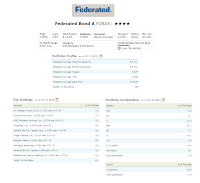

Federated Bond A (FDBAX)

The Federated Bond mutual fund objective is to provide as high a level of current income with consistent capital preservation. This bond mutual fund invests mainly in a diversified portfolio of investment-grade fixed-income securities. It may invest minority of its assets (<35%) in junk bonds or high yield bonds. This fixed income mutual fund may also invest in government securities.

Fund Profile

- Fund Inception Date: 06/28/1995

- Ticker Symbol: FDBAX

- CUSIP: 31420F103

- Beta (3yr): 0.88

- Rank in category (YTD): 15%

- Category: Intermediate-Term Bond

- Yield: 5.38%

- Capital Gains: 0%

- Expense Ratio: 0.98%

- Net Assets: $ 1.38 billion

- Number of Years Up: 14 years

- Number of Years Down: 2 years

- Average Duration: 5.4 years

- Average Maturity: 8.5 years

- Annual Turnover Rate: 13.00%

|

| Federated Bond A Fund |

Morningstar has rated this best mutual fund with 4-star rating. The YTD return of this fund is 2.19%. This fund has recorded 14 years of positive return and 2 years of negative return. The best 1-year total return of the fund was achieved in 2009 with 26.46%. And the worst return was in 2008 with -10.27%. Based on the load adjusted return, the fund’s performance is as below:

- 1-year: 2.61%

- 3-year: 12.74%

- 5-year: 6.43%

- 10-year: 6.57%

Best Government Bond Mutual Funds

As of January 31, 2012, this FDBAX fund has total of 420 holdings. The top 10 holdings are JP Morgan Chase & Co (0.9%), Boston University (0.7%), AT&T Wireless Services Inc (0.6%), Citigroup Inc (0.6%), General Electric Capital Corp (0.6%), Grupo Televisa SA (0.6%), Morgan Stanley (0.6%), Petroleos Mexicanos (0.6%), General Electric Capital (0.5%) and MidAmerican Energy Holdings Co (0.5%). These top ten holdings represent 6.2% of the total portfolio. The effective maturity of the fund is 8.5 years and the effective duration is 5.4 years.

Investing in this mutual fund involves risks such as Interest Rate Risk, Issuer Credit Risk, Counterparty Credit Risk, Call Risk, Prepayment Risk, Liquidity Risk, Leverage Risk, junk bond risk, foreign investing risk, derivative risk, etc.

Disclosure: No Position

Other Top Bond Mutual Funds:

No comments:

Post a Comment