |

| 6 | Amana Trust Income | AMANX | 1.44% | 8.31% |

| 7 | Sextant International | SSIFX | 0.96% | 6.91% |

| 8 | Lazard Emerging Markets Equity Open | LZOEX | 2.43% | 21.17% |

| 9 | Fidelity Select Software & Comp | FSCSX | 0.00% | 16.39% |

| 10 | Tocqueville Gold | TGLDX | 0.00% | -11.39% |

More:

Best Mutual Funds Families 2015 List