Best Performing Closed End Funds

Best Performing Closed End Funds

High yield bond fund utilizes its assets to purchase lower quality debts issued by government or corporation. It may invests in U.S. or foreign entities. It provides high yield income for investors. You can buy CEF funds from your brokerage just like ETF funds. As part of taxable bond fund, it may have shorter duration than high quality bonds.These top performing high yield closed end funds are sorted based on its 1 year total return. You can find other fund review information below. I have listed the expense ratio fee, yield or distribution rate, leverage, share price, NAV, holdings, top sectors, and more.

Top performer high yield bond closed end funds are:

- Pioneer Diversified High Income (HNW)

- Credit Suisse High Yield Bond (DHY)

- Helios Strategic Income (HAS)

- Babson Capital Corporate Investors (MCI)

- First Trust High Income Long/Short (FSD)

- Pacholder High Yield Fund (PHF)

- Pioneer High Income Trust (PHT)

- Dreyfus High Yield Strategies (DHF)

- Credit Suisse Income (CIK)

- Putnam High Income Securities (PCF)

- BlackRock Debt Strategies Fund (DSU)

- BlackRock Corp High Yield III (CYE)

- BlackRock Senior High Income Portfolio (ARK)

- Babson Cap Participation Investor (MPV)

- Western Asset High Yield Defined Opportunity (HYI)

Pioneer Diversified High Income Fund (HNW)

Pioneer Diversified High Income Fund (HNW)

This Pioneer Diversified High Income fund invests mainly in preferred stocks, floating rate loans and insurance linked securities. The fund’s CUSIP is 723653101. Introduced to public in 2007, it has market value of $166.2 million. It is currently trading 1.1% premium to its NAV. The yield is is 9.50%.More: Best Performer High Yield Bond CEF Funds 2012

This best performing CEF fund has YTD return as of July 2013 is 5.46%. It has returned 8.37% over the past 1-year and 14.12% over the past 5-year. The effective leverage is 28.71%. This top high yield bond fund has 3-stars rating from Morningstar. It has average duration of 2.42 years.

The top 4 sectors as of June 2013 are US High Yield Corp (32.06%), Bank Loans (19.39%), Event-linked Bonds (16.88%) and Emerging Markets (13.77%). The top holdings are Fixed Income Trust Series (1.44%), Alliance One International, Inc (0.91%), Altair Re (0.87%), SUCSRX (0.87%) and Queen Street IV Capital Ltd (0.87%).

Credit Suisse High Yield Bond Fund (DHY)

The objective of this top CEF fund is seeking to deliver attractive returns from U.S. high yield bond markets to investors. This Credit Suisse High Yield Bond fund focuses on diversified portfolios of global high yield bonds. It invests mainly in below-investment-grade U.S. fixed income securities. The fund manager is Thomas Flannery and Wing Chan. It has $232.3 million of market value. It has a high yield of 10.32%. The annual expense ratio is 2.21%.This top performing high yield bond CEF fund is ranked with 2-stars rating by Morningstar. Since the inception in 1998, this fixed income fund has returned 5.51%. The past performances are as follow:

- Year 2012: 23.81%

- Year 2011: 11.16%

- Year 2010: 13.90%

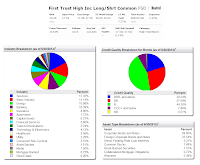

First Trust High Income Long/Short Fund (FSD)

First Trust High Income Long/ Short Fund is a diversified, closed-end management investment company. It uses its assets to purchase a diversified portfolio of U.S. and foreign high yield corporate fixed-income securities. This best performing fund is currently traded at 8.94% discount from its NAV. It has a distribution rate of 7.89%. The annual expense ratio is 1.88%. The portfolio manager is MacKay Shields LLC.Previous: Top High Yield Municipal Bond Mutual Funds 2012

Morningstar ranks this high yield bond fund with Neutral rating. The yearly performance of this fund since inception in 2010 is -7.87% in 2011 and 29.41% in 2012. It has 1.00% YTD return as of July 2013. The average duration is 4.38 years and the effective maturity is 4.80 years.

The top asset type breakdowns are Corporate Bonds and Notes (69.95%) and Foreign Corporate Bonds and Notes (23.54%). The top industries are Services (17.35%), Basic Industry (13.14%), Energy (10.88%) and Banking (10.38%).

Closed End Fund Performance

| No | Fund Name | Ticker | Rating | Closing Price | Yield | YTD Return | 1Y Rtn on Price |

|---|---|---|---|---|---|---|---|

| 1 | Pioneer Diversified High Inc | HNW | 3 | $20.43 | 9.37% | 6.61% | 10.24% |

| 2 | Credit Suisse High Yield Bond | DHY | 2 | $3.09 | 10.32% | 1.60% | 6.87% |

| 3 | Helios Strategic Income | HSA | 2 | $6.14 | 7.93% | 0.80% | 6.43% |

| 4 | Babson Capital Corporate Invs | MCI | 5 | $16.30 | 7.36% | 8.56% | 6.06% |

| 5 | First Trust High Inc Long/Shrt | FSD | Neutral | $17.50 | 7.88% | 0.31% | 5.04% |

| 6 | Pacholder High Yield Fund | PHF | 4 | $8.82 | 8.91% | 4.80% | 4.85% |

| 7 | Pioneer High Income Trust | PHT | 5 | $16.77 | 9.82% | 10.77% | 4.74% |

| 8 | Dreyfus High Yield Strategies | DHF | 3 | $4.13 | 9.43% | 5.47% | 4.69% |

| 9 | Credit Suisse Income | CIK | 3 | $3.75 | 7.50% | -2.52% | 4.55% |

| 10 | Putnam High Income Securities | PCF | 4 | $7.91 | 5.90% | 2.78% | 3.31% |

| 11 | BlackRock Debt Strategies Fund | DSU | 2 | $4.09 | 7.35% | -1.29% | 3.29% |

| 12 | BlackRock Corp High Yield III | CYE | 3 | $7.33 | 8.27% | 0.82% | 3.28% |

| 13 | BlackRock Senior High Inc Port | ARK | 2 | $4.09 | 7.09% | 0.79% | 2.99% |

| 14 | Babson Cap Participation Invs | MPV | 5 | $14.33 | 7.53% | 5.50% | 2.71% |

| 15 | Western Asset High Yld Def Opp | HYI | N/A | $18.08 | 8.74% | 3.75% | 2.24% |

No comments:

Post a Comment